The number of players who pay for virtual goods in mobile games declined from 1.5 percent in January to 1.35 percent in July, according to a study of millions of gamers by mobile-marketing-automation firm Swrve.

In an exclusive interview with GamesBeat, Swrve chief strategy officer Hugh Reynolds and Swrve CEO Christopher Dean said they found that 62 percent of all mobile-game revenues come from 0.13 percent of all players. Those are scary and depressing numbers for developers and publishers, as they rely on virtual-goods purchases for most of their revenue in free-to-play mobile titles.

“This shows how game companies are dependent on a small group of people who are paying the bills,” Reynolds said.

VentureBeat is studying mobile app analytics solutions –

Share your knowledge, and we’ll share all the data with you in return

This means that great care should be taken when acquiring new users, as the vast majority of them provide no revenue, Reynolds said. Companies have to try really hard to ensure that anyone acquired is likely to spend money. The data were contained in Swrve’s latest “monetization report” on mobile games. It covers information from the month of July 2014, and it comes six months after Swrve’s first monetization report.

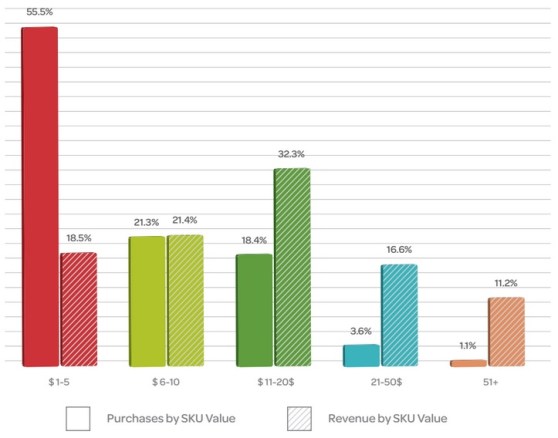

The good news in the report is that significant growth occurred in the mid-tier of spenders — or those who spend between $10 and $20 in a month. Those payers represented 18.4 percent of unit sales and 32.3 percent of revenue, compared to just 8.2 percent and 22.4 percent, respectively, six months ago.

In some ways, this isn’t bad news. The percentage of people who spend money in a game is small compared to the number of people who try out a title. But that’s not much different than the percentage of people who buy something compared to the number of people who try things out in any business, Reynolds said.

“The conversion rate is always small,” Dean said.

In January, the top spenders accounted for 50 percent of revenues. That means spending is more concentrated now.

The report also found that the monthly mean average spend is $24.93 (up from $22 in January). The typical paying player makes just under three purchases in a month, with the average price of each purchase being $8.34.

About 50 percent of all paying gamers make only one purchase in the month, with 16 percent making five or more in the same period. Individual purchases of a value up to $5 made up 55 percent of all purchases. But they accounted for only 18.5 percent of revenues. Meanwhile, purchases of more than $50 made up only 1 percent of all purchases but contributed more than 11 percent of revenue.

“These findings stress once again just how important it is to consider retention and conversion — rather than simply acquisition — when it comes to building a successful mobile business,” said Dean. “With such a significant percentage of revenues coming from a small base, it is essential to both attempt to increase that number with smart in-game campaigns but also identify your most important players and personalize their experience.”

He added, “One interesting finding was the growth in ‘mid-tier’ SKUs [stock-keeping units]. The data suggest that users are more willing than ever before to make relatively

significant one-off in-app purchases in mobile and that developers should start to consider this type of purchase as core to their business.”

In the end, Reynolds said, “You have to identify the people who generate revenues, understand those people, build a relationship with them, and give them the marketing campaigns and user experience that they expect.”

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More