Candy Crush Saga is still one of the highest grossing games on mobile, but the stock market doesn’t find this all that impressive anymore. And even double-dipping on the Candy Crush name might not help the social-gaming publisher.

King Digital’s stock is currently trading at around $11.60. That’s just a few percentage points better than its record low of $10.93, which it hit last week. King’s share price is actually down 1.7 percent today despite the company releasing Candy Crush Soda Saga, a followup to its most popular and lucrative game, on Facebook. Investors don’t seem to care that King has another Candy Crush game, as many worry that the original has peaked and the publisher won’t ever have another game to replace it.

King remains a successful company. Candy Crush Saga is still the highest-grossing game in nearly 23 countries. It is in the top 10 highest grossing in more than 100 different markets. It’s maintained its popularity since its release in late 2012. But everything that goes up and makes a ton of money on mobile must eventually come down. And the market is positioning itself for that — and rightly so.

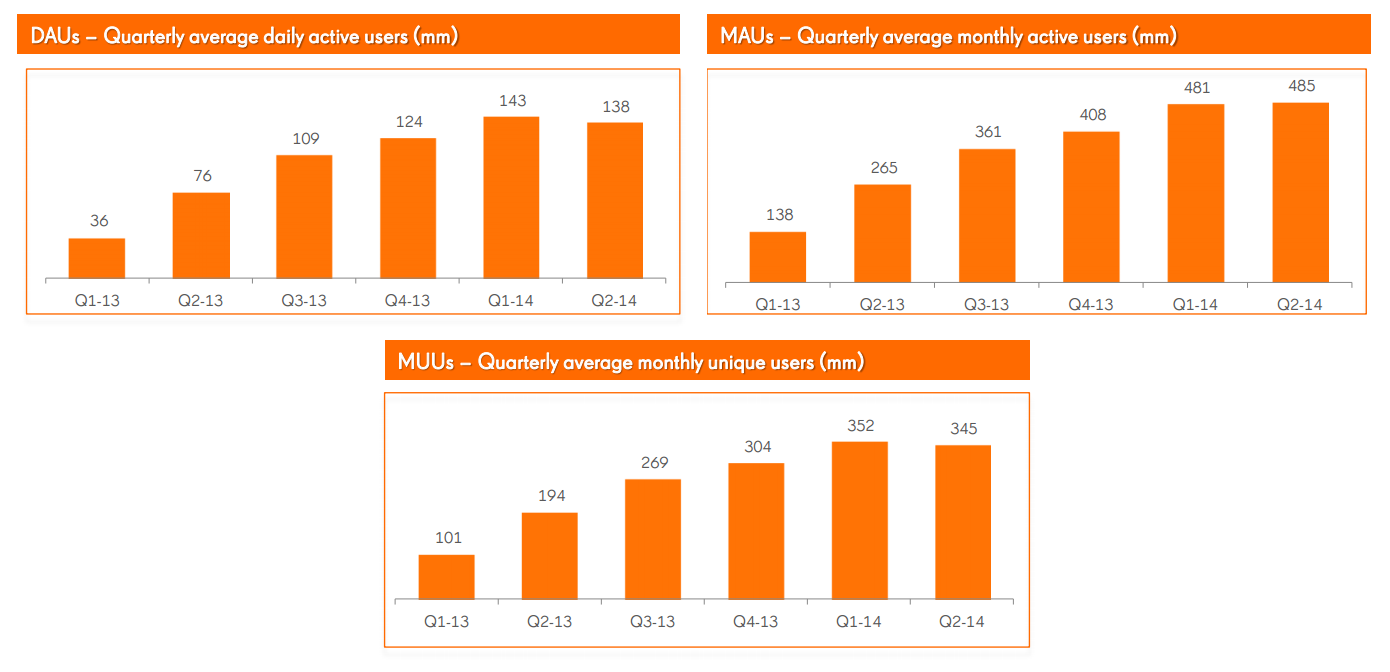

While Candy Crush Saga is almost always one of the top-grossing games, King’s player numbers have started to plateau and even drop in recent months. In August, the company reported its Q2 financial results, and it revealed that its daily average players (DAUs) were down from 143 million in Q1 to 138 million in Q2. Meanwhile, its monthly active users only increased from 481 million in Q1 to 485 million in Q2. Similarly, King’s unique gamers dropped from 352 million in Q1 to 345 million in Q2.

Those numbers are all heading downward, and that’s likely due to Candy Crush Saga losing just a bit of its momentum. Since then (and really since King went public in March), investors have waited for the publisher to show that it can re-create the success of Candy Crush Saga. It has not, and many investors are hesitant to put their money into the company until it proves that it can.

Again, this doesn’t mean that King hasn’t had any successes. It has released a number of new mobile games, like Diamond Digger Saga, that have caught on and are performing well. That puzzle game is the 25th highest-grossing app in the United States right now, for example. But King built its reputation on having the biggest release on mobile and social platforms, and the gap between the 25th highest-grossing app and the No. 1 highest-grossing game is pretty huge.

King seems to realize that another Candy Crush Saga is unlikely, and it wants to continue pumping money makers that aren’t necessarily phenomenons. Even Candy Crush Soda Saga doesn’t seem like it could do more than appease fans growing restless with the original game.

Want more mobile investment data?

Get a free 43-page summary of our Mobile Investment Review.

“Our long-term strategy is to develop global game franchises which are loved by millions of players around the world,” King chief creative officer Sebastian Knutsson said in a statement. “Candy Crush Soda Saga offers fans new gameplay features and challenges to delight in, and has been designed to complement the original title, which we believe players will also continue to enjoy.”

The biggest thing about King is that it may likely make the entire market cool toward mobile-game developers. Prior to its initial public offering, the word was that King was the anti-Zynga. That publisher, famous for Facebook megahits like FarmVille, quickly lost its value on the stock exchange because it wasn’t ready to shift to iPhone and Android. King doesn’t have that problem. It’s making money on Facebook and smartphones, but even that can’t keep its stock from plummeting.

Right now, King might have more success by shifting its model to follow some of the new leaders on mobile. Developer Glu has started to stand out thanks to its lucrative megahit Kim Kardashian: Hollywood, which is using the celebrity’s persona to market the game. Glu’s starlet-endorsed game has already made $50 million in four months, and it should keep making money like that for the foreseeable future. It’s possible that a big company like King could do something similar, and analysts think that is likely.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More