The console business has ruled gaming for years. But its reign may officially end next year.

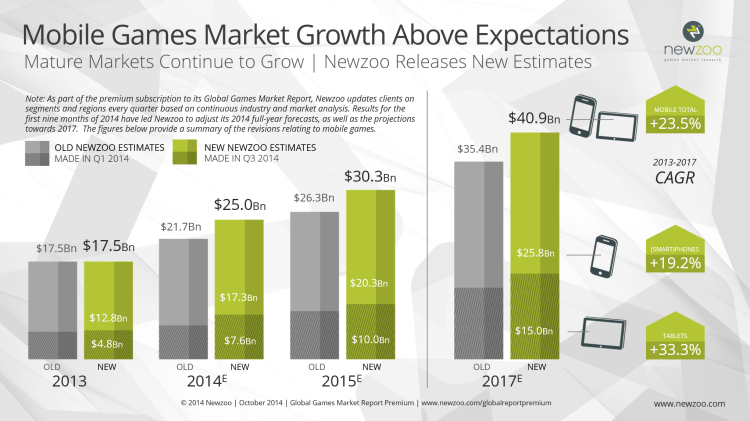

The mobile game business is expected to surpass console games in revenue in 2015, according to Newzoo. The market-research firm said that mobile games will hit $30.3 billion in 2015, up from $25 billion in 2014. Newzoo’s latest quarterly estimates are more optimistic than in the past, following strong year-to-date growth in both mature and emerging markets, for smartphone and tablet games. Amsterdam-based Newzoo is more optimistic about mobile games than rival SuperData Research, which predicts that mobile games will hit $21.1 billion in 2014. By 2017, mobile games are expected to top $40 billion.

One new milestone: Apple’s game revenues could be double those of Nintendo this year. Apple is expected to generate $4 billion in revenue from games sold in its iTunes App Store, while Google could generate $3 billion in revenue in 2014. Last year, Nintendo’s revenues were $2.4 billion, and the total is expected to be smaller this year.

Need help monetizing your app?

Learn what successful game developers do differently.

The newly revised Newzoo forecast for 2014 is up 42 percent from mobile game revenues in 2013. The North American market is now expected to grow 51 percent year-on-year, while Western Europe is expected to grow 47 percent. The fastest-growing mobile game market is Southeast Asia and China, which will be up 86 percent.

Japan’s iOS and Android game revenues are growing fast, but the overall market is just stable because of the collapse of traditional feature phone game revenues. Game revenues on tablets are growing faster than on smartphones, Newzoo said.

“With the public release of these new forecasts, Newzoo is deliberately countering the sentiment aired in recent months that the mobile gaming market is becoming saturated in mature Western markets, especially the U.S.,” said Vincent van Deelen, market analyst at Newzoo. “This is simply not the case. We are also emphasizing that the recent results of individual high-profile companies such as Rovio, King, DeNA, and Gree are not necessarily indicative of the state of the mobile market as a whole. It is not in our interest to inflate market figures, but the hard facts have forced us to adjust our estimates upward. We have maintained our year-on-year growth rates toward 2017.”

Newzoo said that the high mobile growth rate is driven by both “organic growth,” lifting the overall market, and “cannibalistic growth,” which comes at the expense of other segments. Handheld console, casual, and social gaming have been weakening. Spending for online PC games and massively multiplayer online game is going toward mobile devices.

Peter Warman, CEO of Newzoo, said that in mature Western markets, the battle between iOS and Android is shifting toward tablets. The iPad keeps iOS ahead in overall mobile game spending, while the Android market is fragmented across different operating systems and devices.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More