Market-leading public cloud Amazon Web Services (AWS) had another rough quarter revenue-wise in the third quarter of 2014, Amazon.com disclosed in its earnings statement today.

And while Amazon continues to be vague about the financial figures of its public cloud, it’s possible to make an educated guess.

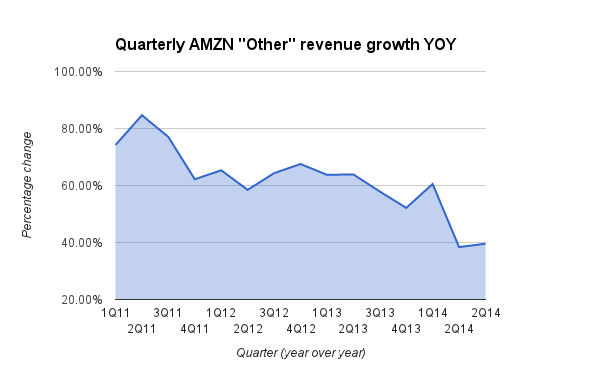

For the second quarter in a row, the year-to-year revenue growth rate for Amazon’s “other” revenue — including AWS as well as advertising services and co-branded credit card agreements — came in below the considerably larger numbers in years past. It hit 39.58 percent, based on $1.34 billion in revenue.

That’s just above the second-quarter revenue growth number of 38.39 percent.

As top competitors Google Compute Engine and Microsoft Azure move fast to lower prices and introduce new features, Amazon has also done its share of price cutting.

And as Amazon continues to run that play, its revenue growth just isn’t what it was in the golden days.

To be fair, though, it’s not like Amazon’s cloud revenue isn’t going up anymore. It is.

And Amazon has indeed been hard at work, frequently introducing new features.

In the words of Amazon chief financial officer Tom Szkutak, “The team is innovating very quickly.”

A summary of AWS news in the quarter:

- A new T2 instance

- A hint of an AWS region in Germany, which actually launched today

- The Zocalo file-sharing service

- New mobile application services

- A price cut for the Route 53 managed domain-name service (DNS)

- Tax credit for a new data center in Ohio

Perhaps the team Szkutak spoke of simply needs to innovate just a little bit harder.

Amazon stock was down more than 10 percent in after-hours trading.