Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

Now that it’s out, how will Apple Pay change the dynamics of mobile marketing?

The consensus of the experts we consulted is that it will have an impact — but there are wide differences of opinion about the size of that impact and Apple Pay’s advantages vis-à-vis credit cards.

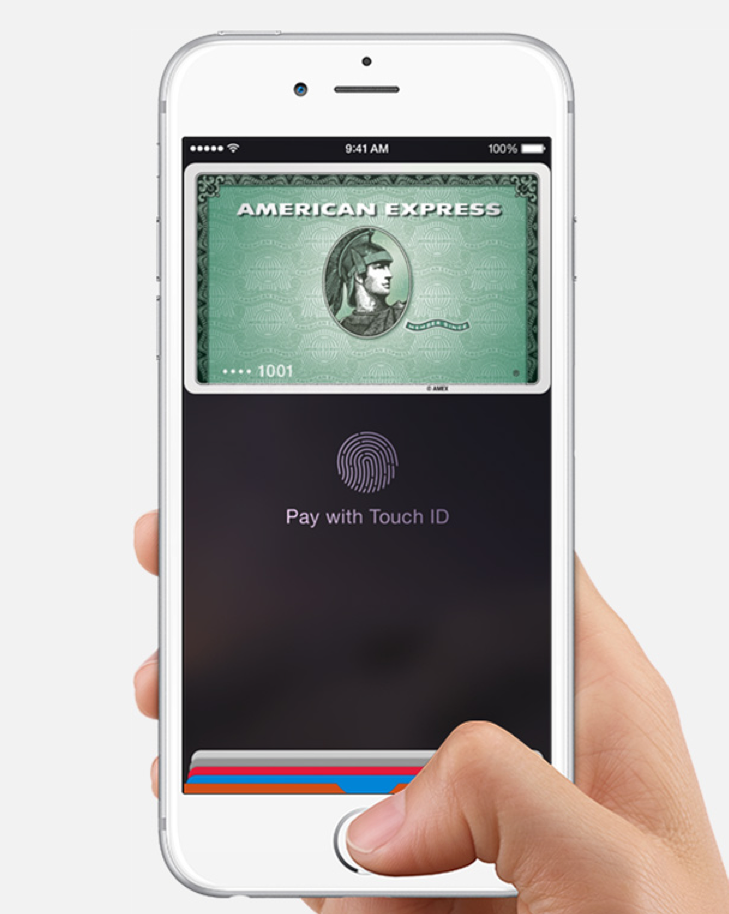

The payment process itself is speedy and straightforward. As VentureBeat’s Devindra Hardawar noted in his maiden voyage:

“When checking out at participating stores, you just need to hold your phone up to the payment terminal, watch your default [credit] card pop up [on the screen], and hold your finger down on the Touch ID sensor for authentication.”

That kind of speedy and painless payment process could impact how people make purchases online, in brick-and-mortar stores, or both.

The online impact could be affected by the reported planned integration of Apple Pay into iAd. Users could thus almost instantly buy online products seen in mobile ads.

Assuming that integration happens, Forrester analyst Jennifer Wise told VentureBeat there will be three impacts.

“It will boost attribution for mobile ads’ impact, it will boost m-commerce, and it will complement marketers’ ability to specifically target customers ready to make the purchase.”

Mobile developer or publisher?

Learn how successful apps make more money with fewer ads.

The return-on-investment of mobile ads is hard to determine these days, she pointed out, “which is holding back spend.” A direct, relatively frictionless pay method means marketers can get hard info on whether those ad campaigns are working to create sales.

iAd also allows for retargeting, where a user who has abandoned a purchase earlier can be shown another, more enticing ad later.

Time savings?

But not everyone thinks this kind of “see ad/buy painlessly” flowthrough will make that much of a difference.

“How often do we click on an ad and instantly buy the item?” asked Richard Bagdonas, cofounder and CTO at beacon platform provider Mahana.

Mobile ads for video games, he noted, use iTunes credentials anyway.

But online shopping from a mobile device — which has a shopping cart abandonment rate of 97 percent — could get a boost by a quick payment process.

“A lot of time when people are shopping online, they have to put in their credit card numbers, [and] people get cold feet,” Gartner Research VP Mark Hung noted. Even with a stored credit card, he told us, it’s “a three-step process,” while Apple Pay, requiring just a Touch ID fingerprint confirmation, is just one step.

It may be that there are other factors holding back mobile online purchases, such as not wanting to make a decision using a small screen. The physical store may be the arena where mobile payment could create new forms of shopping.

But there still need to be several next steps to really change the in-store dynamic, Bagdonas told us.

“Apple Pay should be looking to leverage iBeacons,” the beacon provider told us, with consumers being recognized “when they get near the cash register so the merchant can change their experience.”

The bigger issue for in-store sales with Apple Pay, Bagdonas said, is that it’s still not that much of a time savings to tap a phone on the point-of-sale terminal, compared to having a credit card swiped.

“Apple Pay doesn’t replace the requirement for me to enter my phone number to get the member savings,” he said — at least until Apple Pay supports loyalty cards.

“With Apple Pay I have to enter my phone number on the PIN pad, then answer the questions about donating to charity on the payment terminal before I ever tap my phone to pay. Any appreciable time savings aren’t there. The half-second in time savings could be quickly eaten up by the cashier waiting for the receipt to print or if they want to hand me coupons.”

It’s worse at sit-down restaurants, he said, where there’s no point-of-sale terminal at the table. In those situations, Bagdonas said, “Apple is banking on OpenTable and other mobile payment companies to bake Apple Pay into their apps. This means Apple Pay’s success is based on the success of others.”

There’s another important fact: “Credit cards don’t rely on a battery nor do they rely on a fingerprint to work,” Bagdonas adds.

‘Closing the loop’

But mobile marketing technology firm Vibes sees the in-store use of Apple Pay as “closing the loop” of mobile marketing.

Vibes’ VP of marketing Mark Tack told VentureBeat that Apple Pay needs to be seen as part of Passbook, the app that holds coupons, loyalty cards, offers, and credit cards.

He said Vibes’ client Pep Boys has found that “26 percent of customers who saw an offer added it to their Passbook,” and 30 percent of all Pep Boys mobile wallet offers (including ones in Google Wallet) were redeemed in the store.

“All roads need to lead to saving branded content on your phone” in Passbook, he said, from whatever advertising or marketing push. From there, Apple Pay is a quick way to close the deal.

“Passbook is the shopping companion that acquires all the branded content for the customer,” he said. “Now that Apple has added the payment option,” it can increase consumer usage in stores.

None of this matters if Apple Pay doesn’t get a critical mass of consumers and retailers. One of the doubters about that happening is our own Stewart Rogers, director of marketing technology at VB Insight.

The worldwide market share for iOS is slightly under 12 percent. The iPhone 6 and 6 Plus are still a relatively small slice of that. (Apple Pay also works on the Apple Watch, iPad Air 2, and iPad mini 3.)

“Google Wallet is in many more devices,” Rogers said, “but they’ve never managed to get it beyond the U.S. and it hasn’t really picked up any traction. I think there’s a long way to go on NFC [near-field communication] pay tech.”

“Even if everyone bought an NFC iOS or Android device tomorrow,” he pointed out, “we still have to wait for every merchant to upgrade their payment devices.”

‘A game changer’

Gartner’s Wise is more optimistic about the prospects for Apple Pay succeeding where others haven’t.

“It comes with the trusted Apple brand, and it feels secure to consumers — card issuers verify and authenticate the card, it has on-device encryption, and it requires Touch ID to activate,” he said.

And Parks Associates’ Jennifer Kent described Apple Pay as “a game changer because Apple does not release products without the necessary marketing resources.” None of the other mobile payment players “has put nearly enough resources into consumer education,” she said, “resulting in a lack of traction for the mobile payments space as a whole.”

There’s also the matter of timing, she said. Next year is when merchants will be upgrading their point-of-sale systems because of a new industry initiative intended to reduce the risk of fraud by accepting EMV [computer chip credit card] payments, which are more secure than traditional mag-stripe cards.”

“Payment terminals that accept EMV are typically able to accept NFC payments as well,” she said. “There will be many more merchants who accept contactless payments in 2015 than ever before.”

In that case: Chicken, meet egg.

The question at that point is whether they can get something cooking.