The game business is booming, but its biggest retailer failed to impress investors with its third-quarter results.

GameStop generated $2.09 billion in revenue during its Q3. That is down 0.7 percent from $2.11 billion during the same period last year. It also is well under Wall Street’s estimate of $2.2 billion. The company also reported earnings per share of 50 cents, which missed analysts’ predictions of 61 cents. The company points to a tough comparison due to a major annual franchise moving into November, but it also claims that most of its internal numbers are looking up.

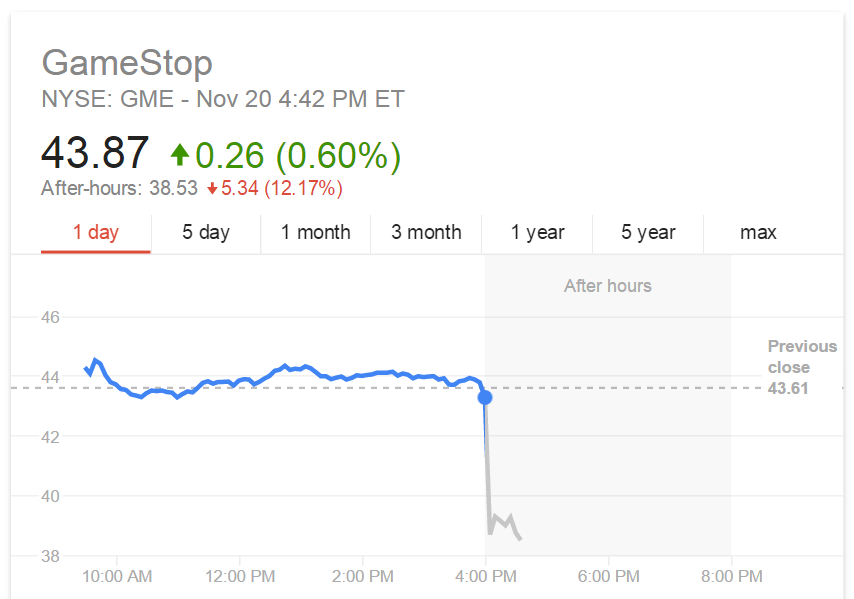

The market is punishing GameStop for missing its earnings. The stock price is down around 13 percent to $38.76 in after-hours trading. That’s after closing the market today at $43.87.

“Overall, most of our major product categories performed very well,” GameStop chief executive officer Paul Raines said. “But our third-quarter results were impacted by Assassin’s Creed: Unity moving out of October.”

GameStop noted that hardware sales are up 147.4 percent year-over-year thanks to the strong performance of PlayStation 4 and Xbox One. Likewise, the retailer continues to generate sales from selling codes and cards for digital content. That sector of GameStop’s business is up 52.4 percent from Q3 2013.

Looking ahead to next quarter, GameStop expects to bring in earnings between $3.40 per share and $3.55. It also expects annual growth somewhere between 13.5 percent and 18.5 percent.

For Q4, GameStop is targeting earnings between $2.08 and $2.24 per share.

“As we look at the holiday quarter, we are focused on relentlessly applying our competitive advantages,” said Raines. “[That includes] convenience, strong [consumer relationships], knowledgeable associates, and value through our unique forms of currency, which include buy-sell-trade and the new PowerUp Rewards credit card, to deliver a successful quarter.”