Cloud file sharing company Box today came out with some more good news and bad news in the most recent edition of its S-1 filing to go public. The filing reflects a company that’s continuing to work very hard to become a solid investment for public markets.

The picture of Box now looks better than it did in July, when the company issued updated financials.

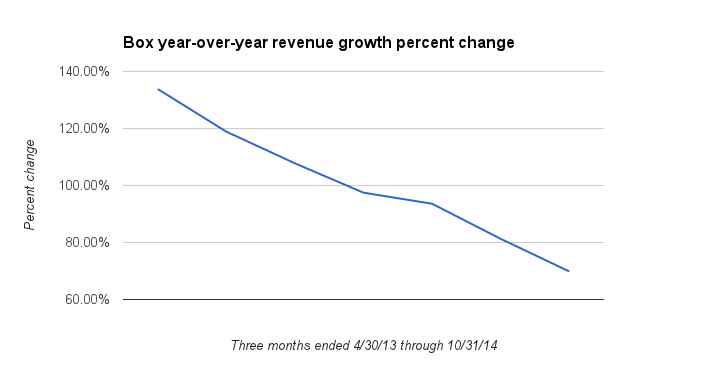

First, the bad news: The company isn’t growing its revenue at the speed it was in the past. To be exact, revenue for the quarter ending on Oct. 31 came in at $57 million, up 69 percent above the year before. That percentage representing growth is the lowest since at least the end of April 2013, if not earlier.

Here’s a chart depicting the trend:

But all this is countered by good news the company had to share.

Revenue itself in the quarter ending on Oct. 31 — that $57 million figure — has never been higher for Box. And year over year, the loss for that quarter is down a bit, coming in at $45.42 million, compared with $51.39 million the prior year.

It’s unclear when Box will actually go ahead and price itself to go public. Today’s filing didn’t go into that territory.

Box offered VentureBeat the following comment on its IPO plans:

Our plan continues to be to go public when it makes the most sense for Box and the market. As always, investing in our customers, technology, and future growth remains our top priority.