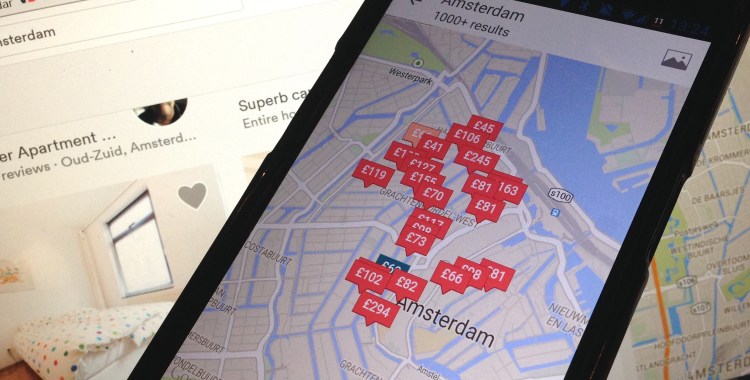

San Francisco and Portland were among the first U.S. cities to impose hotel-style taxes on Airbnb hosts, with San Jose set to join soon. Now, however, Airbnb is gearing up to start playing the role of tax collector in its first European city — Amsterdam.

The Dutch city has had a fractious past with Airbnb, having declared the service illegal before reversing that decision.

As with many other locales, the crux of the problem is that Airbnb hosts aren’t subjected to the same taxes as official guesthouses or hotels. While many cities, including Amsterdam, already technically impose levies on Airbnb hosts, the responsibility has typically fallen to the property owner to pay these fees.

Now, Airbnb will collect tax for Amsterdam City Council at the point of transaction, with five percent of every booking retained by Airbnb starting from February 2015.

“This is good news for our hosts, who will benefit from a simplified tourist tax process and clearer information on what local laws and regulations may apply to them,” Airbnb public policy chief David Hantman said in a blog post.

“It is also a great example of how we are working together with policy makers across the world on progressive rules that strengthen cities and help local residents make a little extra money to afford living costs.”

This could also set a precedent across the continent, with many official hotel and B&B owners in other cities and countries no doubt frustrated at the apparent regulatory double standards.