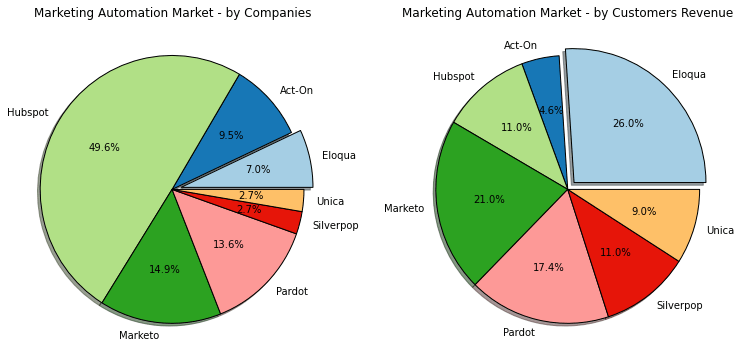

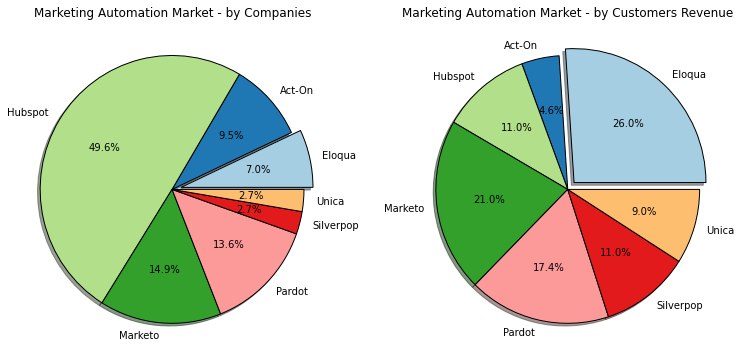

In the marketing automation world, one thing’s a given: Hubspot has top market share. And it does — with close to 14,000 installs across the web … about as many as all other marketing automation vendors combined.

But what if you look at enabled revenue?

With the tables flipped, all of a sudden Oracle’s Eloqua looks pretty impressive. According to predictive lead scoring leader Mintigo, Eloqua is leading all marketing automation vendors when you look revenue it enables, not just clients who have signed on. By this measure, Eloqua has 26 percent market share, followed by Marketo with 21 percent, and Salesforce’s Pardot with 17.4 percent.

Above: Marketing automation market share by clients vs by client revenue

“We track 10 million companies, and 100 million people in those companies,” Mintigo CTO Tal Segalov told me. “I believe the right hand side view is much more representative of the actual market situation – Eloqua is indeed the leader, closely followed by Marketo, and then Salesforce. The other players really trail behind these leaders.”

VB is studying the big marketing clouds …

Share what you know, and we’ll share the data with you.

On the one hand, this is obvious. Hubspot is not primarily a marketing automation system for enterprise, being designed much more with the needs of small and medium-sized enterprise in mind. On the other hand, this brings much-needed clarity to the market.

Also interesting is that if you add IBM’s older enterprise solution Unica with IBM’s newer somewhat more midmarket-focused Silverpop, no-we-don’t-exactly-have-a-marketing-cloud IBM actually comes in very close to those leaders, at 20 percent.

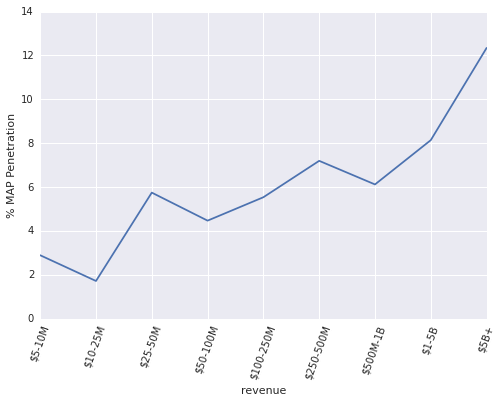

Another interesting thing Mintigo found in that 100-million-company data hoard?

Total marketing automation penetration is often given as a tiny fraction of the overall business world: 3-5 percent. However, when applying the same logic, the reality is that for larger businesses with larger revenues, marketing automation is driving a much greater share of the revenue flowing through the ecosystem than its installed based would have you suspect.

Above: Marketing automation penetration by B2B revenue

“How much of total B2B revenue is being driven by Marketing Automation solutions today?” Segalov asks. “The answer to that is about 10 percent.”

At the $250-500 million revenue level, over seven percent of companies are using marketing automation. At the $1-5 billion level, it’s over eight percent. And in the $5 billion+ revenue bucket, over 12 percent of companies are using marketing automation. Clearly, the higher revenues you have, the more likely you are to be using marketing automation … which means that a disproportionately high percentage of B2B revenue is impacted by marketing automation.

The one company we’re not seeing in the data above? That would be Adobe, who’s marketing cloud includes Neolane, an acquisition the company made a few years ago.

That’s just part of what we’re studying for VB’s February Marketing Clouds report.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More