Adobe, Oracle, Marketo, and Salesforce are leading the marketing cloud charge in enterprise. But besides these usual suspects, newcomers like AgilOne, Sailthru, and Hubspot are giving the enterprise players a run for their money.

And what about Big Blue?

IBM, unfortunately, is burdened by a largely incoherent and unfocused martech strategy.

Today VB Insight is releasing perhaps the most data-driven and comprehensive report on marketing clouds ever created. It’s almost 24,000 words and 120 pages — although we’d never recommend reading all of it in one sitting; it’s designed for browsing — and covers almost 3,000 data points on 18 major marketing cloud vendors. 1,483 marketing technologists contributed their insights to it, and it includes market penetration data based on an analysis of marketing tech embedded in tens of millions of websites.

The big news?

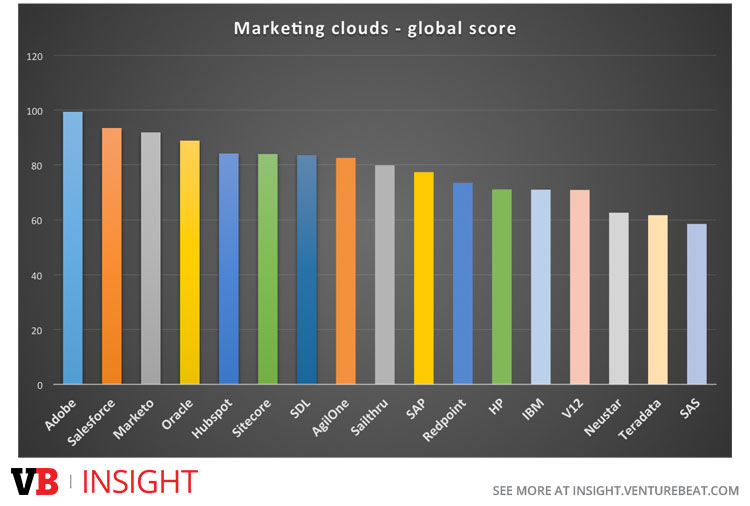

Adobe is killing it in marketing clouds. The company racked up 99.4 points on our 12-category scoring matrix — which we reveal, in detail, in the report. And Adobe has the most publicly reported revenue in marketing clouds by more than a factor of two.

Above: Top marketing clouds by global score in our matrix

That said, Salesforce has perhaps the strongest combination of vision and ability to execute in marketing clouds, and would have challenged Adobe for the lead with a few more answers from the company (it declined to answer one question on our marketing survey). Marketo is a very, very, very interesting leader in the enterprise space as well, with an unmatched focus on the specific needs of marketers, and Oracle surprised us with not only a massive scope of marketing cloud features, but also perhaps the greatest ability to extend the tentacles of the marketing cloud into sales, service, and support portions of the organization of any company on the list.

1,483 marketing technologists participated in the creation of this report:

Marketing Clouds: How the best companies are winning via marketing technology

Perhaps even bigger news, however, are the upstart marketing clouds.

Relatively small and new players are emerging from the customer experience and omnichannel spaces to give marketers a single system with which to twist and push all the knobs and buttons of their marketing technology infrastructure. That includes companies such as Sitecore and SDL on the customer experience side, and startups such as Sailthru and AgilOne on the omnichannel side.

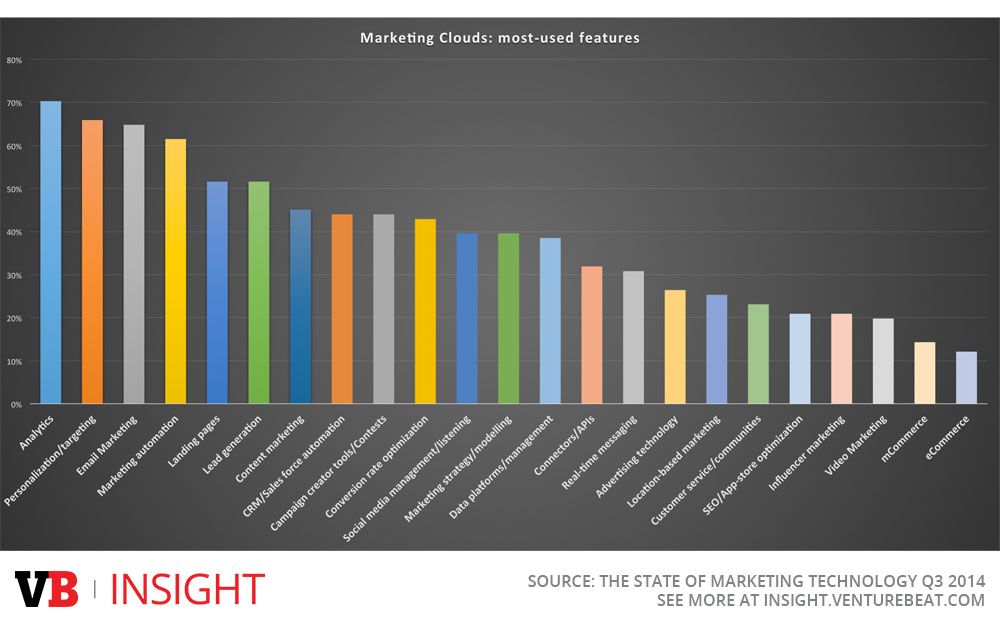

Above: The most-used features of marketing clouds, as marketing technologists told VB Insight

Sailthru and AgilOne, particularly, are friendly on the wallet of the budget-sensitive enterprise or average midmarket firm, starting at just $2,500 to $3,000 per month for what are actually very significant solutions covering massive swaths of your martech needs — more in both of these companies’ cases than SAP, HP, SAS, or IBM.

Another surprise?

Perennial midmarket marketing automation favorite Hubspot put its foot in the ring, asking to be included in the marketing cloud report. That was a bold move, given that most marketing automation systems (which we’re studying this month) focus much more tightly than a broad marketing cloud. And that most marketing clouds incorporate a marketing automation system as part of their overall solution: Oracle-Eloqua, Adobe-Neolane, Unica-IBM, Pardot-Salesforce, and so on.

But the now-more-than-marketing-automation system did shockingly well. Hubspot hit 84.2 points in our matrix, scoring higher than HP, SAP, or IBM.

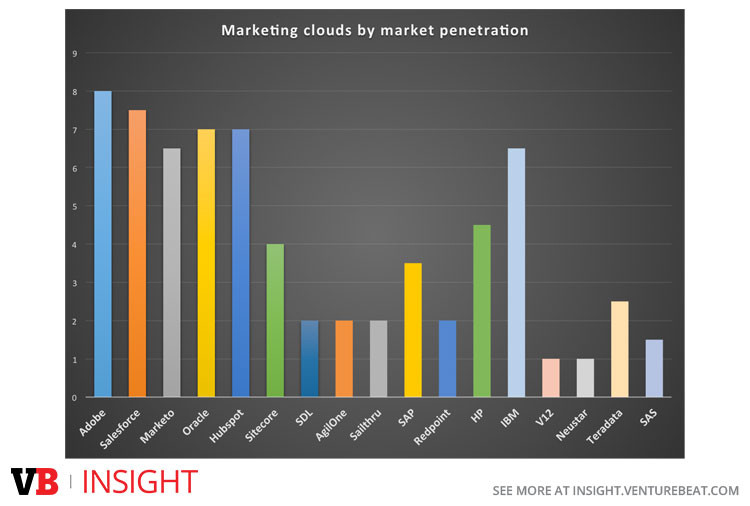

Above: Marketing cloud penetration data

One of the ways we were able to make this report more data-driven than any other we’ve seen is partners. HGdata provided data on tens of millions of websites, as did Datanyze. Both helped us understand how widespread the various embedded bits of marketing clouds are around the web. In addition, Mintigo provided significantly useful revenue share data.

IBM, however, did not fare so well.

The company has extremely capable point solutions in marketing tech which it has tried to unify around the brand IBM ExperienceOne. Unfortunately, that brand is just a brand.

For example, in customer analytics, IBM has eight separate Tealeaf-branded product families and 12 separate named products. In digital marketing, it has 12 different IBM-branded products, including six analytics products. In omnichannel, the company has nine different products, plus 11 more in omnichannel advertising.

As we write in the report, you’re looking at chaos. Martech spaghetti. And IBM is sorely in need of a martech dictator to come in, cut its product list, and focus on building more features into fewer, broader solutions.

The entire report is available now on VB Insight for $499, or free to VB Insight marketing technology subscribers.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More