Square is rolling out a new feature within Square Cash that will let you pay businesses and nonprofits in addition to your friends.

With its latest tool, the company is doing away with paper checks and in the process setting the groundwork for in-store digital payments down the road.

Square Cash for Businesses is aimed at music teachers, dog walkers, and anyone else you might be paying with a check (if you’re not already paying them with PayPal). Money sent from a customer to a business on Square Cash will immediately be deposited in a bank account as opposed to a holding account. Plus, businesses will only have to pay a 1.5 percent fee for each transaction; through Square register, businesses pay 2.5 percent.

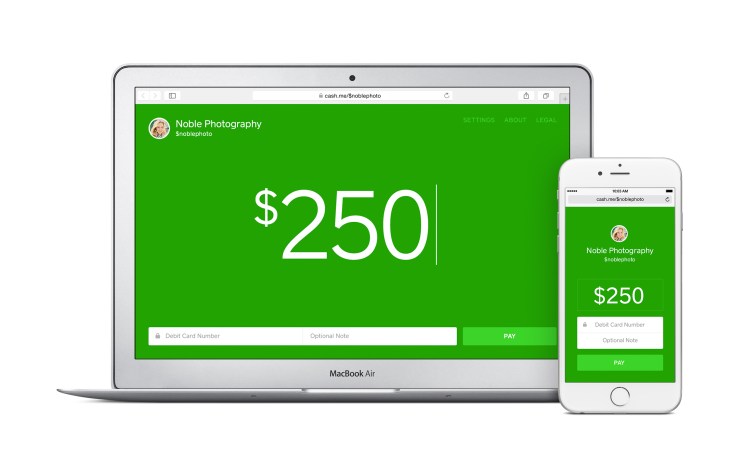

The company is also introducing a feature called Cashtags, which enables businesses to get paid without giving away personal information (ie. phone number, address, email etc). A Cashtag is a way to find and pay a business in Square Cash. For instance, $VentureBeat could be our publication Cashtag.

Users can send money and set up a business account with Cashtag via the app or online at https://cash.me

Square markets the tool as a way to “get paid privately and securely,” which could be seen as a jab to competitor Venmo. The PayPal-owned peer-to-peer payment app features a social feed of all your transactions, making it not-so-private. Venmo was also recently profiled in Slate for operating a platform prone to digital theft.

With digital payments expected to take off in 2015, both in store, in app, and online, it appears as though Square is plotting an aggressive strategy to be the go-to app for small merchants and the self-employed.

https://www.youtube.com/watch?v=16Y4pDr8iZY&feature=youtu.be