Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

Hosting and web domain-registration company GoDaddy made its debut today on the New York Stock Exchange under the symbol GDDY, with shares becoming available at $26.15, up about 30.8 percent from the $20 price at which the company sold shares for its initial public offering.

The debut price is also higher than the $17-19 range that GoDaddy set for its stock shares two weeks ago.

The appearance of GoDaddy on public markets follows several other tech IPOs in recent months, including Box (NYSE: BOX), Hortonworks (NASDAQ: HDP), Lending Club (NYSE: LC), New Relic (NYSE: NEWR), and Workiva (NYSE: WK).

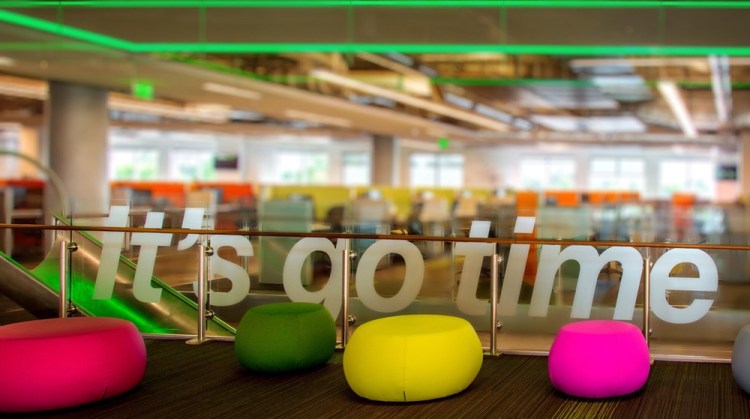

GoDaddy sought to go public back in 2006, but that campaign fizzled out as market conditions changed. This time around, though, it’s “go time,” to use the company motto.

GoDaddy, based in Scottsdale, Arizona, and 18 years old now, isn’t exactly in perfect financial condition.

“We had net losses on a GAAP basis of $279 million, $200 million, and $143 million in 2012, 2013, and 2014, respectively,” as the company put it in a revised S-1 filing with the U.S. Securities and Exchange Commission.

And back in 2011, private equity groups KKR, Silver Lake, and TCV paid a reported $2.25 billion for a controlling interest in the company.

Then again, last year the company generated $1.38 billion in revenue, and it now counts nearly 13 million customers.