Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

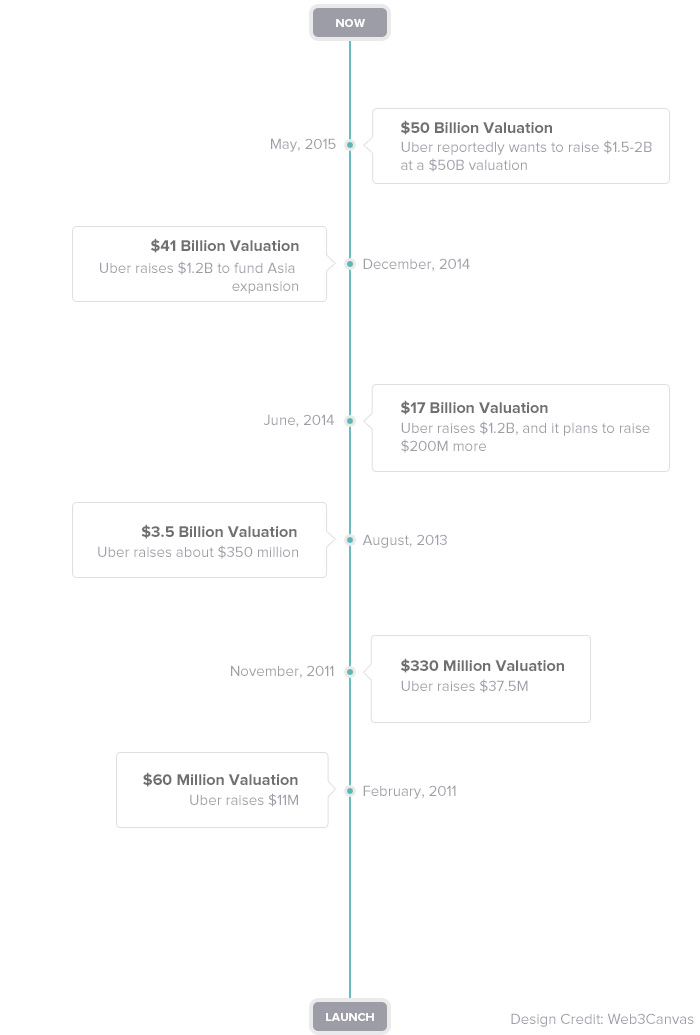

By the end of this month, Uber could be a $50 billion company — at least, that’s the latest rumor, as the transportation company continues its (so far successful) upheaval of a petrified taxi industry.

These days, a $50 billion valuation for Uber hardly turns heads. Back in December, the company announced it’d raised an additional $1.2 billion at a $40 billion pre-money valuation. Only six months prior, the company raised a billion or so at a $17 billion valuation.

The foundation of Uber’s stratospheric valuation is growth. Since 2009, Uber has expanded to serve 300 cities across the globe, and the company has long pitched its ambitions to dominate more than the taxi industry (think: couriers, moving, food delivery, etc). The potential has VCs’ mouths watering, despite the constant legislative setbacks and legal ambiguity.

What’s next? The company could go public. Or raise a couple billion more and delay such a move. Who the hell knows?

For your clicking pleasure, here’s a text version of the valuation timeline with links:

May 9, 2015: Uber reportedly wants to raise $1.5-2B more on huge $50B valuation

December 4, 2014: Uber raises $1.2B at $40B valuation to fund Asia expansion

June 6, 2014: Uber raises $1.2B at record-breaking $17B valuation, and it plans to raise $200M more

August 22, 2013: Uber raises about $350M at $3.5B valuation

November 2011: Uber raises $37.5M at reported $330M post-money valuation

February 2011: Uber raises $11 million at reported $60M post-money valuation