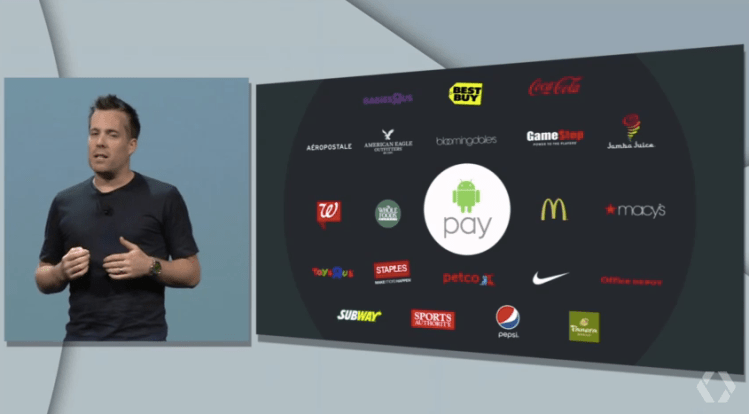

Today Google unveiled Android Pay at the Google I/O developer conference. The new payment platform is a competitor to Apple Pay, which allows iPhone 6, 6 Plus, and Apple Watch users to make purchases on their device or in brick-and-mortar stores.

Android Pay is a payment feature that lets users make purchases both in-app and at physical retail stores. The new feature works through near field communication (NFC) on devices running KitKat or higher at over 700,000 U.S. stores. Google has connected with many of the same partners that Apple has including Lyft and GrubHub.

For select retailers, Android Pay will apply customer rewards at checkout. Though Apple Pay doesn’t currently work with loyalty programs, it is expected to announce a similar capability soon.

Android Pay will also support fingerprint-scanning technology on Google’s upcoming Android M software (much like Apple’s Touch ID).

Apple Pay was announced last September at an Apple Press event. Despite making a big splash in the media, the payment method hasn’t yet taken off with users. Apple Pay is only available to a small number of users — those with the latest Apple smartphone and watch technology — and a recent study shows only six percent of them have ever used the feature.

In that study most users said they often forget to use Apple Pay and were unsure where they could use it. Android Pay will face many of the same issues, though there is room for growth with in-app payments.

Anyone who has ever used Apple Pay or Amazon’s Buy button can attest to the ease of making a purchase with a simple tap of a button or scan of a fingertip. The difficulty is mostly in signing up for the service in the first place.

Google probably won’t be able to sidestep this issue, though if it can easily onboard users who already have a credit card hooked up to their Google Play account, it will at least be doing as well as Apple. Last year, Google announced that it had over one billion Android users.

One thing is for certain, Android Pay has much more opportunity for success than its predecessor, Google Wallet.

Google Wallet failed to take off in a big way because mobile carriers like Verizon and AT&T blocked the company from accessing a chip called “the secure element,” a component that allows financial information and other credentials to be safely stored. The carriers were working on a competing mobile wallet called Softcard, which Google has since acquired.

With Softcard in its pocket, Google is finally able to access the secure element and overhaul its payment system. But this acquisition may be too little, too late. Where Google Wallet was a pioneering product, Android Pay is launching into a crowded market. Apple Pay has already captured the world’s attention, even if it hasn’t taken off yet, and it has features that Google is only now catching up to. What’s worse, Apple Pay isn’t Google’s biggest problem — Samsung is.

Samsung makes the most popular Android devices and, unfortunately for Google, has plans to launch its own mobile payment platform, Samsung Pay, this summer. While a wide range of manufacturers use Android’s operating system, Samsung sells a lot of Android phones, and its payment feature stands to stifle Android Pay’s growth.

To view all of VentureBeat’s Google I/O coverage, click here.