Financial software company Intuit announced today in its earnings statement that it would divest its Quicken, Quickbase, and Demandforce businesses. This is big news, considering that Quicken was once at the center of Intuit.

“As you know, Quicken is a desktop-centric business that does not strengthen the small business or tax ecosystems,” Intuit chief executive Brad Smith told analysts on the company’s quarterly earnings call today (transcript here). “Our strategy is focused on building ecosystems and platforms in the cloud. We value our loyal Quicken customers, and we’re seeking a buyer who will provide the product support and service they deserve.”

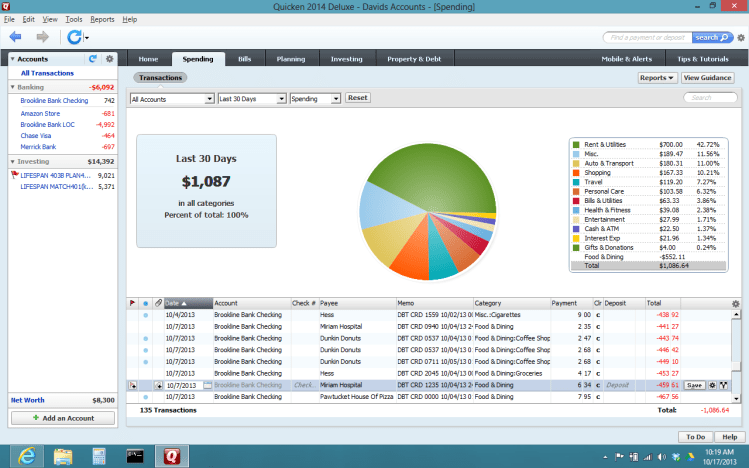

Of course, Intuit brings in millions each quarter from other properties, like TurboTax tax software and QuickBooks accounting software, but Quicken at one point was a sort of institution in desktop software designed to keep track of what you spend.

Quicken, which came out in 1984, is what Intuit was founded on. Intuit pushed hard and successfully beat Microsoft at selling personal finance software for Windows in the 1980s, Intuit founder Scott Cook said in a 2001 interview with the Harvard Business Review.

In the mid-1990s, Quicken started losing money, but the company found ways to reverse the downturn by “making the product more compelling,” said Cook. Quicken “is the core” of Intuit, he said.

Throughout the 2000s, the company said that Quicken had around 15 million users.

“Quicken uses the power of the Internet to help consumers make more informed financial decisions,” Intuit boasted in an undated fact sheet on the product that pegged the user base at 15 million.

But in the past year Quicken has brought in less revenue for Intuit. (Last year Intuit started recognizing desktop software license revenue when services are delivered, not up front.)

In Intuit’s 2015 fiscal year — the year that ended on July 31 — Quicken did $51 million in revenue. That’s down from $96 million, $99 million, and $98 million in Intuit’s 2012, 2013, and 2014 fiscal years, respectively.

Today, Quicken is described as a “held-for-sale asset,” and a “long-lived asset.”

The Mountain View, Calif.-based company, which finished the fiscal year with $365 million in net income on $4.19 billion in revenue, has come a long way. Now acquisitions like Check, Lettuce, and PaySuite have kept the company in the blog headlines. While it might be for the best financially for Intuit to offload Quicken, the company will also be losing some of its heritage.