2014 was another record year for e-retailers in the United States. It was the fifth year in a row that web sales growth has been close to or above 15 percent, with Americans spending over $300 billion online.

The big winner? A full 30 percent of that revenue was captured by Amazon last year.

That isn’t a big surprise, but what might surprise you is the sheer dominance of Amazon when it comes to searching for products for the first time versus search giants such as Google.

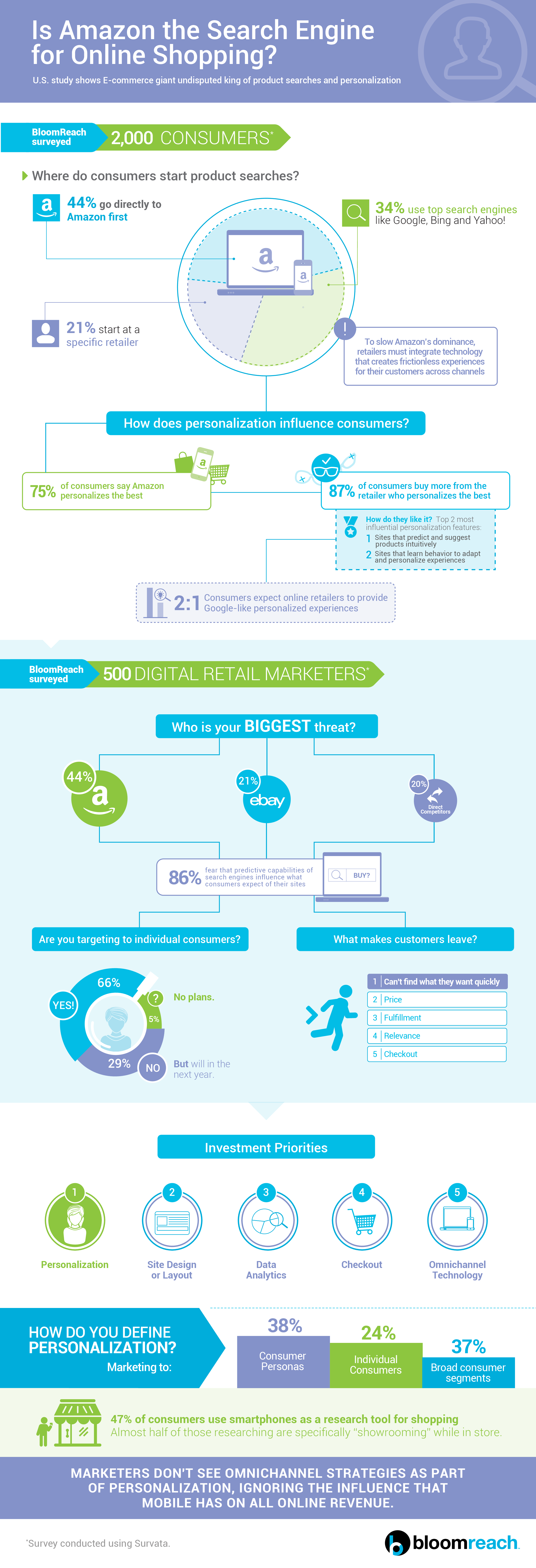

A new survey conducted by BloomReach using data provided by Survata tells an interesting story. Following on from research conducted in 2012 by Forrester Research, which found that 30 percent of buyers use Amazon as their first port of call when searching for products, BloomReach surveyed 2,000 consumers to see if that had changed.

And it has. Significantly.

44 percent of buyers now bypass the whole Web and head to Amazon as their first port of call for product searches.

I asked Joelle Kaufman, head of marketing and partnerships at BloomReach, what may have led to this growth in going straight to Amazon since Forrester’s report.

“Concurrent with this growth in commerce search starting at Amazon is the rapid adoption of smartphones and their widespread use as a shopping device — used for rapid research,” Kaufman said. “Amazon dominates mobile shopping with their app, and that’s a natural place for many shoppers on smartphones to start.”

However, while Amazon advances the battlefield on one side, the traditional allies of retailers — search engines — have inadvertently squeezed retailers from the other. The BloomReach consumer survey found that consumers — at a 2:1 ratio — are wondering why their favorite retailers aren’t delivering the same personalized discovery experience on site or on mobile that search engines provide on the wider Web.

Those facts were echoed as major concerns for digital marketers too.

When BloomReach recently surveyed 500 digital retail marketers (a study also conducted by Survata), marketers not only identified Amazon as their biggest threat (44 percent) compared to a direct competitor (20 percent) or eBay (21 percent), but 86 percent also feared that personalization technology from top search engines like Google was very or highly influential on consumers’ expectations for their sites.

As a result of the technology gap growing from both ends, personalization ranked as the number-one priority that marketers will invest in over the next 18 months.

While both consumers and digital marketers agreed that convenience and relevance were the top two values that personalization offers, the two groups disagreed on what website personalization feature provided the most value.

Consumers valued the onsite search box as the most important feature, but marketers felt that navigation elements like facets and filters provided the best value. More significantly, marketers’ opinions on the best personalization value were all over the map, breaking down almost evenly across all categories — search box, navigation, suggested/related products and promoted products.

As the landscape for marketing technologies exploded to almost 2,000 participants, marketers have struggled to make sense of the noise. BloomReach’s digital retail marketer survey revealed that marketers are split on how they define personalization: 38 percent believed it applied to consumer personas, 37 percent believed it applied to individual consumers, and 24 percent still thought it applied to broad consumer segments or demographics.

One other surprise from BloomReach’s findings? Despite all the talk about convergence, omnichannel, and going “mobile first,” marketers are focusing elsewhere.

According to the study, marketers don’t recognize that connecting and personalizing the mobile experience to other channels is important, while previous research shows that the majority of consumers would prefer to be recognized across channels. The BloomReach digital retail marketer study revealed that omnichannel technology ranked last in order of importance.

“Ecommerce executives cannot invest in omnichannel independent of a company-wide strategic commitment,” Kaufman said. “And that commitment requires reporting, compensation and systems changes that are significant. Even ‘pick up in store’ and ‘return to store’ can create significant attribution challenges — who gets credit for the sale? Who takes responsibility for the return? Ecommerce executives may grow their careers by improving just the ecommerce business rather than the whole business. Omnichannel needs to be driven by the C-Suite.”

Kaufman warns that ignoring omnichannel is a poor strategy for retailers that want to compete with the ever-growing e-retailer industry.

“People don’t think, ‘Now I’m going to shop on my phone; now I’m going to shop on my laptop; now I’m back on my phone.’ They just shop,” Kaufman said. “But marketers often painfully approach omnichannel personalization in this way, siloing data and chalking every solution up to a responsive-design problem. Marketers are ignoring the 25x mobile-influence factor, inaccurately thinking that ‘omnichannel’ and ‘personalization’ are mutually exclusive.”

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More