Tod Wilson knows what it means to be a small business owner. He’s been traveling down the entrepreneurial path since he graduated high school. Working with his godfather in the bakery business got him hooked and eventually led him to open Mr. Tod’s Pie Factory in Somerset, New Jersey. But even after appearing on Shark Tank and seeing business pick up, he felt something was missing: a way to really differentiate himself from the rest of the pack.

“I want to make Mr. Tod’s a national brand,” Wilson told VentureBeat, voicing an aspiration shared by many small business owners. According to the United States Census Bureau, there are nearly 28 million small businesses in the country –accounting for 54 percent of all sales and 55 percent of all jobs — and the sector has been rapidly growing at a rate of 49 percent since 1982.

Still, with so many stores and big box retailers angling for your money, how can a small business remain competitive? Certainly, improved customer experience is one of they key ingredients, and increasingly, small business owners have turned to technology for help in this department. Among the many merchant services and payments providers on the market, Square, with its aim of being a full-stack commerce provider for the growing small business community, has emerged as a formidable player.

Taking note of small business

Square’s recent filing for its initial public offering paints an interesting picture of its relationship with the small to medium-sized business community. Since 2011, Square’s main customers have been businesses with annualized gross payment volume of less than $125,000. “Most of the sellers that use our services are small businesses, many of which are in the early stages of their development…,” the company wrote in its S-1 filing.

In fact, much of what Square has produced so far has been targeted at the small-business owner. From payments offerings like the initial card reader and the Square Stand to business financing through Square Capital, the company has been on a mission to help entrepreneurs grow and thrive. Chief executive Jack Dorsey staunchly supports this mission and has pledged to give more than half of his equity to his newly created Start Small Foundation, which is aimed at helping small-business owners and others in underserved communities, starting with those in Ferguson, Missouri.

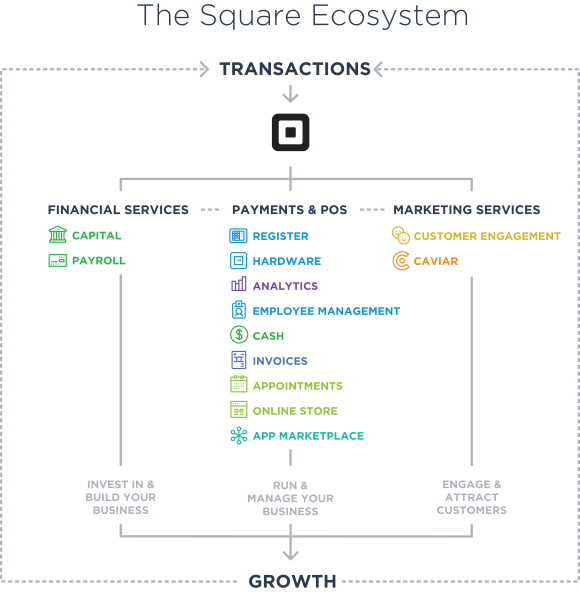

Square, which some call “an operating system for small business,” has made available a myriad of tools and devices to help a fledgling one-person business expand without compromising on personalized customer experience.

While the company that put Square on the map was Starbucks, it was a flower cart named Lilybelle that really launched Square in the small business space. Today, Square’s customer base represents a host of industries, although most come from the retail, services, and food sectors.

“The thing about Square is that its biggest advantage is that it could empower SMBs to become more of a digital business,” said Brian Solis, principal analyst at Altimeter, a Prophet company, and author of X: The Experience When Business Meets Design. “Digital Darwinism knows no sides — it’s an equal opportunity disruptor. SMBs struggle with this and it’s devastating to the economy if they don’t adapt.”

For Mr. Tod’s Pie Factory, Square’s technology has provided the tools to sell more pies. When Wilson first came across the technology, he admits he was puzzled, but said he wasn’t afraid: “I was impressed by the seamless nature of Square,” he said. “I was also fascinated to find out that they not only had the [Square reader], but also the back-office stuff. All I had to do was buy an iPad and the [Square Stand] and you were all set up … in the past, I’d be spending $3,500 to do the same thing.”

And while most of Square’s services are focused around payments and point of sale, the company is determined build out a full spectrum of commerce offerings.

‘We expect more from businesses in the age of smartphones and apps’

Running a small business requires the ability to scale and grow over time. These solutions also have to work reliably because there are too many other things an entrepreneur has to deal with in order to make money.

“PayPal, QuickBooks, and Bank of America don’t think about small businesses like Square,” Wilson explained, referring to the comprehensive slat of offerings that these providers offered. He feels that the seamless integration available through Square enables him to not only process credit cards, but also run his business using the slate of back-office software that’s available.

“I believe that any new business today has got to have some mobility or some option to grow,” said Leora Madden, the proprietor of Pearl Wine Company in New Orleans, Louisiana. She opened her business in 2013 doing deliveries and catering, so her first priority was processing payments. “Mobility is important for me because we were the first company in New Orleans to offer full-service liquor delivery to consumers. For us, that’s been the backbone. When you look at fundraising events or event where businesses are showcased, art shows, craft fairs, there’s a lot happening in the small business market that takes them out of their brick and mortar.”

Now, she has a brick and mortar store to manage as well, and she feels that Square just gets it: “I did a lot of research in terms of different point of sale systems and what they had to offer,” Madden explained in a phone interview. “Because Square is so meticulous about releasing software only when it’s absolutely ready and has mobility, it’s the most amenable to two business models. That’s something that, to this day, is hard to find.”

“Having a bar and having experienced bartenders, they’re used to point of sale systems like Aloha, Micros, etc., but they’re expensive and in-depth systems for restaurants and bars,” she continued. “We’ve grown with Square to offer more features like those large systems, but at the end of the day, for me to have access to systems that work for both my retail and my bar, you can’t put a price on that. There really is nothing like it in the market that can handle it.”

In essence, Square is primarily a software company, that, on the hardware side, offers a well-designed credit card reader plus its POS device, the Square Stand. And that’s what most businesses need these days: a way for people to swipe their cards and a simple POS system. Yes, you can integrate third-party peripherals if needed, but what Square seems to have capitalized on is how people engage in commerce in the age of smartphones.

Merchants like Mr. Tod’s and the Pearl Wine Company agree that part of Square’s appeal is its innovative mentality. “These guys have their hands on the pulse of small business in America,” Wilson said. For him, a big victory for small businesses has been the introduction of Square Capital, a merchant cash advance program that has advanced over $225 million to help small businesses grow: “Square is making it easier to access capital … that’s one of the things that concerns businesses.”

“When you’re trying to scale and open up new locations and have a lean and mighty team, not having to worry about payments or that the customers are satisfied is a huge thing,” he said. And, although he initially was in disbelief about the cash advance program providing capital so quickly, Wilson’s business turned to it when his first shop in Somerset, New Jersey was destroyed during Hurricane Sandy. “Square can provide capital in time of need — that’s a lifesaver and you don’t forget it. You stay loyal.” This fall, Wilson said Mr. Tod’s will be opening up new stores in Harlem, New York and Montclair, New Jersey, both of which will be using Square.

Changing the status quo for Square

Above: Philz Coffee chief executive Jacob Jaber appearing on Bloomberg on February 25, 2015 talking about Silicon Valley’s coffee addiction.

With 30 stores set to open by the end of 2015, Philz Coffee in San Francisco knows how important customer service is. People want to come in, place their order, and be on their way, chief executive Jacob Jaber explained, describing how Square has helped him achieve this objective.

“We took a lot of time to look for a great POS partner. First and foremost, what’s important is how to deliver the best customer experience,” he said. “We wanted a partner that was customer focused and simple. We wanted a partner that was innovative and forward-thinking, but what we found with our analysis was that there wasn’t a perfect solution. However, with Square it was really special and unique because it was on an iPad and the interface was magical. The way [Square] is thinking is much different than any other POS player. They want to make commerce great.”

For Jaber, it was about using technology to get technology out of the way and finding a solution that would help his company stay relevant as it grows.

As each company approaches commerce differently, what new technologies solutions like Square are proving is the importance of convenience and flexibility.

Take Kristin Maddox, for example. The owner of Red Chair Salon in San Francisco once shared with me how she switched to Square after getting fed up with her traditional credit card terminal provider charging exorbitant fees. She also talked about time wasted on the phone with her pre-Square provider. Jaber seconded that complaint, telling us that he once used a manual payment system which required his team to physically scroll through the receipts to reconcile transactions — tedious work to say the least. What’s more, he said, “There was a system that we used before Square and at least twice a day, we were on the phone with support (e.g. the screen was frozen, items kept disappearing, etc.). Every day, every location. In our home office, there were collectively 10 hours regularly spent on POS issues. Today, it’s maybe an hour a week. Square is focused on the team, making it easy for them to spend more time with customers.”

With many small businesses apparently favoring Square, what do incumbents and big payment providers like American Express feel about the changing commerce landscape? An American Express spokesperson wrote in an email that the more choices small businesses have, the better it is for their company: “We are very focused on remaining competitive in a highly dynamic industry, including aggressive competition provided by traditional and emerging payments industry participants … while [Square and PayPal] compete with American Express, at the same time they also have expanded American Express Card acceptance among small merchants whom we might not otherwise have reached.”

The closed system of commerce

With so much heavy-hitting competition in a still-growing space, there is debate whether Square will be able to stay competitive. Much of the concern has to do with Square’s closed/proprietary system (like Apple versus Android). As Forrester’s principal analyst on payments, Brendan Miller has taken a close look at the market space. He told me that he thinks that what Square is doing is interesting: Right now the company has a marketplace, software, card reader, POS system, and Capital, none of which are designed to play nicely with the likes of PayPal, Revel Systems, and First Data. But it’s the comprehensive nature of this system that appeals to small businesses, Miller believes.

If you’re an entrepreneur, Square will capture your interest with its card reader. As you build up your business, you’ll remember that experience to tap into other Square products, like its Register offering, Square Analytics, Square Invoices, Square Appointments, Square Payroll, and even its customer relationship management tool. Because you’re so pleased with the service you’ve received with these value-add products, you’ll remain a loyal customer of Square, not just accepting, but embracing the closed system.

What’s interesting is that consumers don’t feel as drawn to Square as businesses do. Both Square Wallet and Square Order, which were aimed at the average patron, were ultimately shuttered.

Miller said there are two things taking place in the marketplace today that work in Square’s favor. The first is that merchants want to have a better relationship with their customers and, to accomplish that, need tools that will help not only speed up checkout lines, but also manage backend integrations to make operations more efficient. The second thing is something that has recently came up: the introduction of chip credit cards. Square has been on the forefront of this technology, having debuted a chip reader in 2014 ahead of the switch to EMV cards in the U.S.

Risky business

But trying to monopolize the small business market is anything but easy. There’s a lot of competition in the POS space, including from rivals PayPal and First Data, two companies that are now public. And when it comes to transactional volume, Square falls far short of both. PayPal handled $235 billion in 2014, while First Data did $1.7 trillion in the same time frame, just in the U.S.; Square processed $23.8 billion.

And if that’s not enough, Miller believes that a significant challenge to Square will be its ability to take on all merchant verticals, as it may not be possible to create something that will appeal to everyone. Right now its biggest industries are retail, service, and food. Other important industries in the space include repair and leisure contractors, health and beauty services, charities and education, and transportation. As Square goes public, will it continue to innovate in order to reach newer audiences? Would a more open ecosystem fare better than a closed one?

Although interested in Square’s potential, Miller did offer some cautionary advice to merchants eager to jump on board. He said that by signing up with Square, they’re essentially eliminating the ability to negotiate for better payment processing rates. He also advised potential customers to look at whether the Square software meets their particular vertical needs, to examine the customer support and service, and think about the hardware they’ll need as they grow, because, once they buy into Square, they’re stuck with it unless they drastically overhaul their POS system.

Square certainly faces some strong competition, especially from the non-traditional payment companies — it seems everyone wants to go after the small business space these days. The race is on to see whether Square can stay ahead of the curve before big retailers like Target, Westfield, Walmart, and Sephora — all of whom have opened innovation centers — figure out how to out-innovate Square and master the customer experience. And, with 95 percent of its revenue coming from payments and POS services, Square has to innovate or it’ll find itself facing some bumpy roads after its public debut.

As much as merchants mentioned in this article have touted Square’s capabilities to help their businesses, it’s not going to be the same experience for everyone for various reasons, whether it’s support or just overall guidance. This is to be expected — you’re not going to have a 100 percent satisfaction rate and definitely not have a system that’s 100 percent what you’re looking for.

What does seem to be clear, though, is that Square is currently giving small businesses enough forward-thinking technology to let them worry less about how their business is managed and focus more on the people they really depend on: their customers.

“People want that human interaction, people crave it,” said Jaber. “It’s a luxury today.”

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More