Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

SAN DIEGO, California — Back in the 1980s, when Arvind Sodhani first approached his boss, then-CEO Andy Grove, about using Intel’s cash to invest in other tech companies, Grove’s reaction was typical of his fiery personality.

Grove eventually came around, however, and it was one of the most important moves that Intel ever made. Intel’s strategic investment and acquisition group has invested $11.6 billion since 1991 in 1,400 companies in 57 countries. During that time, 213 Intel Capital portfolio companies have gone public and 377 were acquired.

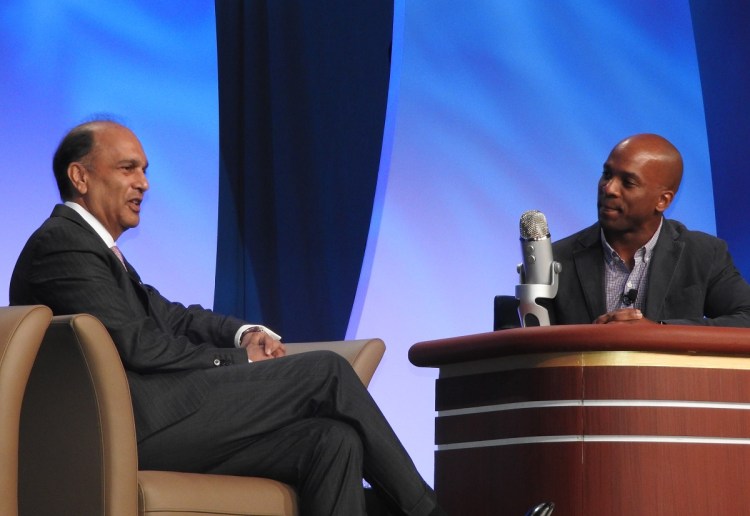

“We’ll do $300 million to $500 million in investments a year now, making us the biggest tech VC,” Sodhani said in a fireside chat today with CNBC’s Jon Fortt at the Intel Capital Global Summit in San Diego, California. “We have created a lot of strategic value for Intel and created double-digit returns. I’m very proud of that.”

Sodhani started investing at Intel decades ago, and he has led the Intel Capital group since 2005, and he has put nearly 35 years in altogether at Intel. He retires in January, and his talk today at the Intel Capital Global Summit will be his last. More than 1,200 people are attending the event for investments and networking through Wednesday. Wendell Brooks, who joined Intel Capital about 18 months ago, will take over as president of Intel Capital.

Brooks, a former investment banker and ex-engineer, joined Sodhani on stage.

“We have an unbelievable team built by Arvind,” Brooks said. “I appreciate the size of the shoes I have to fill.”

Sodhani announced today that Intel Capital has invested $22 million in 11 more startups. That brings to 56 the number of investments Intel has made this year. The investments have a wide range and include Internet of Things, virtual reality, drones, cloud computing, and data center technology.

At first, Intel Capital’s role was simply to invest in the PC ecosystem.

“I said to Andy that we can’t do all of the R&D for the PC ourselves,” Sodhani said. “We need fellow travelers. Why not take ownership stakes? I was thinking of the Japanese keiretsu system.”

At first, Intel invested in chip companies such as 3DFX Interactive. It was a limited vision.

“We are now a tier one VC,” Sodhani said. “We have 200 people. Sixty-five are investment managers. We are in 25 countries. We go from one end of the spectrum to the other.”

Sodhani has his own vineyard in Napa Valley, and he is producing his own wine these days.

“That’s a hobby, not full time,” he said. “Once an investor, always an investor.”

One of his last legacies was creating the $125 million Intel Diversity Fund earlier this year.

“The ability to create new companies isn’t limited to a certain group of people,” Sodhani said. “We are looking for drive. If you have a great idea and want to pursue it, do it. Absolutely.”