Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

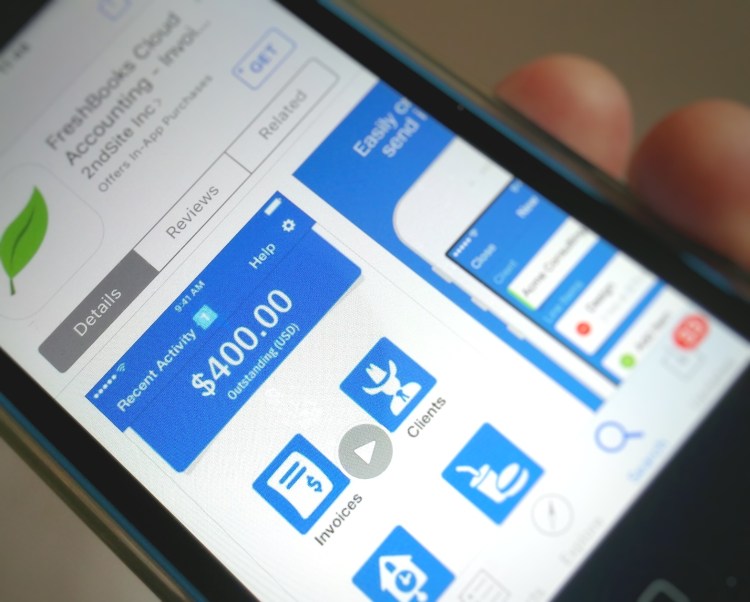

Cloud accounting software company FreshBooks has revealed that it’s entering the mobile-payments space with the launch of a new card reader that lets merchants accept credit card payments through a smartphone.

Similar to Jack Dorsey-owned Square, which recently filed to go public, FreshBooks has a branded contraption that plugs into an iPhone’s audio jack. It is designed as a simple solution for smaller merchants who want to go “cash-free,” and accepts most of the common bank cards as payment. The Toronto-based company is inviting small businesses to apply for early access ahead of the service’s expected launch in the U.S. in the first half of 2016.

Besides the $29 up-front cost of the card reader, merchants will also be charged 2.7 percent + $0.30 for each Visa and MasterCard transaction, while American Express (AMEX) will cost 3.4 percent + $0.30. This is marginally more expensive than Square’s current rates. The reader will also accept both the old-style magnetic-stripe bank cards, and the new security-focused EMV chip cards.

On the surface, this may seem like an odd vertical for FreshBooks — a company that provides cloud-based invoicing, expense-management, and time-tracking tools. But it’s entirely in keeping with its recent strategy, and when you delve into the details, it makes a lot of sense.

Back in October, the company launched Payments by FreshBooks, aimed at helping small businesses accept online credit card payments. So the expansion into brick-and-mortar stores is a natural extension of this. For small merchants, FreshBooks’ key selling point over more established competitors such as Square is that its card reader will be integrated directly into FreshBooks’ broader accounting and payments offering, which means that invoices and other reports are synced in real time as each payment is processed.

FreshBooks already claims existing relationships with millions of merchants, so this will put the company in a good position to cross-sell its new card reader. It’s not coming in from a standing position, so it should see some interest from merchants seeking a fully integrated point-of-sale system.

“Since day one, FreshBooks has been committed to helping service-based small business owners save time, get paid faster, and look professional, and the FreshBooks Card Reader is the next step as we continue delivering on our promise,” said Mike McDerment, cofounder and CEO of FreshBooks. “Seventy-five percent of small businesses already use mobile devices to run their businesses, and the FreshBooks Card Reader will offer them with yet another way to streamline their workflow while on-the-go.”

Though FreshBooks’ first hardware product will initially only work with iOS devices, a spokesperson told VentureBeat that support for Android will follow some time next year.