Alphabet (GOOG), Google’s recently formed umbrella company, today for the first time disclosed financial figures for the non-Google efforts that the company calls “Other Bets.” That category includes somewhat mysterious initiatives like X (formerly Google X), Sidewalk Labs, Fiber, Nest, Calico, and Verily (formerly known as Google Life Sciences). But those hoping for more granular information about Alphabet’s less traditional products might be left feeling disappointed today. Too bad.

There is no specific financial detail available on, say, the Project Wing drone delivery program or the robotics division inside of the X lab. If you wanted to know how much revenue Fiber brings in, you’re out of luck. Want to know about sales of Nest? Sorry, nothing to see here. (Although on today’s investor call Alphabet chief financial officer Ruth Porat did say Nest had “very strong year-over-year and quarter-over-quarter revenue growth.”)

On top of that, Alphabet’s executives are still not breaking out financial figures for certain properties inside of the Google operating segment — including Android, YouTube, Google Apps, Maps, the Google Cloud Platform, and Nexus mobile devices.

Search revenue? Not here. Google Play sales? No. Chromebook sales? Nope. Chromecast sales? Nah. Pixel C sales? Nooo. Android Wear? Not gonna happen. Android Auto? No way. YouTube Music/YouTube Red? Not mentioned in the earnings statement. On and on we go.

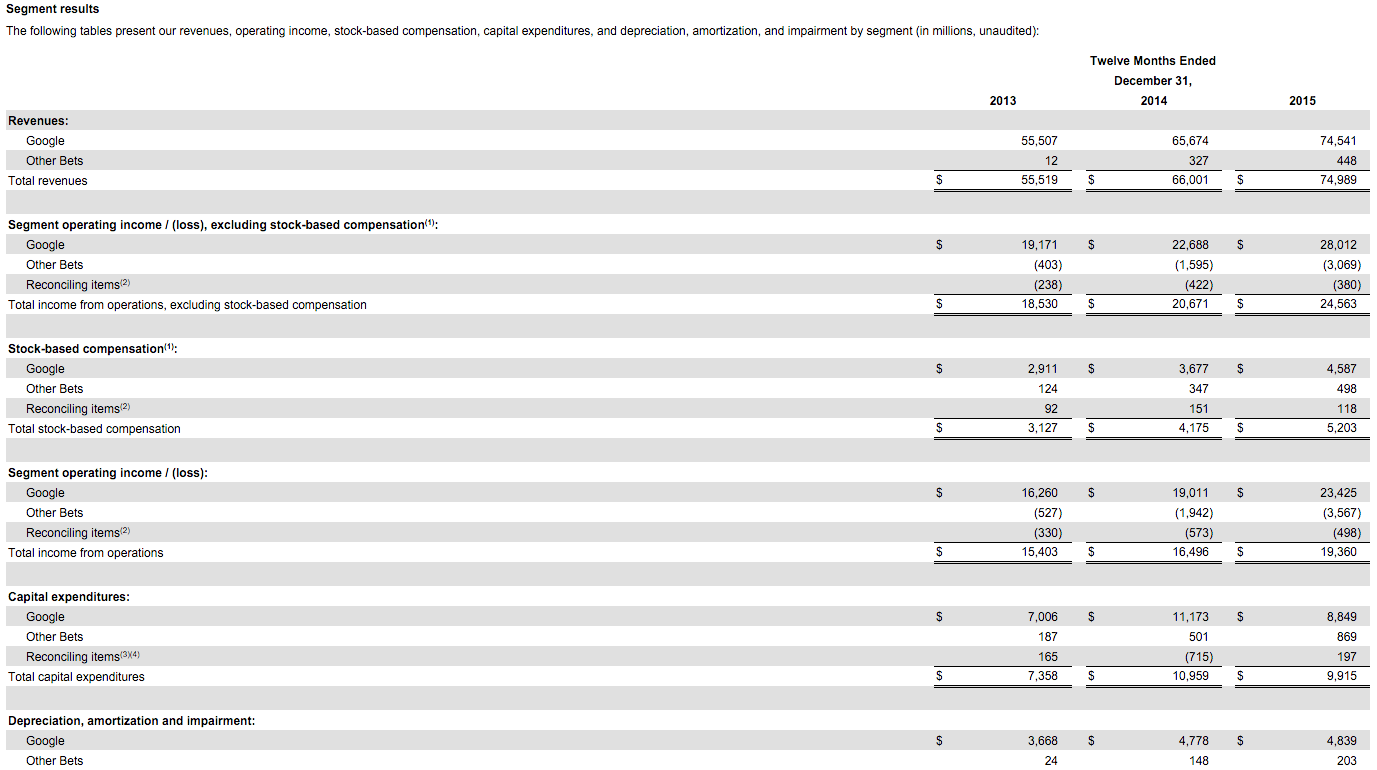

What we do know — and what hasn’t changed — is that Google’s huge and profitable advertising business ($19.07 billion in revenue out of Alphabet’s total revenue of $21.32 billion for the quarter, or 89 percent of the total) is essentially paying for much of Alphabet’s other operations, certainly including the Other Bets.

Indeed, the majority of other bets are “pre-revenue,” as Porat said during today’s investor call. (Verily, Nest, and Fiber are leading the way business-wise in the Other Bets segment, she said.) We just don’t know exactly how these businesses are performing.

We do know that, in the aggregate, Alphabet’s Other Bets led to an operating loss of $3.6 billion in 2015, with just $448 million in revenue.

If you look at Berkshire Hathaway, the holding company that includes Berkshire Hathaway Energy Co. (containing PacifiCorp, MidAmerican Energy Company, NV Energy, Northern Powergrid, Northern Natural Gas, and Kern River Gas Transmission Co.), Business Wire, Heinz, and See’s Candies, you’ll see clearer information on income and revenue on multiple types of businesses on its quarterly filings. As a result, they’re more useful for consumers and investors alike. In that area, Alphabet can do more.

Google cofounder and Alphabet CEO Larry Page said the whole point of Alphabet was to give its companies “independence” to “develop their own brands,” and improve “the transparency and oversight of what we’re doing.” But even with today’s revised filing format, Alphabet’s entities remain shrouded in mystery, and the company (like Google before it), remains difficult to understand.

Google’s stated mission is to “organize the world’s information and make it universally accessible and useful.” Well, it would be nice to see Alphabet make information about itself more accessible.