Adjust, a company that helps publishers identify which ad networks are bringing them the most business, has today released a tool that allows publishers and ad networks address an increasingly thorny problem: fraudulent publishers that pose as authentic apps and rob ad networks of their ad money.

Adjust ran a beta test with some of its customers, including popular apps like San Francisco-based HotelTonight, and said it found that between 1.35 percent and 5.55 percent of 400 million tested app installs were fraudulent — in other words, tampered with or outright falsified.

Here’s an example of how the ad process works. Typically, HotelTonight pays a range of ad networks to help it gain new customers; those ad networks in turn advertise HotelTonight’s app on other publishers, hoping to lure users into installing HotelTonight. The networks get paid when they convert users. But fraudulent publishers are faking conversions, thus taking money from unsuspecting networks that are too time-strapped to do a full verification themselves.

Until now, no network has had the motivation or technology to stop this, in part because they usually get paid for those fake conversions — with apps like HotelTonight footing the bill, because they have no way of determining in real time which users are genuine and which are fake. This fraud has become a massive problem in the app ecosystem, with some estimates pegging mobile ad fraud at up to $1 billion.

Pepe Agell, VP of business at Chartboost, one of the largest mobile game ad platforms, said last week that ad fraud has drastically increased over the past two years.

Adjust is just one of several so-called attribution players, or companies that verify accuracy of installs and ad campaigns that flow through an increasingly complex supply chain of networks, exchanges, and publishers. Kochava, Tune, and Appsflyer are competitors, and they too have developed fraud prevention technologies. Simon Kendall, Adjust’s lead data analyst, said that the solutions offered by Tune and Kochava are manually managed services.

Indeed, Adjust said its solution is the first to offer a real-time prevention tool at the time of attribution. In other words, publishers and networks don’t even get billed for fraudulent conversions. Other tools on the market, according to Kendall, allow publishers and networks to detect fraud after the fact and then go back to their partners to demand reimbursement for payments that turned out to be based on fraudulent activity. That’s a problem for smaller networks or publishers, who often don’t have the clout to demand reimbursement.

Indeed, Adjust said its solution is the first to offer a real-time prevention tool at the time of attribution. In other words, publishers and networks don’t even get billed for fraudulent conversions. Other tools on the market, according to Kendall, allow publishers and networks to detect fraud after the fact and then go back to their partners to demand reimbursement for payments that turned out to be based on fraudulent activity. That’s a problem for smaller networks or publishers, who often don’t have the clout to demand reimbursement.

However, there’s a semantic struggle between antifraud vendors. Kochava, for one, has offered some sophisticated fraud tools for seven months now, and has said its own tools are real-time too. Kochava also said it retains so-called “lower-level data” on campaign activity, including things like impressions — something it said other players like Adjust haven’t done — allowing Kochava to have more proof of what actually happened when dollars are contested. Adjust, in response, said that it does have visibility of lower-level data, but conceded it has a policy of “not exporting personally identifiable information retrospectively in adherence to EU privacy laws.”

So, to be sure, it’s hard to say for sure how radically differentiated Adjust’s new offering is without going for a deeper dive. [We’ll have the opportunity for this discussion at our upcoming Mobile Summit on April 4-5, where one of our hour-long working sessions will be dedicated to attribution-related topics; so far we have Tune CEO Peter Hamilton helping lead that conversation.]

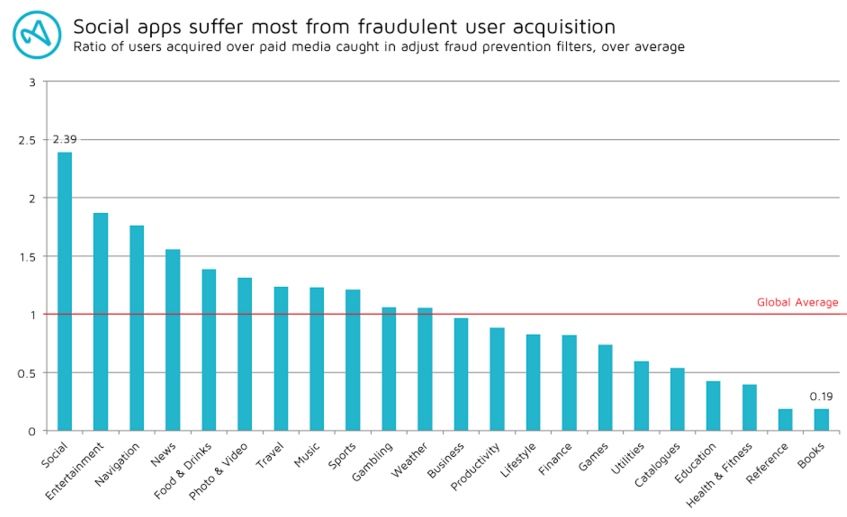

Still, the extent to which Adjust is finding fraud is noteworthy. Adjust’s Kendall said an educated guess is that almost 5 percent of all traffic (outside of Facebook and Twitter, which are publishers that own their own ad networks and so exert more control) will be caught by filters as fraudulent.

So far, the lower 1.35 percent is the average figure the company caught in its beta test, but the number is expected to increase as Adjust’s suite of filters continue to expand, Kendall said. As such, the 5 percent number is in line with other fraud studies. Forensiq, another antifraud company, last year estimated fraud at up to 5 percent — and calculated that $1 billion of about $20 billion in ad spend was being affected.

Adjust estimated that $1.7 million of fraudulent charges from so-called anonymous IPs was identified and prevented within the 17-day beta test alone, based on existing cost-per-install (CPI) ad rates. Globally, 535,529 paid installs were rejected during the beta test.

Adjust said its Fraud Prevention Suite, released today, has been vetted and tested by companies like HotelTonight.

Paul H Müller, Adjust’s cofounder and CTO, wrote a guest post for VentureBeat in January outlining the significant problem of fraud in the industry, pinpointing areas that can be solved immediately by attribution vendors and other areas that are more tricky. The suite released today solves some of those remaining tricky areas, the company said.

Also noteworthy is that the percentage of ad fraud traffic is heavily skewed between different types of paid traffic, depending on whether it is coming from Facebook, Twitter, and Instagram, which are less susceptible to fraud, or other sources. The safer traffic made up almost 50 percent of the data set. In other words, if you’re analyzing traffic outside of those platforms, you can multiple the fraud factor by a factor of two, Adjust said.