Glispa, the global performance marketing firm, closed the year with a revenue run rate of $100 million, thanks to its ability to help developers find new users through advertising, and then measure how much those users stay engaged with a game or app That means it’s on course to hit $100 million in the next year, based on its most recent results.

Back in March 2015, e-commerce vendor Market Tech Holdings of London acquired a majority stake in Glispa for $77 million. According to market researcher eMarketer, the worldwide mobile ad market will grow from $65 billion in 2015 to $133.7 billion by 2017. That figure will rise to $166.6 billion by 2018, when mobile ads will account for 24.1 percent of all advertising spending worldwide. This growth is happening because it is easier than ever to figure out how effective an advertisement is at getting a user and then figuring out precisely how valuable that user is. And for Glispa, half the users are gamers.

Berlin-based Glispa’s tools can be used to plan and launch marketing campaigns on mobile devices and the Web, enabling app publishers to reach a more diverse set of users across the world through performance-based ads (those where the publisher gets paid if the user takes an action like installing an app). Lin said that Glispa also goes beyond the install, tracking how much a user plays, how far they get into a game or app, and whether or not they wind up spending anything in a free-to-play title.

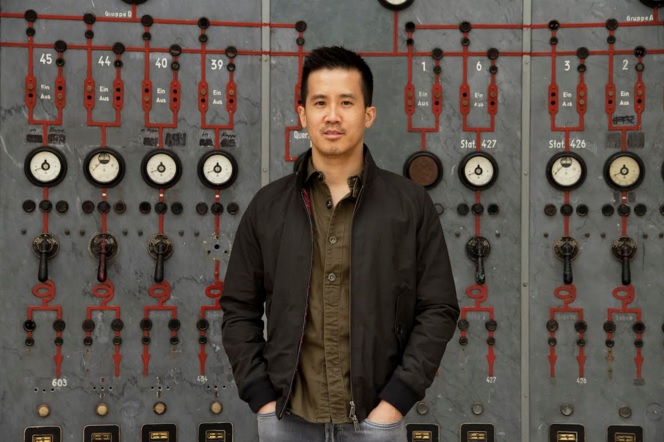

Gary Lin, chief executive of the ad-tech vendor Glispa, said in an interview with GamesBeat that the company has now been profitable for seven consecutive years. The company was particularly strong in native ads, which are ads that leverage the same content that an app or game uses. In a Lord of the Rings game, for instance, an ad with the character Bilbo Baggins may pop up and ask you if you want to buy some pipeweed in an in-app transaction. Users might take to that kind of ad better than a typical banner ad.

“About 40 percent of revenue was driven by our native monetization initiative,” Lin said. “We’ve done that organically, as we haven’t used any external capital yet. All of the traction we have had in the last year was not through acquisitions. It was done organically.”

Glispa competes with other performance-based marketers such as Facebook. During the year, the company launched its new Glispa Audience Platform is designed to take 100 terabytes of raw data — all anonymized and secure from hacking — and make it actionable. Glispa has an international reach of a billion active users and serves hundreds of billions of ad impressions monthly. Lin said that the platform contributed to significant growth in 2015.

The platform anonymously profiles users and their inclination to play certain kinds of games, their demographic information, and their purchasing habits. Glispa will integrate it into its existing services — such as its real-time bidding engines, re-targeting platform, native ad monetization, and mediation systems. Publishers can use this data to capture more users and improve their profits and overall ad campaign performance. About 30 percent of the company’s staff is devoted to product and engineering.

“The underlying trend has not changed. We placed the right bets, with a lot of emphasis on product and engineering,” Lin said. “The customers are more sticky. We focused on performance, measurable returns, and clear return-on-investment for the advertisers. We sift through thousands of sources of users to find high-quality users.”

Once Glispa finds a user, then it uses metrics to figure out engagement and optimize for the users who are the highest quality. That scales to high numbers but without sacrificing quality, Lin said.

“We pinpoint the sweet spot and figure out if an advertiser got their money’s worth,” Lin said.

And to be able to do this right, you need the ability to sift through tons of data in real-time.

“You need to scale and build a strong enough foundational technology,” Lin said. “We have built it.”

Customers include big companies such as Alibaba, Amazon, Gilt Group, OLX, Baidu, Hasbro, Zynga, and Gumi. Glispa runs campaigns in 187 countries. Much of that is in the U.S. and Europe, but a growing percentage is in emerging markets such as China, India, Brazil, and Southeast Asia.

“In the year ahead, Glispa plans to invest in its mobile ad tech foundation with a combination of acquisitions and organic growth,” Lin said. The aim is to boost Glispa’s supply side business, as well as its analytics and audience profiling.

As for where the industry is going, Lin said, “Facebook is setting the standard on user-level targeting. Ad tech companies that want to stay relevant will have to substantiate a premium on their inventory based on user profiling. There’s a big gap across the ecosystem now. I don’t think game developers can fill this gap, nor should they. That is where we are focusing, on the supply side.”

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More