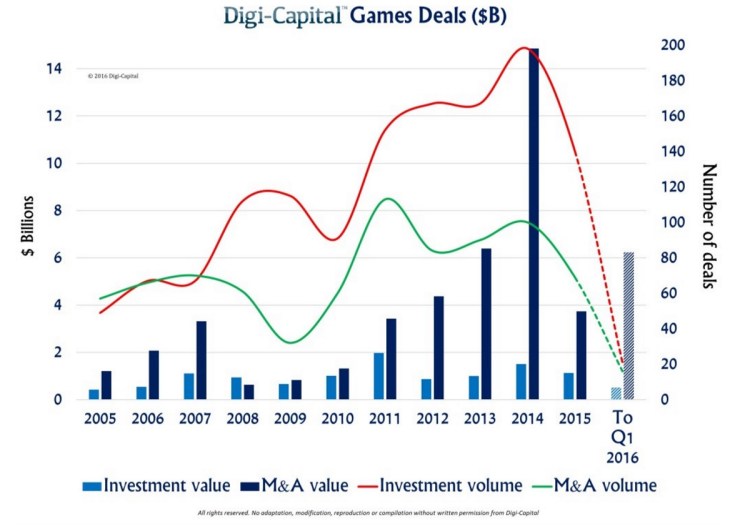

Games deals rebounded in the first quarter of the year, with game startups raising more than $500 million, according to tech adviser Digi-Capital. But there are “rocks beneath the surface” of that good news as mobile game investments plunged, the report said.

Last year was the worst in a decade for game deals, or the combination of both game investments and mergers and acquisitions. The Q1 numbers make that look like the market thawed, but the $500 million raised in Q1 included three big deals that were more than half the total, according to the report by Tim Merel, the managing director of Digi-Capital and CEO of Eyetouch Reality.

The number of games companies that successfully raised money in Q1 2016 actually dropped 40 percent compared to the 2015 quarterly average. Similarly, games mergers and acquisitions appeared to make a spectacular recovery in Q1, with over $6.2 billion dollars of exits.

But $5.9 billion of that amount came from the actual closing of the previously announced deal of Activision Blizzard buying Candy Crush Saga maker King. The remaining $300 million amounted to 36 percent of the 2015 quarterly average. Extreme concentration and a lack of momentum characterized games deal-making in Q1, Digi-Capital said.

The investments that did happen were dominated by categories such as games tech, web games, and console/PC games sectors, with the largest deals happening in Asia.

“It is worth noting that the previously dominant mobile games sector took under 10 percent of games investment in the first quarter, where it had taken around $4 of every $10 invested in games in previous years,” Digi-Capital said. “There could be more thawing of games exits during 2016, with larger consolidation deals and take-privates coming over the horizon to move the market forward.”

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More