Event ticketing startup YPlan has been acquired by travel publication Time Out in a deal worth £1.6 million ($1.96 million), a figure that will rise to £2.4 million ($2.94 million) after a year if certain terms are met.

Digging down into the details of the acquisition reveals that Time Out won’t be parting with any cash directly — it will be swapping 1,166,644 in ordinary shares, with each share representing a value of £1.393. The deferred £0.8 million will be payable “12 months after completion subject to no warranty claims being made under the sale and purchase agreement,” according to a statement.

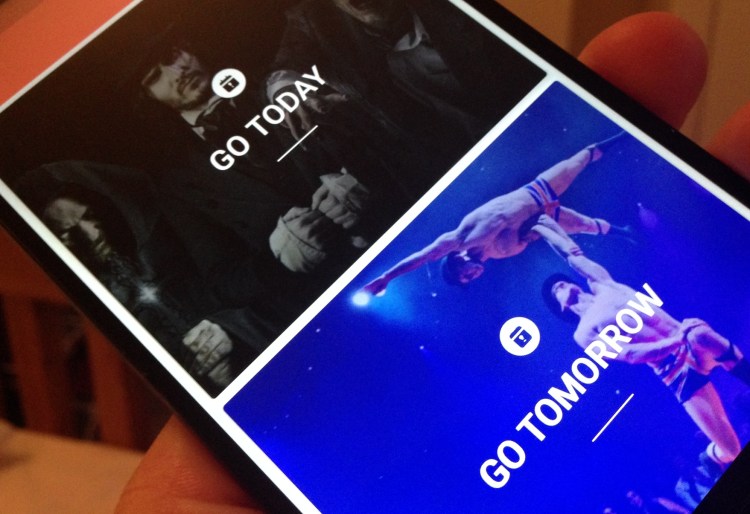

Founded out of London in November 2012, YPlan emerged as one of the most popular event-booking apps in the U.K. capital, letting users book tickets on the spot for myriad shows happening that same day. The service later launched in New York in 2013 and in San Francisco six months later.

In an interview with VentureBeat last year, YPlan cofounder Rytis Vitkauskas laid out his vision for how YPlan would become a $1 billion company. In reference to WillCall, a company similar to YPlan that was acquired by Ticketfly in 2014, Vitkauskas said:

WillCall launched as we were writing the code for YPlan. They carved a niche, got stuck in San Francisco, tried New York and L.A., then got acquired. We’re not sure that’s the right approach — one niche that’s very deep, and one where there is not much margin in. I’m not sure that’s the path to building a billion-dollar business, which is what we’re here to do.

YPlan had raised $37.5 million, including a $12 million round in 2013 that saw actor Ashton Kutcher enter the fray. But things started to look grim for YPlan earlier this year when news emerged it was cutting 30 percent of its workforce as it scaled back its U.S. operations. “As a startup, we are reliant on an exceptional team to drive our business forward,” said Vitkauskas at the time. “As we continue to evolve our proposition, it is crucial that we now streamline our operations and align the right teams to the focus areas where we see the best opportunities to maximize the company’s growth.”

To have burned through close to $40 million, the bulk of which came less than two years ago, is notable, and the fact that the company didn’t raise any more cash, electing to sell for next to nothing, is perhaps a red flag for other tech startups. For the year ending December 31, 2015, YPlan reported a pre-tax loss of £6.2 million ($7.58 million), though “subsequent reductions in its cost base” have reduced the losses for this year.

Time Out was launched as a London-focused city guide publication in 1968, though it has expanded internationally since then. The company has been pushing its digital smarts in recent years, and as with many other “legacy” publications, the print-based incarnation is now completely free. Time Out went public and raised around £90 million ($110 million) earlier this year, indicating at the time that it may pursue acquisitions to grow.

“Developing ecommerce and monetizing our audience is an important element of our ambitious growth strategy,” explained Julio Bruno, CEO of Time Out Group. “We acquired YPlan because its advanced technology will significantly accelerate this strategy. It will enable us to offer our large audience more online booking opportunities, whilst improving the user experience.”

Moving forward, it appears that YPlan will continue to operate as is and will be integrated into Time Out’s existing business. The deal actually makes a lot of sense for Time Out and YPlan, given that Time Out is used by more than 100 million people around the world to find things to do in major cities, and the publication already sells tickets for events. If it wasn’t for the terms of the deal, this could otherwise have been pegged as a great exit and a win-win for both companies.

“Today is an exciting day for YPlan as we become part of Time Out, a global media and entertainment company,” said YPlan’s founders, putting a somewhat positive spin on the story. “Both companies are an excellent fit. For us as founders, the acquisition is a natural continuation of our vision for YPlan: to enable people to discover and do amazing things, whether in their beloved home cities or while traveling. We’re both very proud to join with our team such an iconic brand and to be part of Time Out’s next chapter.”