Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

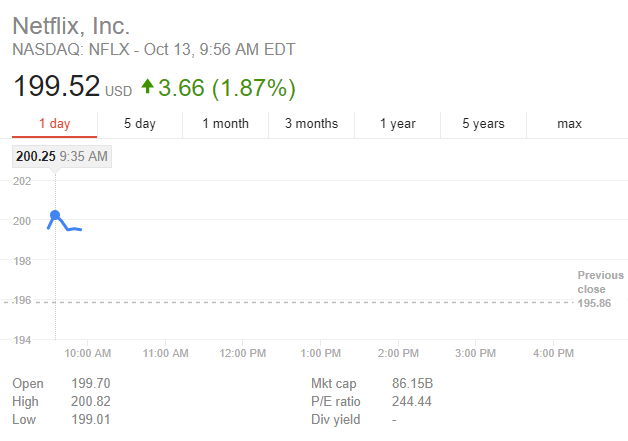

Netflix shares topped $200 for the first time today, as the video-streaming prepares to announce its Q3 earnings next week.

The magic $200 mark was passed following Goldman Sachs’ prediction that the company will post subscriber gains above expectations over both Q3 and Q4. Netflix stock breached $200 only briefly as the markets opened this morning, then dropped slightly below the tide-mark again.

This milestone moment comes shortly after the company announced a price hike in the U.S. and several other markets around the world. Netflix announced price increases for two of its three subscription tiers on October 5, with the mid-level $9.99 plan bumped up to $10.99 per month, and the top-tier incarnation rising to $13.99 per month from $11.99. Wall Street clearly liked this news, and in the days following the announcement Netflix stock saw a notable spike.

Many had predicted that Netflix was gearing up to hit the $200 mark. For context, Netflix shares were at around $184 on October 4, but by the time the markets closed on October 5 the shares were up to more than $194, before hitting a peak of $198 on Friday, October 6.

Netflix announced its initial public offering (IPO) way back in 2002, when the Los Gatos, California-based company offered a DVD subscription service. The company set its IPO price at $15 per share, and after a slow start its shares have been on a general upward trajectory for the past few years.