Funding in the digital health space continues to accelerate as health care reform has put the spotlight directly on the shortcomings of the U.S. health care delivery system.

The digital health accelerator Rock Health tracks investment in the space, and has just released its fourth quarter and whole-year numbers.

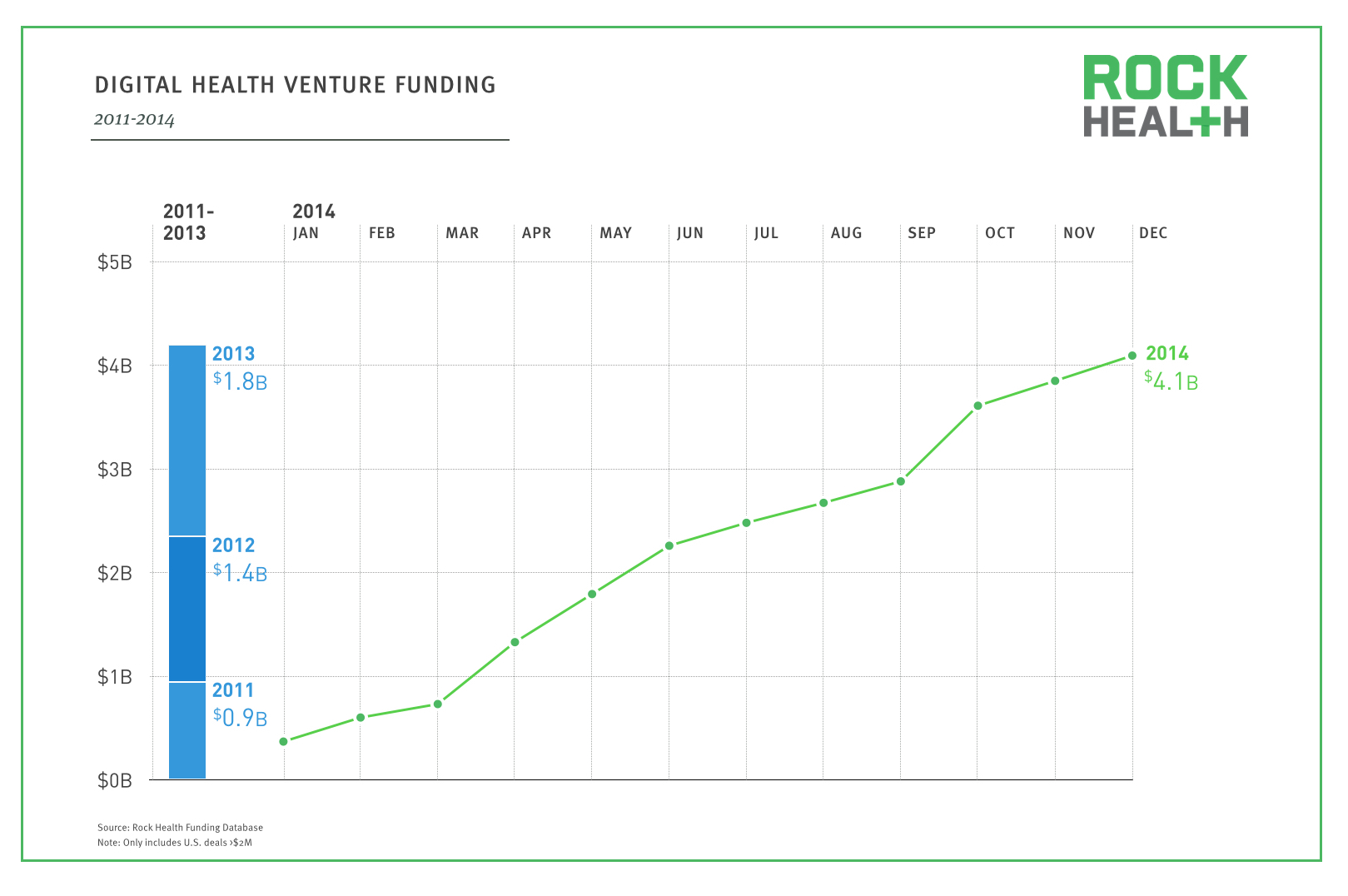

On the top line, digital health funding in 2014 exceeded $4.1 billion, Rock Health said, a total greater than that of the past three years combined. The $4.1 billion total represents a growth of 124 percent over last year’s investment total.

Investments in the fourth quarter totaled roughly $1.1 billion.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

“It is obvious that our health care system is undergoing a technology-based transformation, with health reform serving as a massive tailwind,” wrote Rock Health director Malay Gandhi. “Entrepreneurs (and investors) are taking note (and advantage).”

The new report said 258 digital health companies received funding, with an average deal size of $14.1 million. The average deal size in 2014 was 40 percent larger than last year’s average.

KPCB, Khosla Ventures, Sequoia, Andreessen Horowitz, First Round, and Venrock were the biggest investors in the space in 2014.

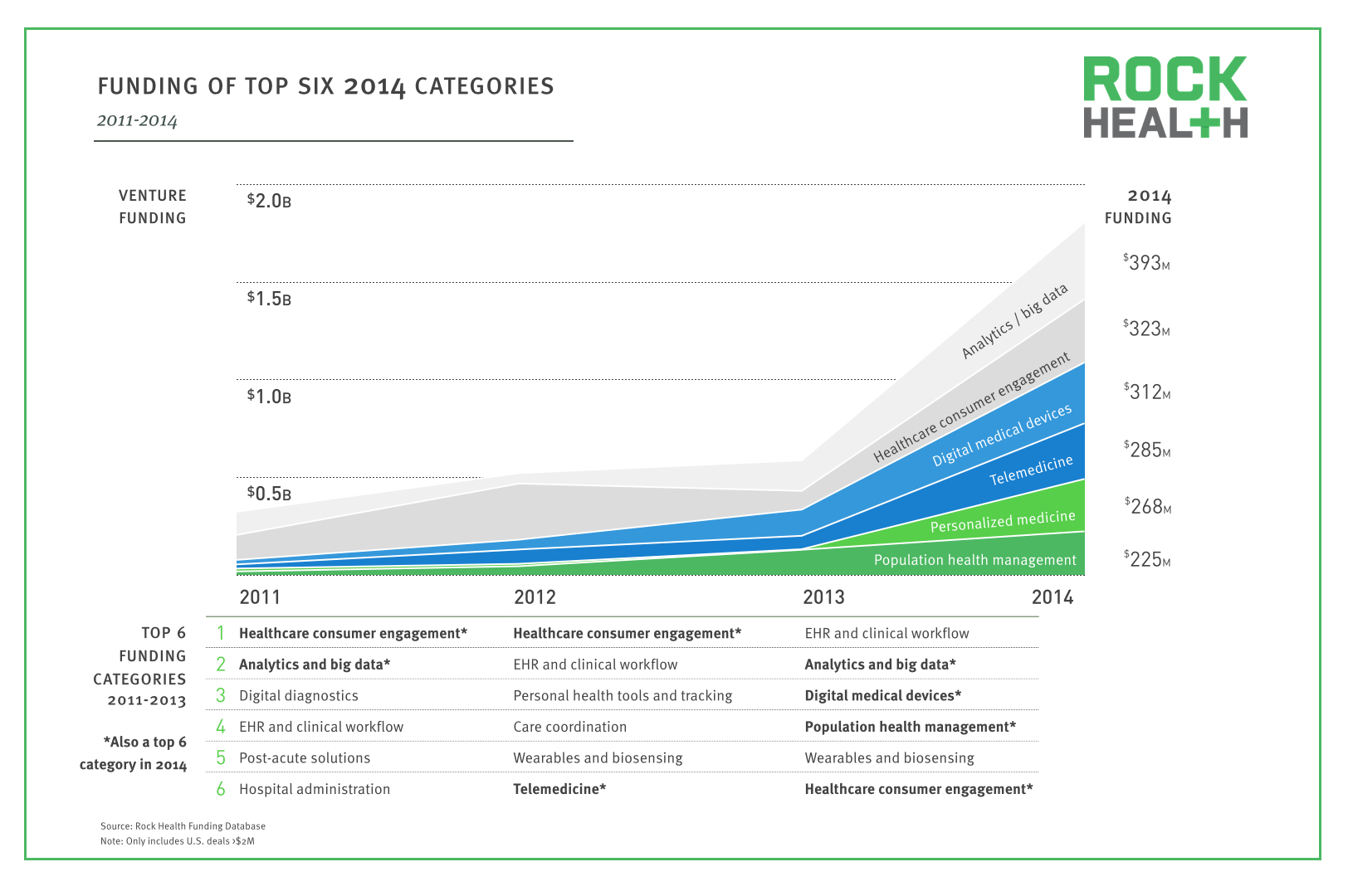

The subcategories that received the biggest investments include analytics and big data, health care consumer engagement, digital medical devices, telemedicine, personalized medicine, and population health management. These top six categories accounted for 44 percent of all funding in 2014, Rock Health said.

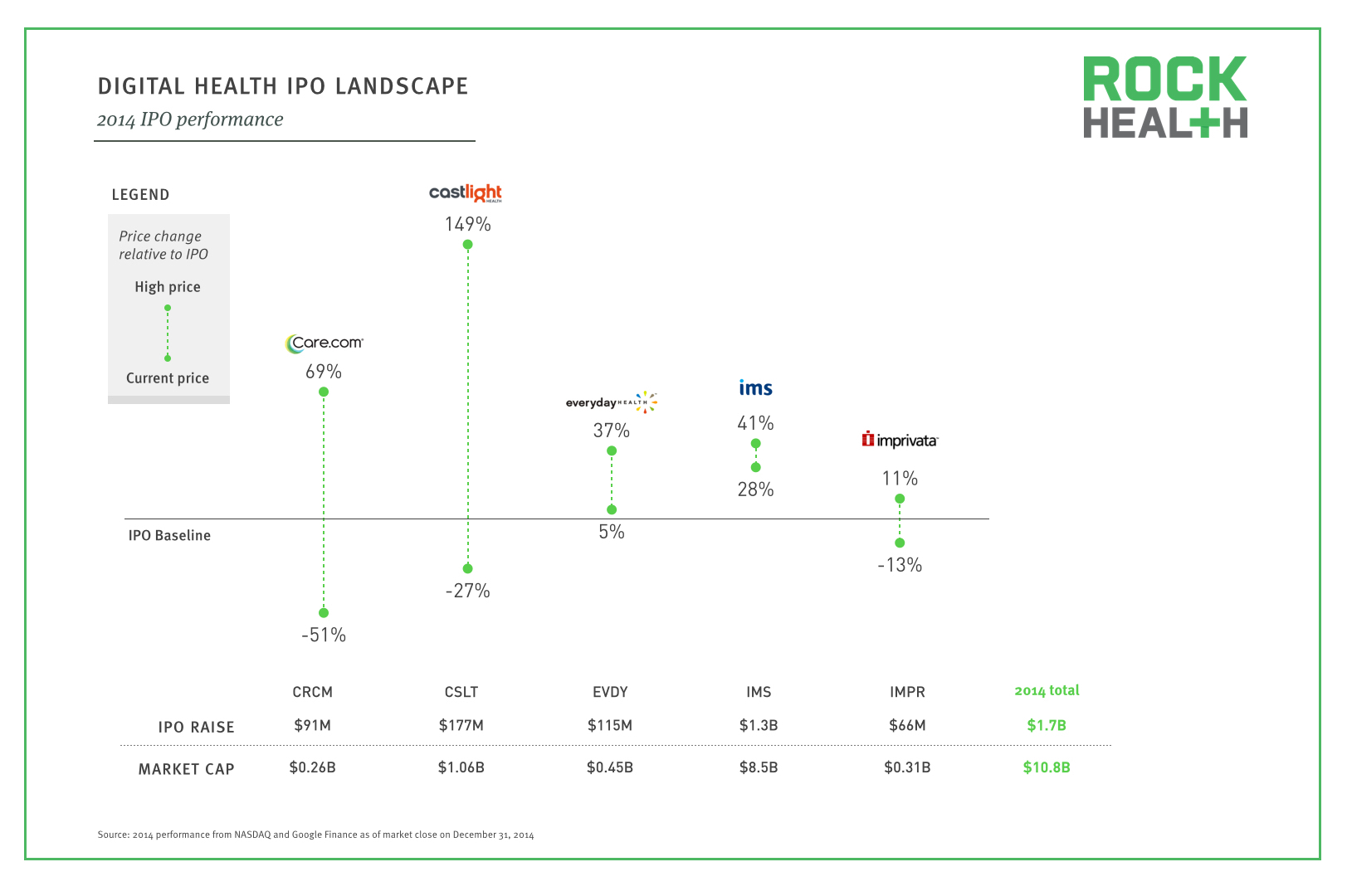

Five digital health companies went public in 2014, raising a cumulative $1.7 billion. These included Care.com, Castlight, Everyday Health, IMS Health, and Imprivata. But Rock Health observed that three of the five stocks are now selling at below the offering price.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More