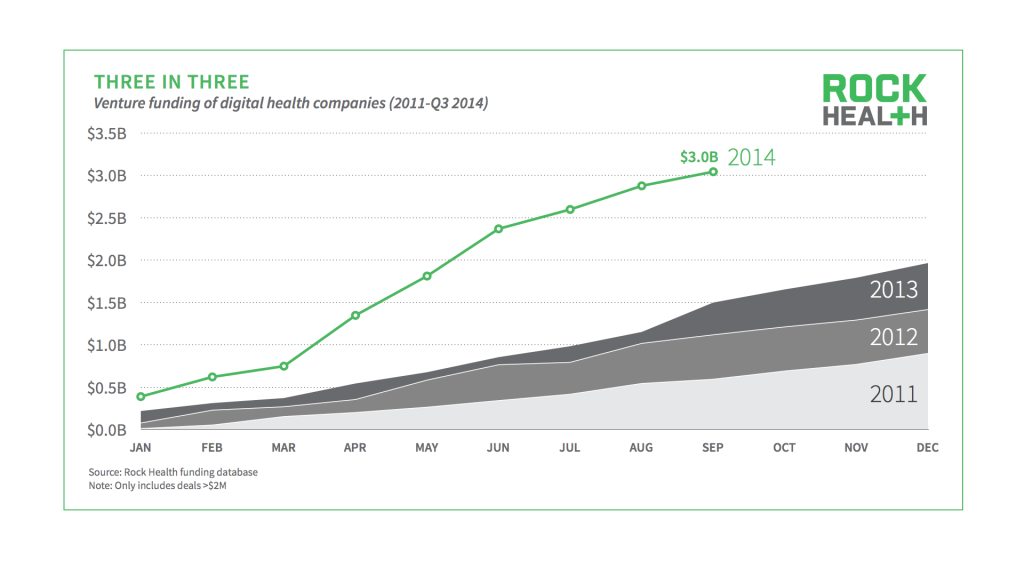

Investments in digital health companies this year has risen to $3 billion — and the year is only three quarters over.

By the midyear point, 2014 digital health investments had already eclipsed 2013 investments. And investments have continue to accelerate since then. The total for this year is now twice the full-year total for 2013, according to a new report from the digital health accelerator Rock Health.

The investment sizes trended down slightly during the third quarter. The average deal size for the year dropped $2.5 million per deal to $13.1 million after the third quarter deals were factored in. But the average investment size in 2014 is still 31 percent larger than the average deal in 2013, Rock Health says.

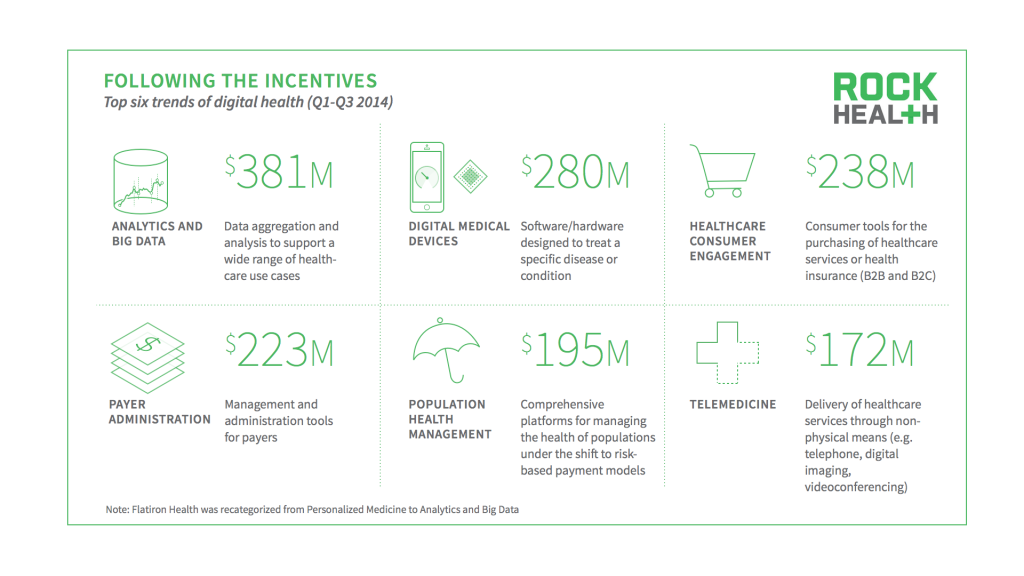

The top six business types targeted by investors remained largely the same in the third quarter (see chart below), with analytics and big data outperforming all other categories, followed by digital medical devices, consumer engagement, payer administration, population health management, and telemedicine.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

The most active investors in the space so far this year, according to another report out today from StartUp Health, include Founders Fund, Khosla Ventures, Sequoia Capital, and Venrock, each of which have at least six investments in the sector. Andreessen Horowitz, Mayo Clinic, Qualcomm Ventures, and SV Angel each have five investments so far this year.

Even though summer activity tends to slow deal flow, StartUp Health says, the third quarter saw 15 acquisitions by companies including Google, Practice Fusion, Cerner Corporation, and WebMD/Medscape.

Investor dollars continue to flow toward technologies that remove both friction points from healthcare access and healthcare delivery costs.

Telemedicine climbed into the top six investment areas in the third quarter. Remote doctor visits via video app has increasingly come to be seen as a way to increase patient engagement and eliminate costly ER visits.

Teladoc, for example, raised a large $50.3 million funding round during the quarter.

Aside from Teladoc, the other large funding deals in the quarter included Proteus Digital Health, which raised another $52 million, and Chunyu, which raised $50 million.

Geographically, California continues to dominate the digital health funding space, representing 37 percent of all funding so far this year. Together, New York and Massachusetts account for 20 percent of funding dollars, Rock Health says.

Mark your calendar for VentureBeat’s HealthBeat conference October 28-29.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More