Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

Technology mergers and acquisitions reached an all-time high in 2015 with $313 billion in deals announced, up 82 percent compared to the $171.6 billion announced in 2014.

The volume of deals shows that the forces of consolidation were powerful during the year, but it also demonstrates that tech has become so critical that the need to own it is driving up demand for the sector despite the choppy stock market.

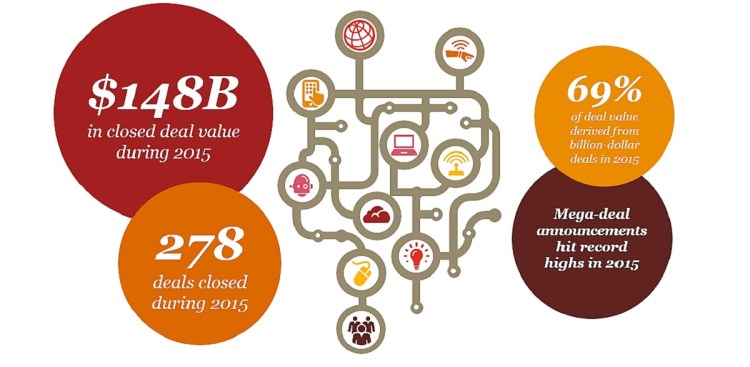

Only 278 transactions actually closed, totaling $147.7 billion in 2015. Those figures for closed transactions were down slightly from the year before, according to a report by accounting and consulting firm Pricewaterhouse Coopers (PwC).

The 278 closed deals count was down from 2014’s 289, which were valued at $164.8 billion. While the wide spread between announced deals and closed deals isn’t unusual, the fact that the stock market started cratering in the fourth quarter could have scuttled a number of deals that were in the closing stages.

Consolidation in the semiconductor sector drove the deal value, while software led the increase in number of deals. Besides chips, consolidation also occurred in enterprise storage and consumer-facing Internet businesses, PwC said. This momentum is expected to carry over into 2016, even with the bumpy stock market.

According to PwC, dealmakers continue to invest in cloud, Internet of Things, ecommerce, and data security. With 10 megadeals (deals valued at over $5 billion) announced in 2015, including the largest technology transaction in history, ongoing fundamental shifts in the competitive landscape are prevalent, PwC said.

The semiconductor sub-sector generated the most deal value, reaching over $38 billion, with moves such as Intel acquiring rival Altera for $16.7 billion.

Information technology services also saw a record level of mergers and acquisitions, led by the financial, health care, and public sectors.

Deals over a billion dollars made up 69 percent of deal value generated in 2015. For full-year 2015, there were 30 deals in excess of a billion dollars that closed, with 11 $5-billion megadeals closing in the fourth quarter alone. By year end, there was a total of 15 megadeals that were announced but were still pending. The largest proportion of deal volume in 2015 continued to be smaller transactions (less than $100 million in value), making up 49 percent of deal volume for the year.

Private equity firm deals remained relatively flat in 2015, comprising 12 percent of deal values; activity was largely driven by software and IT services transactions.

Cross-border transactions comprised 38 percent of technology deals in 2015. Foreign acquirers outpaced U.S. technology companies, investing 69 percent more capital into the U.S. than U.S. companies invested abroad.

As for 2016, the shifts in competitive dynamics and market needs are causing companies to reevaluate their strategic plans and adapt to the new landscape. In addition, several key themes will continue to fuel growth and deal activity in the technology sector throughout 2016 and beyond, including advancements in virtual reality and artificial intelligence, IoT, and rapid convergence across industries, PwC said.