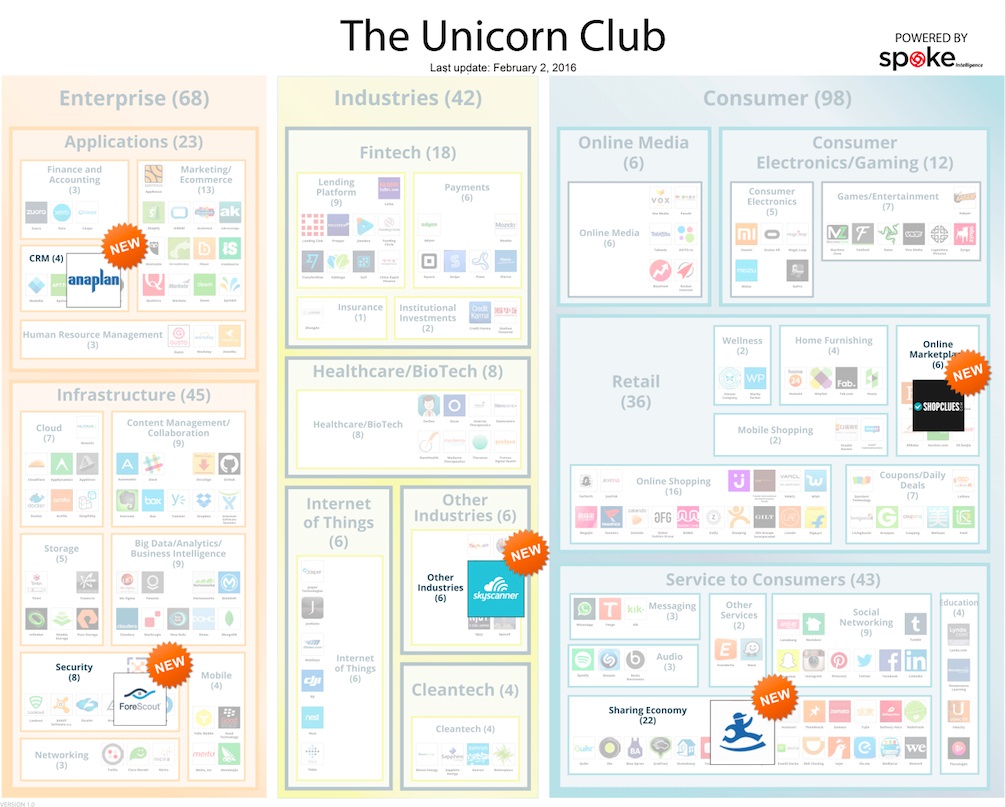

This January, five global tech startups raised a total of $858 million to become the latest members of the Unicorn Club.

The one making the biggest leap was Shanghai-based Dada ($1 billion valuation), which raised $300 million in Series D financing from DST Global, Sequoia Capital, and other sources. Dada, a sort of Uber for things, has an app that links delivery workers to local delivery jobs.

Global travel site Skyscanner ($1.6 billion valuation) raised $192 million in January, with Yahoo Japan adding to its stake and Artemis, Baillie Gifford, Vitruvian Partners, and the Malaysian government’s Khazanah Nasional Berhad fund coming on board. The company says 50 million travelers a month use its site to price-shop flights, car rentals, and hotels.

Indian e-commerce marketplace ShopClues ($1.1 billion valuation) picked up over $100 million in a Series E round led by the Singapore government’s GIC wealth fund. The four-year-old company expects to become, in the first half of next year, the first pure-play Indian e-commerce company to turn profitable.

Business planning platform Anaplan ($1.09 billion valuation) raised $90 million from investors led by Premji Invest and including Baillie Gifford, Founders Circle Capital, Harmony Partners, and earlier Anaplan investors. The company said it will use the money to fulfill increasing global demand for its cloud-based planning, modeling, and collaboration platform.

And Forescout Technologies ($1 billion valuation) joined the club with a mere $76 million in new financing led by Wellington Management. Forescout plans to use the money to expand operations and increase R&D efforts in its Internet of things cybersecurity specialty.

The full Unicorn Landscape Report is available here.

Meanwhile, Unicorn members Lyft and Jawbone got new cash infusions, and Legendary Pictures cashed out in a big way.

Legendary, a pioneer in bringing private Wall Street equity and hedge fund investors to movie production, was bought by China’s Dalian Wanda Group for $3.5 billion, the largest acquisition of an American film production company by a Chinese firm. Wanda chairman Wang Jianlin, his country’s richest man, said he wants to expand and change the landscape of the global film industry.

Three-city ridesharing firm Lyft got a $1 billion lift, half of it coming from General Motors, which said it’s forming an unprecedented partnership that could eventually lead to on-demand, self-driving cars. Before that, the companies plan to set up hubs where Lyft drivers can get discounted rentals of GM cars. Funding also came from Saudi Arabia’s Kingdom Holding Co. and others, bringing Lyft’s valuation to $5.5 billion.

Another San Francisco tech firm, Jawbone, went next door to the Kuwait Investment Authority, which led a $165 million mezzanine round to fund operations, growth, and new product development. Jawbone is known for its wearable technology, including ERA and Bluetooth headsets, the UP activity tracking system, JAMBOX wireless speakers, and NoiseAssassin noise cancelling technology.

Also in San Francisco, Sunrun closed on $25 million of senior secured credit facilities to support its largest-in-the-US home solar business. The five-year deal is with a syndicate of investors arranged by Investec and will let Sunrun add to its 20,000 installed systems, many of which it retains ownership of, either leasing them to homeowners or selling homeowners the electricity they produce.

And one-time Unicorn Gilt Groupe was acquired for $250 million in cash from Hudson’s Bay, owner of Saks Fifth Avenue and other department store chains. Gilt’s online shopping platform pioneered the limited-time “flash sales” popular following the 2007-2008 recession and specializes in “insider prices” on high-end merchandise. Hudson’s Bay plans to create Gilt “concept” stores in its Saks Off Fifth discount stores.

You can track the 200+ company Unicorn Landscape on VBProfiles.com.

Philippe Cases is CEO of Spoke Software, where he focuses on building a Market Intelligence Platform dedicated to tracking innovation.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More