Over the last year you’ve probably seen a variation of the headline, “Anyone can now invest in startups!” With the birth of equity crowdfunding, we’ve seen the launch of new platforms, including one by Indiegogo, that let the average person back companies for profit instead of just for product or perks. While exciting, this development is fraught: Many will get drawn into the tempestuous world of startup investing without a plan, a budget, or a full understanding of its pitfalls.

If you’re new to startup investing and considering it, here are a few things you should know before going in.

The haves and have nots

Despite the headlines, if you don’t meet the wealth requirements to qualify as an “accredited investor,” you still can’t invest in the majority of opportunities. That’s because a startup raising money from everyone and not just from accredited investors will have to follow a different set of rules, like limiting their raise to $1 million. This has bifurcated equity crowdfunding platforms into two classes.

Established platforms like AngeList and CircleUp remain exclusive to accredited investors, while upstart platforms like Republic, WeFunder, Indiegogo, and Fig are open to everyone. SeedInvest serves both accredited and non-accredited investors.

However, Vladimir Vukicevic, an early pioneer in crowdfunding and the CEO of crowdfunded Meural, says accreditation requirements are routinely flouted. “The dirty secret of equity crowdfunding is that the platforms don’t seriously vet investors to make sure that they’re accredited. It’s often based on the honor system, so some investors broaden their portfolio with little hesitation.”

I’ll let you kick around the implications there, but the important thing to know is that “Anyone can now invest in startups!” should be qualified as “Anyone can now invest in certain startups!”

Nailing down your motivation

Remember that Grandmotherly advice about never going to the supermarket hungry and without a grocery list, because you might end up with excess candy in your cabinets and an upset stomach? The same advice holds for equity crowdfunding. Before you get swept up in a hype video, nail down your motivation and devise a plan.

“There are at least three reasons why people should invest in an equity crowdfunding campaign,” Slava Rubin, Chief Business Officer of Indiegogo, told me. “The first is to earn a return. The second is for the joy of the process. And the third is to create a social good, whether you’re investing in someone you’re already familiar with or contributing toward a broader cause. The interesting thing about crowdfunding is that the same company can have backers with wildly different motivations.”

The three motivators (financial, entertainment, and social) have overlap, but it’s important to figure out which one will drive your investing ahead of time, because that will inform your strategy. For example, if you’re investing seriously, you must diversify your holdings to offset risk, but if you’re investing as entertainment, then diversification might prove distracting.

Motivation will also inform the source and size of your budget. Will you draw funds from your retirement savings? From your disposable income? Or from your annual charitable giving pool? The difference in scale between retirement and entertainment investing might be a factor of 100.

Equity crowdfunding as serious investing

If you approach equity crowdfunding as a serious investor, then the rest of your financial scaffolding must be robust. Investing in a startup is riskier than buying a penny stock, so yskip this article if you haven’t already taken care of the basics, like setting up an emergency fund, paying off your credit card debt, and maxing out a Roth IRA.

If you pass inspection, here are a few prudent steps on how to add startup equity to your holdings.

Phil Nadel, a seasoned startup investor and Managing Director of Barbara Corcoran Venture Partners, one of the largest and most active AngeList syndicates, recommends a first step of setting a budget.

Nadel recommends a maximum of 5 percent of investable assets as a rule of thumb. If you’ve already saved $100,000, then a $5,000 investment budget might be a good place to start. Note that if you are not an accredited investor, the government sets rules on how much you can invest per year based on your income.

The second step is to invest in a lot of startups. Nadel recommends 20-30 for a reasonable portfolio. With our example budget of $5,000, investing in 20 startups means an average of $250 funding per startup.

The third step is to make sure that your startup portfolio is diversified. Mix up the geographies, the business models, and the platforms so that a blight in one category won’t wipe away the sum. For example, don’t invest your $5,000 into 20 consumer VR startups on the same platform.

You may struggle with diversification. The government has erected legal blockades against international deals, and most offerings are consumer-oriented, meaning the massive enterprise market is underrepresented.

The fourth step is to plan for the long-term. It takes on average 7-10 years to see if your investment has panned out, and because startup investing has no liquidity, you won’t be able to sell your shares if you find yourself in a tough spot. Think of startup investing like buying into a retirement fund: Set it and forget it.

The fifth step is to calibrate your expectations. “The traditional model is that if you invest in 10 startups, you’ll lose everything on seven of them, earn a minor return on two, and maybe, if you’re lucky, make a big enough return on the last to subsidize the rest,” said Nadel. “10 isn’t a large enough portfolio though.”

The sixth step is to do your due diligence by researching the company. But this advice comes with a big “gotcha”: If you’re only putting $250 into a startup and value your time at all, then every hour you spend researching and vetting that startup indirectly shrinks your return. If you’re a lawyer who bills $300 an hour and you burn three hours of research into a $250 investment, then … well, you get the point.

So how do you invest responsibly without overdoing it on the due diligence? Rather than focusing on individual companies, spend your time researching high-level items:

- Research the equity crowdfunding platforms themselves. Who are the people behind-the-scenes deciding on what startups to list? What’s their vetting process like? Do they have skin in the game? Do they list companies from every industry or focus on a few? I’ve noticed that the platforms differ wildly on these questions.

- Research broader trends. For example, knowledge about the VR industry can cover multiple VR investments and help you spot the stars. If you’re not as knowledgeable about a space, consult a friend or colleague who is. “If you look at the crowdfunding horror stories of the past,” said Justin Bailey, CEO of Fig, “the vast majority wouldn’t have stood up to a domain expert’s scrutiny in the first place. They’d have been exposed after a 30-minute phone call.”

- Research startup investing in general. The equity crowdfunding platforms contain plenty of educational resources to help you get started, like SeedInvest’s Academy. Fred Wilson’s AVC blog is also a classic resource.

Aside from broad research, Nadel offers a simple due diligence “hack” if you’re risk-averse: Limit investments to companies that already have revenue. “This provides some early evidence of product-market fit,” he said.

Accredited investors on AngeList have long relied on syndicates (like Nadel’s) to pick companies for them. Syndicates take a cut of earnings (“carry”), but in exchange they spend an enormous amount of time vetting each startup they select. If you trust the syndicate itself, you can trust the startup by proxy. Early data on syndicate performance is compelling.

By law, non-accredited investors have no syndicate equivalent, but there are alternatives. One is SeedInvest’s index fund. Alexandra Tynion from Seedinvest sees managed and diversified startup index funds as the future of equity crowdfunding. “We want them to be as prominent and easy-to-use as ETFs,” she said.

Equity crowdfunding as entertainment

I asked Nadel for his thoughts on equity crowdfunding as a form of entertainment. After a long pause, he said, “That sounds like an easy way to lose a lot of money quickly.”

It certainly is. But if approached with thoughtful restraint, entertainment can be a viable approach.

Remember earlier, when I talked about the big “gotcha” with due diligence? That every hour you spend vetting small investments results in a lower return? Well, that’s only true if you think of the time spent as a cost rather than as the entire point.

If you invest $500 into one startup and enjoy scouring its financials, researching its product, asking its founder questions, and following along as it grows, then you’re not buying equity, you’re buying an experience. And 50 hours of an experience at $500 is a better rate than a movie ticket.

Vukicevic likens it to fantasy football. “No one sinks half their life into a season for the cash prize. They do it for the thrill of the process and the week-to-week bragging rights with friends. Investing in a startup has that thrill, and if the startup does well, it also has bragging rights.”

As a side benefit, obsessing over one startup can be an education. You’ll learn a lot about startup finance, which is itself a fascinating area, but you’ll also build literacy in your startup’s vertical. I can imagine the accountant who invests in a machine learning startup, gets inspired to learn the basic principles, and then hires a developer to apply machine learning to his or her own practice.

If you want to invest in a startup for the journey, then start small and see how much mileage you get out of the ride. If you lose interest after a week, perhaps this approach isn’t for you.

As long as entertainment investing is done with hobby money, it’s no better or worse than seeing a play or taking a wine class. In fact, it’s more fiscally sound than America’s biggest hobby: buying lottery tickets.

Equity crowdfunding as social activism

As an executive at AngelList, Ken Nguyen had a front-row seat to Silicon Valley’s funding patterns–and he grew frustrated with what he saw. “A lot of groups are underrepresented in startup funding. Age, gender, ethnicity, and geography play a disproportionate role,” said Nguyen, “and some socially important markets are neglected altogether.” To fix that, Nguyen founded Republic, an equity crowdfunding platform with a social slant.

The majority of startups on Republic are women or minority-led. Some have an obvious social aspiration, like Maternova, which develops clothing to help women in developing countries ward off the Zika virus. Others are more traditional ventures, like Whim, a dating app with a unique hook.

Republic highlights a third motivation for equity crowdfunding: investing as social activism.

If you’re passionate about tech diversity or want to foster innovation in an underserved market, then investing in the right startup could represent a more intimate and impactful contribution than writing a check to a global non-profit.

One approach is to invest with no expectation of a return, treating your investment as an exercise in charity and transferring funds from your annual charitable giving pool. While you won’t see an immediate tax deduction, if an investment pays off you can roll its proceeds into future ventures. Just remember to scrutinize the startups you invest in. Your goal should be to nurture good ideas, not prop up bad ones.

Another approach is to consider social value as a checklist item when building a financially motivated portfolio or investing for entertainment. Picking a few non-traditional startups for your portfolio may even give you an edge, since overlooked entrepreneurs and overlooked markets might help with diversification.

Is there an alternative model?

If you invest in a startup, you’ll generally only receive payment if that company is acquired or goes public. One of the tragedies of startup investing is that you can invest in a company that does well — with products on store shelves — but you’ll lose everything if it doesn’t do well enough.

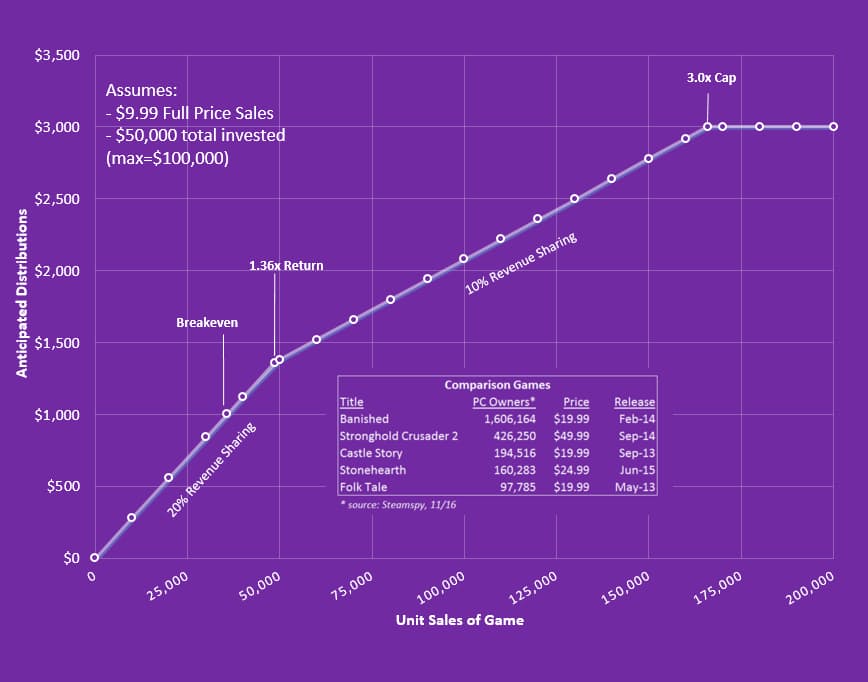

There are methods to change that (secondary markets, planned dividends, or debt-based investing), but these methods carry their own complications. For now, one platform, Fig, already offers an alternative by letting you invest in products instead of companies. (Those products are all video games for now, created by established video game developers, but you can imagine the model expanding to other categories.) In return for your investment, you’re paid royalties.

A royalty structure shrinks your time horizon, increases your success rate, and changes outcomes from black and white to shades of grey. It’s also easier to understand — look at this chart!

The downside is that product investing is specialized and has limited upside. Fig, for example, isn’t structured for mega-returns, so the home runs may not compensate for the failures. You’re also still exposed to existential risks, like if the company developing the video game goes bankrupt or if the video game gets canceled.

If you have a financial motive, wait for more data, but if you’re a video game fan and want to invest for entertainment or to help the industry develop riskier, more interesting titles, then Fig has a good pitch: “People already crowdfund video games with thousand dollar reward tiers,” said Justin Bailey, CEO of Fig, “Now, they can receive a stake for their contribution and sustainably build a better industry in the process.”

The final word

Entrepreneurs are often advised to politely decline money from first-time investors. One reason for this is because startup investing is complicated and an eager first-time investor may miss or misinterpret a key detail and end up disgruntled.

If you’re thinking about buying into a startup and have never done it before, be an exception to this pattern. Spend the time to question your situation and motives, study the field broadly, and craft a plan before looking at any specific opportunity. Also keep in mind that no one will ever fault you for sitting on the sidelines; in the vast majority of cases, that’s the smart play.

Adam Ghahramani is head of digital product for a creative agency in New York City. Find him at adamagb.com or make friends on Twitter (@adamagb).