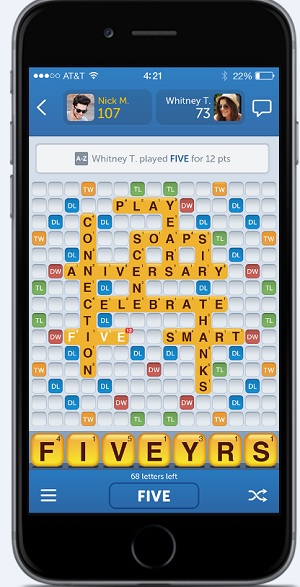

In his first full quarter back at the helm of Zynga, Mark Pincus delivered a solid financial result. The social gaming company that he founded still has a long way to go before its long-awaited turnaround is complete. It has fierce rivals in mobile games, where it is still playing catch-up. Zynga’s player numbers are still dropping as web games crater and the company loses some players in its relaunched Words With Friends mobile game. And Zynga is still losing a small amount of money: $7.6 million in the earnings reported yesterday.

But Pincus also delivered a positive surprise to Wall Street, beating both bookings and earnings estimates in the second quarter. Social casino games such as Wizard of Oz Slots and Hit It Rich! Slots grew 274 percent from a year earlier, and the newly launched Empires & Allies is monetizing three times better than the average Zynga game. Advertising is now 22 percent of total revenue, compared to 15 percent a year ago. And Pincus recruited former EA executive Frank Gibeau to join Zynga’s board of directors. Pincus talked about these developments in an interview with GamesBeat on Thursday.

Here’s an edited transcript of our interview. We’ll have interviews with all the right people at our upcoming GamesBeat 2015 conference on October 12 and October 13.

GamesBeat: With the slots games, they’ve been around for a while. What gave them such a large bump compared to a year ago?

Mark Pincus: That gets to the story and the strategy that we’re pursuing on mobile. We entered the category a couple years ago with a great, proven team in Spooky Cool out of Chicago. It was a slow build. They built great products with some of the most known, iconic brands from the slots floor. Where they’re at now is a long distance from where they started.

What we learned and are learning in mobile is that the overnight successes take two to three years to get to. We’re seeing that with a lot of competitors. We got there through a lot of hard work and investment and great execution to keep improving every quarter, improving the value to players. Consequently, you get the metrics we’ve seen – the retention, the monetization, the lifetime value. At some point you cross a line and start to ignite growth.

It comes from both your brand and products starting to get enough word of mouth, so they have organic growth on top of anything else you do, and your retention being enough that you’re holding a valuable audience. Also, it’s about your LTV being high enough that you can afford to advertise and buy audience at scale, and your team getting better at understanding the player segments that their products appeal to. How do we efficiently get the word out to them and get them engaged in the game?

It may look like it came out of nowhere in a quarter or two. Our slots games have actually been growing well over the last year at a consistently high clip.

GamesBeat: It looks like it’s important to have multiple successful titles in the social casino category. You had a good position with Zynga Poker for the longest time. But I notice that some of the other companies with large market share in this space have multiple titles. It seems like that’s what it takes to be competitive.

Pincus: Every category and every audience segment is going to have different play patterns and behaviors and interests. In social casino, you’re right. The leaders have multiple machines on the floor, right? Because there are so many different brands and machines that slots players are used to playing, what we’ve seen is that the most engaged players are playing a lot of different games. They want that variety.

In our games, we have a very aggressive plan where we are updating with new reels every two weeks. We’re also introducing new product lines, like you saw with Wizard of Oz. We just announced Willy Wonka today.

GamesBeat: So slots is a pretty wide category by itself?

Pincus: It does, I believe, point to the repeatable strategy that we have in other categories. What we’ve done historically, as a company and an industry—There’s a huge value in getting to a winning engine. Getting to winning game engines—You know this. You go way further back than I do in video games. It’s probably a playbook you know well. But we did with Wars and ‘Ville. Competitors have done it with things like Saga.

More than what you saw with the “game engines” of the ‘90s, the video game engines that were all about tech capabilities, game engines today are social systems. These are tuned as services, tuned for elder gameplay. It takes sometimes years in the market to get the tuning to the right place where your game is as compelling at level 100 as it was at level 10.

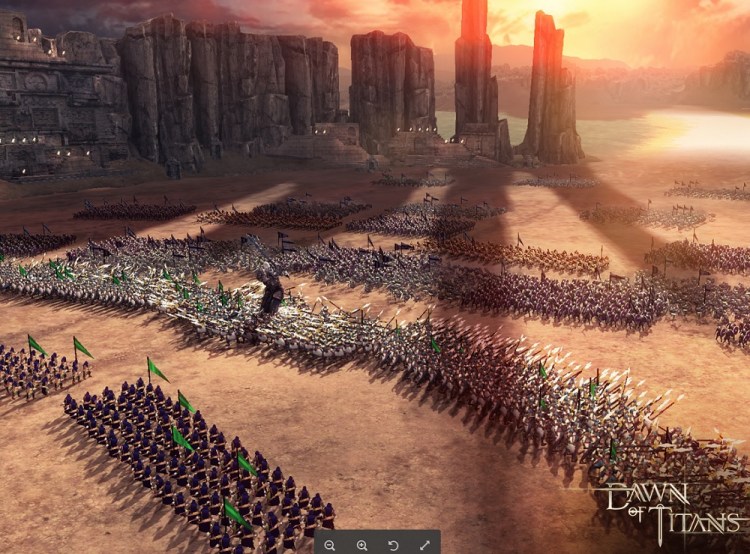

The playbook that we’ve followed in slots, what does that mean? How does that point to our other categories? I want to point out, we’ve recently launched two new games, and we expect to launch three more this year. We see those as the beginning of a similar journey. With Empires and Allies, we’ve re-entered the action-strategy category, which we led in social gaming with Mafia Wars years ago. It’s off to a strong start. It’s a proven team. They’ve built a terrific engine that they’re continuing to tune and add to. They just launched leagues. They have alliance versus alliance coming out this fall.

That story is still being written. It’s not going to be written in a quarter. We think that’s a terrific category that we can make more accessible, more social. We can bring a unique special sauce to it. With focused execution over the next couple of years, we can turn that into a repeatable growth engine as well.

We’ve launched FarmVille: Harvest Swap, which is our entry into the match three space. I’d call that a seed. It’s a smaller entry point for us into an equally large market. We’re seeing in arcade games and especially match three that the audience is overlapping with the slots audience. That’s an audience that also wants variety, wants to play a lot of different games – even a lot of different match three games. We see more opportunities, as that engine matures, to take that more places.

GamesBeat: You had one or two leadership changes in the social casino category. Is that factoring in here in some way?

Pincus: We’ve had the same leadership team with slots since we launched this effort two and a half years ago. It’s the team that came to us through the acquisition of Spooky Cool.

GamesBeat: Their supervisors seem to have changed, though.

Pincus: You’re referring to Barry Cottle, who was at the corp dev level. At one point he was running the whole division from San Francisco. But if you look at our slots franchises, that’s been Lincoln Brown and Joe Kaminkow from Chicago the whole way through.

GamesBeat: How does this fit in with some of the bigger picture? I know that the overall earnings have done pretty well.

Pincus: It was a good quarter with strong execution from all of our teams, and better than our own expectations in almost every category. Even with our web business, led by Farm 2 and Poker and some of our older games—It was all stronger than we anticipated. The teams did a great job on Farm 2 specifically. They’re continuing to introduce what we call bold beats. It’s almost on the level of launching, for other companies, new IP or expansion packs. Those are performing very well. It’s a committed player base.

Across our web and mobile business, the story that I don’t think has come out enough in the last year or two is that our advertising team and capabilities, our advertising interest, has been a great growth engine. Our ad business itself is up 44 percent in the last year. It grew 15 percent in the quarter. It’s now nearly a quarter of our overall booking. Ad revenues are higher margin because you don’t have to pay a fee to the platform, too.

GamesBeat: Is that expected to also have more potential for the future?

Pincus: We’re definitely bullish on the future of the ad business, especially the mobile ad business. We’re investing and innovating. You should expect to hear about new ideas and products coming out of there in the fall.

GamesBeat: Bing is still on the board, right? He knows Frank Gibeau well, but I guess that you did this personal outreach to Frank yourself?

Pincus: My relationships at EA now go back a long way, eight-plus years. I’ve known and respected Frank for a long time. As a competitor, he’s been super smart and strategic. I competed with him on the Popcap deal, where EA bought Popcap. We were very aggressively on the other side of that. He’s made a lot of smart moves. I respect him. When he was no longer part of EA, I thought he’d be great DNA to add to our board and company. We’re going to see him have a highly engaged role with the company, similar to the way that Bing’s been highly engaged.

GamesBeat: How confident are you about running things again?

Pincus: When I came back 100 days ago or so, I said then that my reasons for coming back—I believe in our founding fundamental vision of social gaming. More so now than when I pulled you aside in that Starbucks at whatever game conference, when I was trying to pitch you that poker could be a social game. I’m still pitching you on it.

I believe in the opportunities for social gaming. It’s overlapping with mobile gaming and lots of video gaming, but it’s still different. It’s all getting more blurry as hardcore games and console games talk about being social. We’re not there yet, but I think social gaming wants to be a whole medium, in the same way that social networking and social media are mediums. Over the next 10 years, people are going to do social networking and social media in and around their game-playing. We’re seeing early signs of this, but I don’t think we’re there yet. I see a lot of room for us to invest and innovate and differentiate there.

The second pillar is getting the company back to intensely focusing on being player-centric and data-driven. Investing deeply to arm our teams with the world’s best data and analytics and metrics capabilities. Then seeing that get operationalized into the way that we invest our engineering days and our game design cycles.

I want to deliver on the promise that 80 percent of our engineering days are delivering clear value for our players. That’s a very ambitious goal. I want to deliver on the promise that we’re testing more ideas in a week than anyone else in the world. We’re learning faster about what our players want and delivering it faster as well.

The third pillar is getting back to our founding values of being empowered entrepreneurs. We have amazing people inside our company. Half our battle is just to unlock their creativity and energy, to point to the right hill and get out of their way. That’s what we built the company on. That’s what I’m working every day to get back to.

It’s less about my confidence in my ability to get us there and more about the team. If the leadership team and I create the conditions for success for our teams – empower them, arm them, focus them on the right hills – then they’re going to do the rest.

GamesBeat: One of the last hurdles may be getting highly profitable again.

Pincus: Bing always reminds me that your stock price is a trailing indicator of success, not a leading one. Profitability is also a victory lap we get to take after we’ve delivered the value, not before and not during. We have very well-resourced company. While we’re very focused on being resourceful in our approach to the market – that’s why we announced our cost reduction plan – our number one focus is not profitability. Our number one focus is growing slots and firing on more cylinders, getting more categories in which we’re delivering the social gaming franchises that players love most, and that we can invest in and grow over a long period of time.

That’s what we do well as a company. What we’ve been best at is running live game services as franchises. As we just showed this quarter with Farm 2 web, that’s what we’re best in the world at. I want to get us back to that. In the meantime, we’re thinking about being resourceful to fund our future. This past quarter, we’re not breaking it out, but we invested tens of millions of dollars in futures — new games R&D, core technology, data analytics, infrastructure – to try to set us up for that future growth.

We’re playing the long game. We want to get to multiple high-value, billion-dollar franchises. We’re going to take a multi-year approach to getting there. We know people will want these games three and five and 10 years from now. We want to be in the best position to offer people what they love the most. It’s not obvious that showing a terrific profitable quarter this quarter or the next is going to be the best indicator that we’ll be delivering that value three years from now.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More