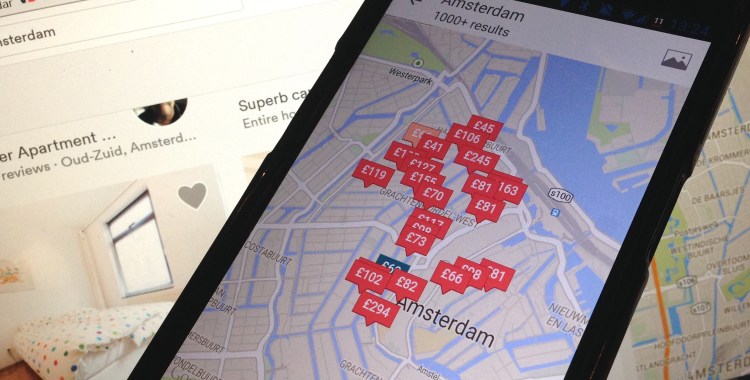

As one of the world’s largest peer-to-peer (P2P) accommodation rental platforms, Airbnb needs little introduction. Indeed, it’s fair to say that Airbnb is hot stuff — but it hasn’t always been that way.

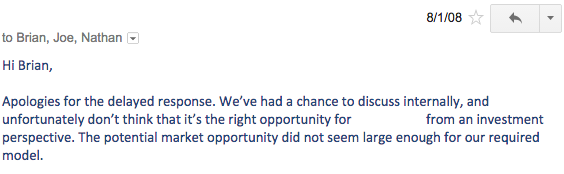

Brian Chesky, cofounder and CEO of Airbnb, took to Medium yesterday to post some responses he received from potential investors way back in 2008, just as the company was setting out. Following meetings with seven “prominent investors in Silicon Valley,” only five responded — and each turned the investment opportunity down.

However, digging down into the details of the terms that were offered is interesting — the company was trying to raise a mere $150,000 at a $1.5 million valuation. This effectively meant you could’ve owned 10 percent of the company for a stupidly small amount of cash.

While the names of the responders have been redacted, it still gives a fascinating insight into what life was like before the so-called sharing economy came to fruition. Four of the five emails cite fairly practical reasons for not wishing to proceed, such as “it’s not an area we are currently investing,” concerns with “technical staffing,” and “we’ve not been able to get excited about travel related businesses.”

But one email stood out, as it specifically noted that the “market opportunity” just seemed too small.

Today, with 1.2 million listings across 190 countries, projected revenue of $900 million in 2015, $1.5 billion in fresh funding, and a valuation of $24 billion, reading such historical misgivings can be amusing. However, hindsight is a wonderful thing, and it’s easy to mock attitudes that were given at a time when such a business model had yet to be proven at such scale.

But Chesky’s purpose for penning the blog post is less about poking fun at short-sighted investors than it is about encouraging other fledgling startups. If one multi-billion-dollar company couldn’t give away 10 percent of the company for $150,000 just seven years ago, then the same could easily apply to the next disruptive startup out there.

The point is, don’t be disheartened if you struggle to get investors on board at first.

In 2008 we were raising $150,000 at a $1.5M valuation. Here's the response. Think of this next time you're rejected. https://t.co/wZEnQSn0Eq

— Brian Chesky (@bchesky) July 12, 2015

For the record, Airbnb went on to raise a $20,000 seed round via Y Combinator in 2009, and a further $600,000 through Sequoia Capital and Y Ventures a few months later. This was then followed by $7.2 million in November 2010, then a bumper $112 million less than a year later. The company has raised more than $2 billion to date.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More