The seventh annual AliFest featured Chinese internet giant Alibaba Group‘s global ambitions and its complicated relationships with eBay and Yahoo. By far the most intriguing speaker was eBay chief executive John Donahue, whose company was previously vanquished by Alibaba’s Taobao in China.

The seventh annual AliFest featured Chinese internet giant Alibaba Group‘s global ambitions and its complicated relationships with eBay and Yahoo. By far the most intriguing speaker was eBay chief executive John Donahue, whose company was previously vanquished by Alibaba’s Taobao in China.

As he took the stage, Jack Ma, CEO of the Alibaba Group, said, “I got an SMS (text message) from a friend before going up: ‘Jack, what’s up? Why is he [eBay CEO John Donahue] doing here? Isn’t he a competitor?'”

But Donahue stated that eBay won’t compete for consumers in the Chinese market, not that it has much hope of competing there anyway. eBay acquired EachNet for $180 million in 2003 (which had 85 percent market share), as its entry into China’s business-to-consumer (B2C) market. But it lost out to Alibaba’s Taobao, which offered free listings, local servers, and more localized features. By the time it essentially left China in 2006, eBay had spent a total of $280 million in the China market.

Donahue offered no clear vision of how eBay could cooperate, but Alibaba clearly had an angle. David Wei, CEO of Alibaba.com, said in an interview that he wants to reach the “90 percent of eBay sellers who source offline.” Alibaba’s vision is a business to business to consumer, or “B2B2C,” chain from AliExpress supplier to eBay seller to eBay consumer. Alibaba views this as cooperative with eBay, though it’s unclear what eBay stands to gain in this arrangement.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

AliExpress, a ‘wholesale platform for small sellers,’ is Alibaba’s play in the space. AliExpress formally launched in April 2010 and is ambitious and well-funded: Alibaba has budgeted $100 million for acquisitions in the US in support. The recent acquisitions of Vendio and Auctiva, two sites offering tools for eBay sellers, are part of this effort. Both of those sites will offer integration and exclusive discounts to encourage sellers to source from AliExpress.

eBay and Global Sources, an Alibaba competitor, previously cooperated on a wholesale service that failed because of the difficulties in ensuring quality, availability and delivery times in cross-border transactions.

eBay and Global Sources, an Alibaba competitor, previously cooperated on a wholesale service that failed because of the difficulties in ensuring quality, availability and delivery times in cross-border transactions.

“I think the two acquisitions of Vendio and Auctiva awake eBay to consider more seriously the business to business to consumer (B2B2C) market. Jack [Ma] and John [Donahue] have confirmed that both businesses should seriously, officially explore how to create value for both companies’ customers,” said Wei.

As AliExpress moves Alibaba closer to the consumer, it raises the obvious question: is Alibaba aiming to challenge eBay for consumers in the US and globally? Representatives adamantly denied that the Alibaba Group might compete with eBay for global consumers, but a review of AliExpress and Taobao suggest that it may ‘reconsider’ in the future.

AliExpress is meant as a business to business (B2B) platform, but a quick review of the site reveals significant business to consumer (B2C) potential. The top-selling item is an iPhone/iPod cable that retails for $0.61, with free shipping worldwide from Hong Kong (no minimum order quantity or size). That’s cheaper than this author could find on eBay’s “Buy Now” ($1.00) or Amazon ($1.90), when shipping is factored in. Pages and pages of previous buyers show quantities of 1-3 units, which makes clear that consumers worldwide are enjoying cheap China prices and shipping that is almost certainly completely subsidized by Alibaba at present. In general, AliExpress looks like a mix of deals that appeal to small sellers and consumers.

Wei stated that any B2C on AliExpress is a mistake, as Alibaba discourages consumers from using the website: “I have never seen any online or offline platform in the world, that can serve both wholesalers and retail consumers. For example, wholesalers never want their pricing to be that transparent to retail consumers.” He said low order quantities and sizes are available solely for the sake of sample orders. But AliExpress prices are very similar to those found on Taobao, which is for consumers, albeit only Chinese so far. It’s not difficult to imagine that Alibaba is using AliExpress to test waters for an eventual entrance into global B2C.

Still, the learning curve is steep. “We have no knowledge or insights about consumers in the states,” Wei readily concedes.

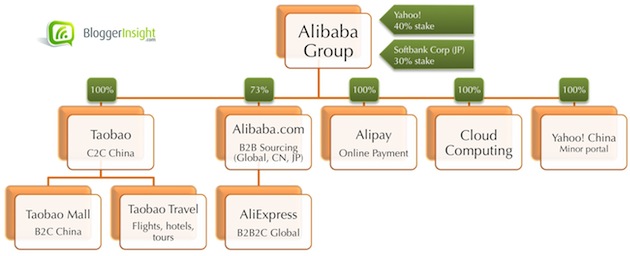

Any global consumer play would likely come from Taobao, The Alibaba Group’s other star holding. Taobao controls 80 percent of the e-commerce market in China, offering both C2C and B2C.

Most of AliExpress’ core features, from its rating system and customer chat to its “Escrow” payment, are borrowed from Taobao. Notably, AliExpress does not use eBay’s PayPal, another sign that ‘cooperation’ only goes so far.

In Japan, Alibaba is already challenging eBay via a partnership with Softbank-owned Yahoo Japan, which will enable merchants to sell through each other’s platforms. “After we join our strengths together we will definitely beat eBay,” said Masayoshi Son, Softbank Chief Executive, chairman of Yahoo Japan, and Alibaba board member.

Taobao has extensive consumer e-commerce experience and high aspirations. In its B2C Taobao Mall, it works with more than 20,000 brands, including more and more international heavyweights, including Adidas, Uniqlo, and Jack Jones. Insiders say Taobao itself will IPO in 1-2 years, further evidence of the ambitious plans of The Alibaba Group.

The Unwanted and Ailing Grandfather: Yahoo!

Just as conspicuous as the presence of eBay’s CEO was the absence of Yahoo speakers at AliFest. In 2005, Yahoo purchased 40 percent of the Alibaba Group in return for $1 billion and the Yahoo China property. It’s an open secret that The Alibaba Group wants to buy back its stake, but Yahoo is not selling on what has been a spectacular investment. The research firm Stifel, Nicolaus & Co. states that as much as 85 percent of Yahoo’s stock price may be attributable to the value of Yahoo Japan and Alibaba.

“Yahoo is like our grandparent. And that’s the grandparent, who as a grandson, I don’t visit… The grandparent used to have something very important to [us], which doesn’t exist anymore: the search engine technology,” stated David Wei. When asked if Alibaba would terminate the relationship if possible, Wei responded: “The grandfather may pass away himself, unfortunately, before this question can get answered. It’s a question of grandparents ts keeping healthy.”

Yahoo has a ‘bull in a China shop’ relationship with Alibaba. Yahoo! CEO Carol Bartz expressed dissatisfaction with Alibaba’s management of Yahoo China, which has faded into insignificance as a portal in China (from 15 percent market share to less than 1 percent) despite the continued strength of others like Sina and Sohu. Second, Yahoo went out of its way to express solidarity with Google in its position vis-a-vis the Chinese government, to which Alibaba spokesman John Spelich responded, “Yahoo’s statement was reckless… given the lack of facts in evidence.”

The latest imbroglio, on the eve of AliFest, was the statement by Yahoo Hong Kong’s Managing Director that Yahoo may try selling ads to mainland Chinese SMEs. “If Yahoo begins to compete with Alibaba for customers in China, we will have to re-evaluate our relationship with Yahoo further in light of this activity and the intentions it implies,” stated Spelich.

But it seems that the Alibaba Group has little recourse beyond tempting Yahoo with an enormous buyback. “China-based companies buying ads on the Yahoo Hong Kong network does not affect the investment (in Alibaba),” Yahoo said.

International Aims, International Culture

Of Chinese internet giants, Alibaba is the most accessible to an international audience. Other guest speakers at AliFest included Arnold Schwarzennegger and US Ambassador to China, Jon Huntsman. The Netrepreneur Summit featured 10 star sellers from Alibaba.com’s worldwide network, which runs especially deep in the US (16 percent of registered users), EU (16 percent), India (11 percent), and Pakistan (3 percent).

CEO Jack Ma himself is the story of the Chinese dream. At age 12 he became determined to learn English, so everyday for the next 9 years he biked 40 minutes to a hotel to serve as a free guide to foreign tourists. Today he gives keynote speeches in fluent and charming English. His humble background makes him a hero to many Chinese entrepreneurs.

A group of U.S. college entrepreneurs from the Kairos Society that Alibaba flew out for the event reported a fun, Zappo’s-like atmosphere at Alibaba.com headquarters, with a bell that rings for each sale to suppliers. Inspired by Schwarzenegger and the visiting entrepreneurs, Alibaba pledged $3 million for a new “Schwarzenegger Emerging Entrepreneur Initiative”.

In addition, the entire Alibaba Group has a forward-thinking corporate social responsibility policy that earmarks 0.3% of annual revenue for conservation of environment in China and abroad.

It’s often said that ‘soft skills’ present the greatest challenge for Chinese companies with global ambitions. Alibaba has taken note and is actively building a culture and image to rival the best, as befits a firm with international horizons.

Kai Lukoff is an analyst at BloggerInsight, a spin-off of Web2Asia, that crowdsources market intelligence through an expert online panel of bloggers. Follow Kai on Twitter.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More