Andrew Feldman, corporate vice president and general manager of Advanced Micro Devices’ server chip business, showed off working 64-bit ARM-based processors for servers last week at the Open Compute Project summit last week in San Jose, Calif.

AMD plans to disrupt the huge x86 (Intel-based) server chip market by using smaller and more power efficient ARM cores in AMD-designed server processors. Feldman is leading that charge, and he says the company will ship ARM-based server chips this year. He predicts that ARM server chips will be 25 percent of the data center market by 2019. If that happens, that’s a big blow against Intel.

AMD isn’t going toe to toe with Intel in designing super-fast server chips anymore. And that may be its path to riches, according to Feldman. Its chips won’t need giant air conditioning systems.

AMD’s shift is disruptive in another way. An x86 (Intel-based) processor takes three years and $300 million to develop. Creating an ARM processor can take as little as three months and $30 million. Intel, however, says that the chip that Feldman talked about has weaker performance and higher power consumption than Intel’s Atom C200 (code-named Avoton) processors that started shipping last September. Based on what AMD unveiled last week, Intel believes it has a 65 percent advantage in performance per watt of power consumed. Intel also notes that the ARM chips aren’t necessarily arriving on the schedule that was originally promised.

Here’s an edited transcript of our interview with Feldman. We’re sure that his words will infuriate Intel.

VentureBeat: I see the way computing architecture works now. You have a little device’s processing power. It goes to a smartphone with more processing power. Then the smartphone taps the data center, with the most processing power. So a small device taps everything.

Feldman: That was the whole insight I brought to bear in my keynote. What these devices do is display the answers that were created somewhere else. That’s one of their limitations, and their glory as well. They give you access to all the world’s knowledge. It’s search or Wikipedia or how to make a reservation at a restaurant or where your friends are hanging out. It’s not that they have that information, but they can access it.

The simple proof point is, if you turn off your radio on that device, what you’re left with is an Angry Birds machine. It’s not a very useful device anymore. It’s not even a great phone. The Blackberry was a better phone, but a less cool device. It didn’t do as good a job of giving you access, and that won the day.

That’s the irony of the smartphone. “Smart” became more important while “phone” became less. We can build much better phones, and they do. If you go to the third world, they never drop calls. My dad called me from Mongolia and I dropped the call from the 280 freeway, in the heart of Silicon Valley, on the coolest new iPhone with AT&T. It’s because the phone became less and less important. Its ability to access the data center became more and more important.

Above: Andrew Feldman of AMD

VB: What does that mean?

Feldman: One of the things I pointed out in my talk is that the data center has snuck into our daily lives without our noticing. When we send an email or take a photo of our dog or watch the Suzuki Method graduation with our child playing the violin and recording it, we don’t realize the data center has become a part of our lives. That video is in the cloud, whether in iCloud or an Android service. We email it through Gmail to a grandmother far away. We tweet about it. The data center has snuck in to how we interact with the world.

That’s going to happen more and more with wearables, too. It’s not that wearables are interesting per se. What’s interesting is their ability to get to the data center.

What that led us to think about is a series of questions. Can we imagine a world with less compute, with less storage. Can we imagine a world where the workloads are bigger, more like CAD/CAM, or do we see the workloads being more like Twitter? The answer, obviously, is the latter. Can we see a world where graphics are less important? Can we see a world where power and space in the data center are less important? Those produce obvious answers for us, and for you and your readers who think about this as well.

When you take the next step and use those observations to create a bounding box for your future, we ask, “What have we learned from 50 years of the history of compute?” Smaller, high volume, lower cost parts always win. That’s what we’ve learned. That’s how the mainframes were beaten by the micros, and the micros by the minis, and the minis by the workstations, and the workstations by x86.

VB: How is this going to play out?

Feldman: Where I began in this industry, I was the first non-engineer and the only PC in the building. Everyone else had Sun workstations. Now we have 6,000 engineers, maybe 5,000 engineers, and not one of them has a workstation. All of them have access to x86 and use it, because it was smaller and cheaper and higher volume.

When we think about that, we say, “ARM has those advantages on x86.” There were eight billion ARM processors shipped in 2012, compared to 13 million server parts, plus or minus. ARM amortizes its R&D over hundreds of partners. Intel amortizes its R&D over Intel. We amortize ours over us in the x86 world. The ecosystem that has produced in the handhelds and the clients is remarkable.

What we’ve seen is exactly this pattern of the small nibbling their way up. Intel was sure it would win the phone, and got clobbered. Abject failure. Not once, but three times. ARM nibbled up from sensors, up into the phone, and from the phone up into the pad, and from the pad it’s working into the Chromebook. In its wake it’s laying waste to the client side. At first everybody says it’s underpowered, there’s no software, and then three years later everybody says, “Why would we buy something else?”

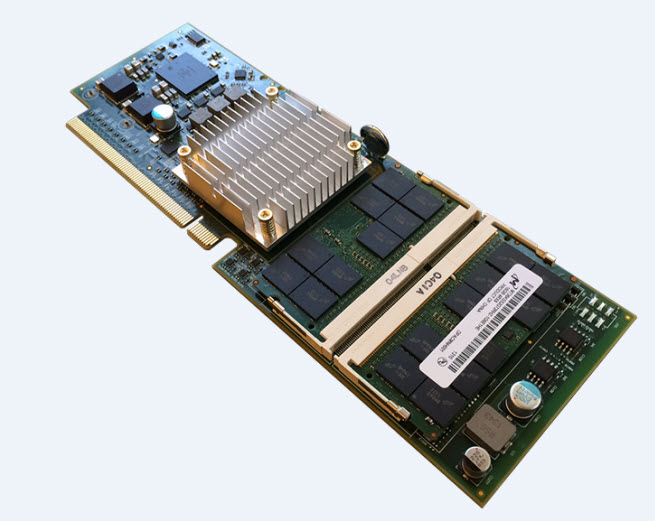

We see that same pattern nibbling up all the way into the server space. We’re throwing gas on that fire by announcing an eight-core ARM server part. We’ll be sampling it in a few weeks. Those are the ARM 857. It’s a remarkable part. It’s the only 28-nanometer ARM server part from a vendor who’s ever built a server part before. It’s hardened for servers. It uses all the IP blocks we’ve deployed in millions of servers over the years, all the RAS functionality, all the error correction, the ECC, the high-performance memory controller, all the technologies that servers have demanded. In addition, it supports a huge amount of DRAM, 128 gigs of DRAM. That’s four times what Intel’s premier single-socket part can support.

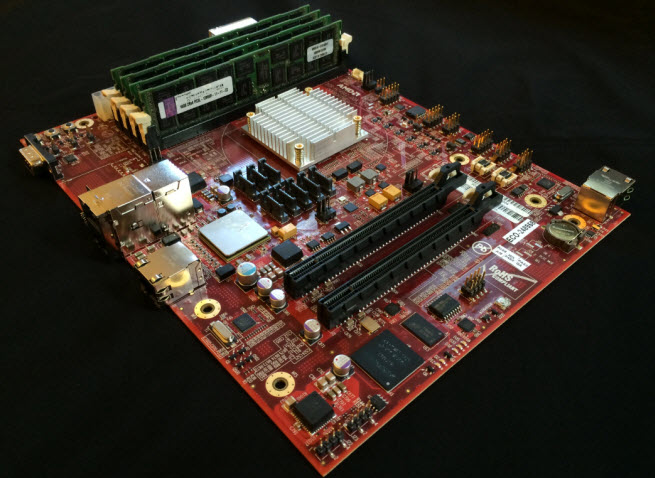

Above: Andrew Feldman of AMD with SeaMicro board

VB: And you demo’d this on stage.

Feldman: We did. In addition to the part, we’re showing an engineering evaluation board with a full software stack. It’s not just, “Here’s a piece of hardware.” It’s, “Here’s a hypervisor. Here’s an OS. Here are the full LAMP stacks. Here are dev tools. Here’s the full set, so that you as a software maker can jump in and put your software on top.” That’s one thing we showed. Huge response.

We also announced a server motherboard that fits the Open Compute Group Hug standard. It’s the first 64-bit ARM open-source motherboard. We put that whole design into the open-source community through the Open Compute Foundation. That’s a really cool board. It fits in my pocket.

It’s my belief that in 2019, ARM will be 25 percent of the server market. Every major data center will be designing their own custom or semi-custom ARM server CPUs.

Above: AMD ARM served board

VB: Not so long ago, Intel’s micro-server man Jason Waxman was still saying that the micro-server market was one percent of the server market’s revenues per year.

Above: Intel’s micro server man Jason Waxman

Feldman: But that’s like me saying it’s 75 percent. It’s in their interest to lie to make it small. [laughs] It’s in my interest to lie and make it big. I’m sure the truth lives somewhere in between. Intel has worked very hard to delay and damage their Atom parts. The result is, they’ve had their teeth kicked in.

The Atom part was designed to win the iPad, and they lost the entire category. They didn’t lose one design. They lost a category. That’s what you get, in our business, when you think you can tell the market what it wants.

They tried this once before when they tried to withhold 64-bit on x86 from the market. They hemorrhaged 25 percent of their share. They tried to use market power and leverage to convince Apple that what Apple should do is use Atom instead of an ARM part. As a result, they have zero percent share in the tablet business. Do they have it in their ability to build a better Atom part? I think they do. But it destroys their E3. If I were them, I’d destroy the E3 anyway, because it’s me or ARM.

The E3, the A5, they’re under attack. The prices are hemorrhaging. Do you know the price they give to the largest seven or eight data centers? It’s radically better than what they give to Goldman or Morgan or any of these other guys, so much so that it would change the economics of the industry completely if they gave that pricing to everyone. Why are they giving it to dudes with hoodies? Goldman’s been one of their largest customers. Morgan Stanley’s been one of their largest customers for 30 years. Instead they’re giving the best prices to Amazon and Facebook and Google, encouraging those guys. It’s remarkable, in my view. It’s a deeply pernicious strategy.

VB: Because they’re trying to make certain customers win?

Feldman: Yeah. They’re trying to advantage one set of customers over another by price discriminating.

VB: And those are the ones that are less useful to them?

Feldman: At this point in time.

VB: Given the kind of part you announced, what part are you attacking, which part of the server market?

Feldman: We’re attacking the part of the market that is bound below by the 13 server SKUs that they announced with Atom. I remind you that when you and I began talking at SeaMicro in 2009, they assured me that Atom would never be a server part. The last year they announced 13 server SKUs with it. It’s bound above by E5s. That’s the space. We’re doing it at a radically different price point. We’re doing it at radically less power, and with a ton more DRAM support.

Above: Andrew Feldman with original SeaMicro box

VB: What’s the distinction between the role in the market each is going to play?

Feldman: Everybody keeps asking me which workloads will go to which. You have to have two vectors of differentiation. There’s a set of workloads, and inside those workloads is a set of customers. Cold storage for innovative customers will all go to ARM, without question. For less innovative customers, they’ll go to small core x86. The memcached layer will all go to ARM, for everybody. The web tier for innovative customers will go to ARM. For trailing-edge customers, it will stay x86. That’s the way the market will unfold.

VB: Is it clear which size of opportunity there is for each one? Is the ARM opportunity much bigger than the x86 in micro-servers?

Feldman: I think the ARM opportunity in micro-servers begins equal and grows to larger than x86. In mainstream servers, it begins smaller and grows to equal over time.

VB: Intel has dropped hints that maybe they’ll do foundry business for other companies. Maybe they’ll do ARM chips in their foundries. It seems like we’re not too far away from them deciding to do ARM chips themselves in a bigger way. Do you detect that they’re going to move in this direction?

Feldman: Here’s what I detect. Foundries are the single most expensive things to build in all of technology. They cost on the order of $12 billion, and they have roughly 1,800 days of life. Intel, over the past three generations of foundry technology, has been able to wring a decreasing game out of each generation. They rely on this game. And so the game is shrinking while the cost of the foundries is growing. That’s an unfortunate trend to be a part of.

They require the client side of the business to keep their foundries full. If you have 1,800 days of foundry life, every day that it’s not 100 percent full, you’re destroying money. So much so—I remind you that there was an earthquake in Taiwan. TSMC announced that they lost a day and a half on a foundry. That was a material event, that the earthquake had interfered with the production of a foundry. What terrifies Intel, all day every day, is empty foundries. That’s what they’re facing right now.

Their sole advantage on the high end, which they’ve been able to maintain because of foundries, is dependent on the client-side business being able to fill foundries. Now their foundries are looking empty. Their gross margins on the high end are shrinking because of it. Now they’ve gone to others and said, “Would you like to use our foundries?” But if you talk to anyone who’s tried to use their foundries, they’re impossible to use.

TSMC is built from the ground up to be a merchant foundry. Everything they do is about how a third party can deliver a part all the way through. Intel’s designed toward their rules. Every bit of tuning and optimization is not designed for you. You cannot be tuned for yourself and suddenly decide, “I’m gonna open up and be a merchant foundry.” That’s why they’ve had such an absence of success there. But they have to say that, because everybody knows their foundries are going to be empty. Once the foundries are empty, you short the stock.

Above: AMD Opteron server board with ARM-based chip.

VB: Is there a reason that this is an area where it’s not that easy to move really quickly off of x86?

Feldman: If Intel mentioned that it’s considering ARM, it’s about a minute a half from throwing in the towel. If Intel decides that it’s unable to compete in x86, the x86 ecosystem collapses.

VB: It’s hard to admit that, I guess. It’s the same boat they were in before the Opteron, right?

Feldman: That’s exactly right.

VB: How do you guys play that strategy out again here?

Feldman: What you do is, rather than try to dictate to the market – “You will have x86 and you will like it. You will not have 64-bit and you will like it. We will withhold 64-bit and put it on an Itanium part only.” – you listen to the market. When they say, “We want lower cost, smaller, lower power-consuming parts,” you think about how you can get there. If you can get there with ARM you make the move.

I know it feels a bit slow for us, but it’s a big change. We committed to it, and we are building a whole lot of ARM server parts and other parts with ARM.

Above: Tegra K1

VB: How do you look at competition from other directions, like Nvidia’s ARM-based Tegra?

Feldman: If Nvidia wants to move up into the server market—I’m not particularly concerned with Tegra. The winners, in the end, in the ARM server market, are Samsung – they haven’t announced, but I assume they will play – Qualcomm, and us. That would be my bet.

I would bet also that Google ends up doing their own parts. Amazon is already doing its own CPUs. They use them in the Kindles now, but they will do more. They have a chip team, a whole mini-company called Lab 126. Their job is to design chips.

VB: Do you believe that you have a shot at some of these guys, because of the semi-custom positioning?

Feldman: For sure. We’re good at that. We’re the best at that. That’s why we’ve run the table in the big semi-custom world.

VB: You’ve been proven pretty good in game consoles as well.

Feldman: That’s the highest-volume single consumer place for a CPU. Each of those guys announced a day with a million units. That’s pretty good. That’s a lot of Xboxes. You just think about what it means to sell a million of anything in a day, let alone a box like this.

Above: AMD is the No. 2 maker of PC processors.

VB: Does semi-custom make the same kind of sense in the data center?

Feldman: Let’s think about that. Semi-custom makes a huge amount of sense when you want to control and optimize the experience of the software running on the hardware. That’s what Apple has done with the iPhone. That’s what Apple has done with the iPad, and why the iPad delivers such extraordinary performance from such a modest processor.

That’s what Google has tried to do at the building level. They’ve tried to modify the building and the racks and the cooling and the servers themselves, the networking and the software. But what they’ve been unable to modify is the processor. It’s the same with Facebook and Amazon and all those guys.

VB: If you can ramp this up, what’s the nature of the ramp?

Feldman: 2014 is the year where people kick tires, where data centers maybe announce ports. Major OS vendors — Red Hat, Canonical, and others — announce full-fledged operating systems. This is the year that the first credible ARM-based servers arrive. The software ecosystem moves from adolescence, where it is right now, to maturity. In 2015 you see wide-scale adoption.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=915502ca-044f-4ce2-896f-7b5f0f965903)