Advanced Micro Devices reported fourth quarter earnings that beat Wall Street’s expectations.

AMD is the No. 2 maker of PC processors and graphics chips behind Intel, and its results are a bellwether for the PC industry. The company is readying its Ryzen desktop processors for launch in the first quarter. These chips have a chance to take the performance crown away from Intel for the first time in a decade.

Analysts expected earnings per share to be a loss of 2 cents per share on revenue of $1.07 billion. AMD reported a loss of 1 cent a share on revenue of $1.11 billion on an adjusted basis. AMD credited higher graphics chip sales for the revenue growth, which was up 15 percent from a year ago. Revenue was down 15 percent from the prior quarter, largely due to slower seasonal sales of semi-custom chips (which means chips for video game consoles).

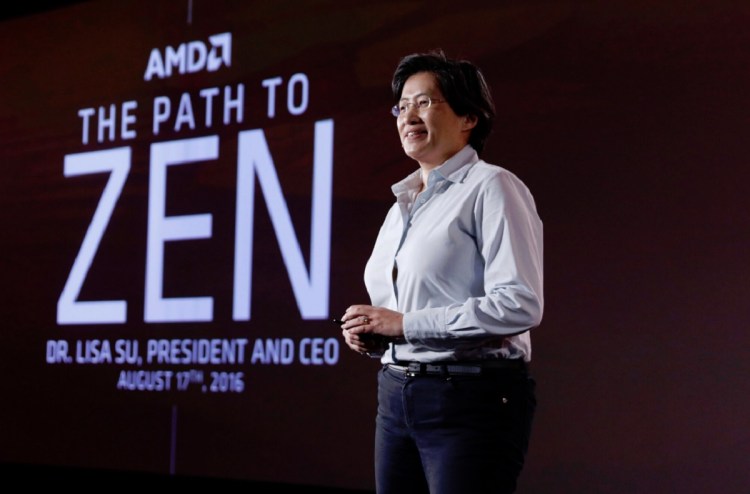

“We met our strategic objectives in 2016, successfully executing our product roadmaps, regaining share in key markets, strengthening our financial foundation, and delivering annual revenue growth,” said Lisa Su, AMD president and CEO, in a statement. “As we enter 2017, we are well positioned and on-track to deliver our strongest set of high-performance computing and graphics products in more than a decade.”

AMD is also preparing its Radeon Instinct artificial intelligence chips, based on its new Vega graphics architecture.

For the first quarter, AMD said it expects revenue to decrease 11 percent from the previous fourth quarter, plus or minus 3 percentage points. The midpoint of guidance would show Q1 revenue being up 18 percent from the previous year.

Non-GAAP gross profit margin is expected to be about 33 percent, and operating expenses are expected to be about $360 million. In after-hours trading, AMD’s stock is up 2.3 percent at $10.61 a share.

Annual revenues were $4.27 billion, up 7 percent from a year ago. The net loss was $497 million, compared to a net loss a year ago of $660 million.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More