Before you get too excited, no you won’t be able to pay with AmEx using Passbook. (Most retailers don’t have the infrastructure to take payments like that.) But you will be able to get details on recent transactions as they happen.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":536153,"post_type":"guest","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,mobile,","session":"D"}']“We’ve essentially re-imagined what’s possible for the newly launched Apple iOS6 Passbook technology – taking it beyond just mobile ticketing, coupons, and loyalty cards,” AmEx spokesman Brad Minor told me in an email. “This is an entirely new use-case for Pass that makes it useful every day, and not just for specific occasions.”

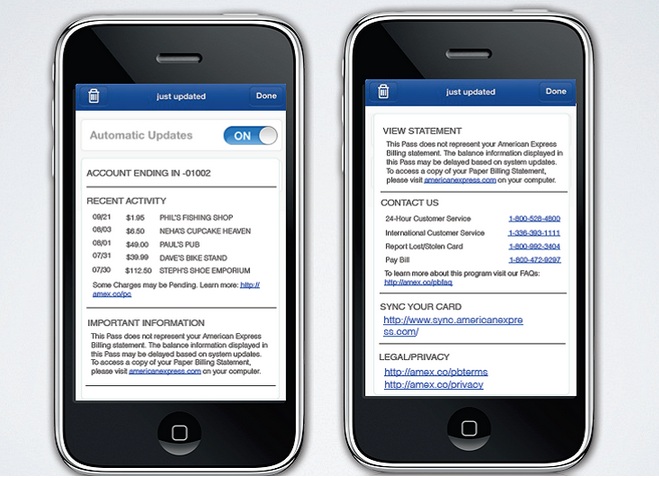

In the initial release, AmEx will be able to notify cardholders when there’s a new transaction on their account. Cardholders can also see current balance and access other recent transactions and customer service information.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

The real-time notification capability allows AmEx to have a two-way dialogue with consumers that hasn’t really existed before. This creates a channel that AmEx could use for new features:

- See nearby offers from merchants based on your phone’s location. AmEx has been a leader among the credit card companies in creating offers.

- If a charge is flagged by AmEx fraud systems as suspicious, the network could send a real-time alert to the user’s registered phone number. The user could then enter a PIN to verify the transaction. Or, the transaction could automatically be verified by determining that the phone is in the same location as the merchant. This would help alleviate the pain of false positives in fraud alerts, increasing legitimate transactions, decrease fraud, and decrease customer service calls. Even in the current implementation, simply knowing that a transaction was attempted in Fiji while you’re in Chicago helps to identify fraud.

- Real-time reviews. Once someone has dined at a restaurant and paid, the transaction alert could be used to solicit a review. This would allow AmEx to create a very powerful competitor to Yelp that avoids two of the biggest data problems with Yelp: it ensures that only verified customers can review a business, and it should increase the volume of data collected by closing the loop and soliciting feedback. (Disclosure: I am short $YELP.) As I’ve written before, transaction data makes AmEx the king of checkins.

- Real-time redemption of Membership Rewards points, AmEx’s loyalty program. When a transaction occurs, the notification could offer consumers the option to pay with points instead of with cash.

- Transaction review data for the blind. The real-time transaction information could be spoken to blind customers, allowing them to verify the transaction amount that was authorized and resolve any issues while they are still at a business instead of after the fact.

The Passbook integration will go live later today.

[Update: AmEx has not yet launched Passbook integration. I will update this story when it has launched.]

[Update: The integration has launched as of Sept. 27. Go to amexpassbook.com on a Passbook-capable device to configure your pass.]

Real-time communication between the consumer and payment networks offers a lot of interesting possibilities. Although today’s move is a small step, it’s an important one that shows how AmEx stays ahead of other card networks.

[aditude-amp id="medium1" targeting='{"env":"staging","page_type":"article","post_id":536153,"post_type":"guest","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,mobile,","session":"D"}']

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More