Ride-sharing darling Lyft has taken a big step toward legitimacy in the eyes of car-free folks and the law with a new partnership.

Today, the company is announcing that it is teaming up with MetLife, a “long-standing leader in the personal auto insurance industry,” as it wrote in an official blog post.

The company’s new partnership will not affect other insurance policies already in place, though Lyft “will be working with MetLife to develop policies for Lyft users,” the company said in an email to VentureBeat.

“This arrangement is designed to help Lyft continue setting the highest standard for trust and safety in peer-to-peer transportation. In the coming months, we will work together with MetLife Auto & Home to develop insurance solutions that further protect Lyft’s drivers and passengers when utilizing this new sharing economy platform,” the company wrote.

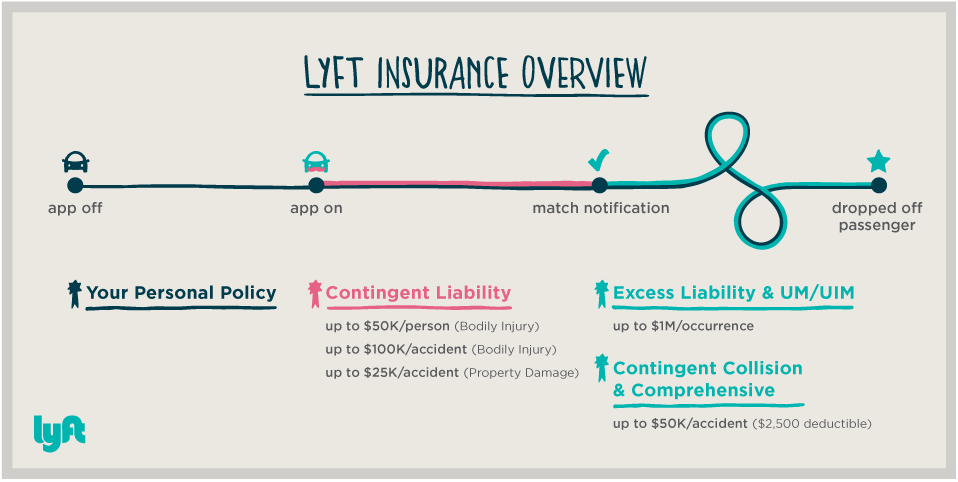

Lyft has had its $1 million liability policy since September 2012, which provides “excess liability protection over a driver’s existing insurance while they are transporting Lyft passengers on a trip arranged through the Lyft platform.”

This new partnership is the latest in Lyft’s ongoing efforts to work with legal and insurance regulations along with its Peer-to-Peer Ridesharing Insurance Coalition and the previously mentioned $1 million liability policy.

There are two main areas this partnership could potentially impact. The first is drivers’ coverage when they are not transporting a passenger. As described by a graphic on Lyft’s blog, drivers are protected by the company’s contingent commercial liability policy when they’re on the clock (i.e. the app is turned on). Once they’ve picked up the passenger, the excess liability policy kicks in to protect them. The new MetLife partnership could yield some extra coverage during the lower-coverage phases.

Back in January, a San Francisco Lyft driver was involved in an accident resulting in an elderly woman fracturing her leg, as we previously reported. The company responded by immediately deactivating the driver’s account while it investigates the incident.

Another area this partnership could impact is the coverage of drivers who do not own the car they drive while working for Lyft.

The recently rebranded Breeze loans cars to people who wish to drive for Lyft or other services but who do not own a car, as we previously reported. According to Breeze, their members simply sign up for personal insurance coverage on their own, which Breeze reimburses them for. The new insurance solutions this partnership will yield could have some implications for these particular drivers despite Lyft not planning on directly working with Breeze and other companies.

Overall, insurance has been the biggest area of concern regarding ride-sharing companies such as Lyft, Uber, and Sidecar. Uber has frequently come under fire due to accidents involving its drivers, so Lyft’s ongoing focus on its own safety and insurance situation is no surprise.