The news of the day in the tech world was once again focused on Apple. Venturebeat has coverage of the new iMacs, Mac minis and MacBooks. However, the main event was the iPad mini.

If you are reading this, then by now you are familiar with the features of the new tablet: its Lightning port, its ultra-thin design, and Jony Ive’s diamond-studded chamfers. However, I think there are some important industry implications for this device and the way it was priced. Last month, I pointed out how difficult the hardware market has become, and the mini looks set to drive that process along.

After years of talking down 7-inch tablets, Apple changed course. What does the company hope to gain? I think the answer is market segmentation. This is one of those “MBA 101” topics: Divide the market into multiple pieces and sell products in each. Apple risks seeing some people who would have bought a larger device opting for the less expensive mini now, but it must believe that it will sell an even larger total number of devices.

I see two pieces to this strategy: one internal to Apple, the second as a major weight on the industry.

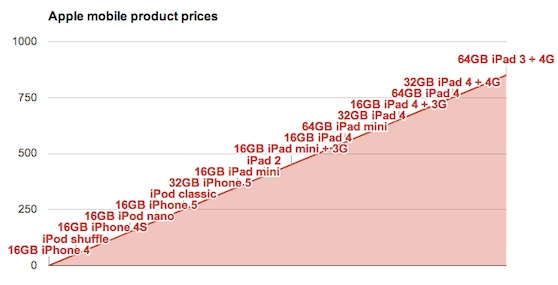

Draw out a number line from $0 to $800, with tick marks every $50, then write down the Apple product at each marker. The new mini fits into several gaps. The base 16 GB mini sits well below the now-discontinued iPad 2, and in between the iPod Touch 32 GB and 64 GB. Put simply, Apple had room for more products here. It risks losing some low-end iPad units and probably some high-end iPod Touch sales, but it has created a whole new category for its offerings.

Apple deserves credit for its originality: After all, it basically invented the smartphone market (yes, Windows Mobile, I remember you). But this does not mean it does not learn from its competitors. It has become clear over the past nine months that there is consumer demand for 5- and 7-inch devices. Samsung, for example, seems to be doing very good business with its seemingly mammoth 5-inch Galaxy Note, a phone that edges into tablet territory. Like many, I was skeptical at first about this product, but it turns out Samsung was onto something. The Note is too big for most people’s pockets, but Samsung has done its homework. It has successfully marketed these devices to women who carry the Note in their purse. I had this point driven home to me last month, when I saw the entire crew from Asiana Airlines Flight 213 in a hotel lobby. All 25 of the flight attendants were carrying 5-inch or larger devices. Amazon and Google have also done well with the Kindle Fire HD and Nexus 7, respectively — although they are ‘doing well’ by a different set of metrics than the iPad.

So Apple saw an opportunity and made its play. It is too early to tell how many minis it will sell, but I think Apple should have a very good Christmas this year.

The same is not true for other hardware makers. For years now, Apple has been effectively capping the prices its competitors can charge. So far, no tablet priced even close to the iPad has done well. The best-selling non-Apple tablets today are all priced at or below $200. Apple products command a premium, that has been true for phones, for tablets, and for laptops for many years. The iPad mini, priced at $329, pushes the prices even further down for everyone else.

When Google launched the Nexus 7, Android management bragged about how little money they were making on the device. That could not have been good news for Google’s hardware partners. Android’s goal is to spread its OS and the Google API as widely as possible. Its hardware partners’ profits seem to be a much lower priority. Amazon, for its part, has charged rock-bottom prices for its tablets, but that is part of its strategy of profiting from selling content, not the hardware itself.

I made some comparisons about the profitability of the various tablets out there. I used iSuppli’s teardowns for estimates of the cost of the iPhone, iPad, Kindle Fire HD and Nexus 7. This is just iSuppli’s estimate, and not everyone agrees, but I think they have a pretty good track record, and are at least close enough. I also made a guess as to the iPad mini’s costs.

By this analysis, it is pretty clear that only Apple is profiting from tablet hardware sales. Amazon may even be losing money.

One interesting fact that comes out of this data is how much we are all paying for memory. This is the one favor Apple has done the industry. Apple charges $100 for each bump in memory. A 16GB iPad Mini is $329, a 32 GB version is $429. The other vendors have mostly followed this pattern. My estimate is that 16 GB of NAND Flash costs about $10, and iSuppli quotes a similar amount. Apple buys so much, it may actually pay even less. That’s a 90 percent gross margin for Apple, comparable to the kinds of margins you ordinarily see for software, i.e. products which have no cost of goods sold. By comparison, most hardware businesses are happy to capture 30 percent gross margins. Apple’s corporate average gross margin is in the 40s.

By my admittedly rough math, almost all the profit Amazon sees on the Kindle or Google/Asus see on the Nexus 7 comes from their mark-up on memory. It will be interesting to see if Apple someday changes its pricing model to make even that slice difficult for its competitors.

Yet even with those healthy memory margins, the other tablet makers do not make much money.

I think this will get even worse. You can now buy a $45 Android tablet in China and an $80 version in the US. This means that even those $200 levels we see today will fade soon. By contrast, Apple has kept prices for its high-end iPads constant.

All of this matters a lot. Apple and Samsung are the only smartphone makers generating a profit today. Market share and revenue look nice in PowerPoint and press releases, but profits are what sustain investment in the future. And there are far fewer of these to go around.

Jay Goldberg is a financial analyst with an investment bank. He has been working with tech companies for ten years. Prior to that he lived and worked in China for almost 10 years. His previous post for VentureBeat was about how hardware is dead.

Top photo: VentureBeat