Mobile platforms are taking over the world, and nothing gets more downloads or makes more money on iOS and Android than video games.

Google’s and Apple’s software platforms have enabled developers of all sizes to get their products in front of customers around the world. This benefits the people making the games, but this is also incredibly important for the platforms and for the hardware that runs them. The truth is that games fuel a great portion of the excitement that people have for their touchscreen devices. On a worldwide basis, games make up 40 percent of all app-store downloads and about 75 percent of app-store spending. That got us wanting to check in on the performance of gaming on iOS and Android around the globe because it seems that as games go, so goes the market.

The longstanding wisdom among the people making games and analyzing how they perform on the markets tells us that while Google’s mobile operating system is growing in terms of market share, iOS still makes developers more money. Is that still true? Is it changing? Is the difference between iOS and Android different depending on the country? We’ve taken a look at the data, and while behavior in the U.S. and the U.K. is similar, it’s wildly different in China.

Before we get into the details, it’s important to know why it’s even worth looking at games and not, say, productivity apps. Games make up a huge portion of revenue on both Android and iOS in just about every market in the world. In Korea, for example, games make up 94 percent of Google Play’s revenue. On iOS in Korea, it’s 79 percent, and the next closest category is music at 4 percent.

Mobile Games Monetization report

176 developers with 1,100 games, 300M downloads, $600M annual revenue tell us what works

While Android makes up 78 percent of the global smartphone market, it only accounts for half the consumer spending of iOS, according to industry-intelligence firm IDC. This is despite that iOS only has an 18 percent market share globally.

How can Android have such a large lead in terms of devices but still fall so far behind in money spent — well, a lot of that comes from where these smartphones are selling.

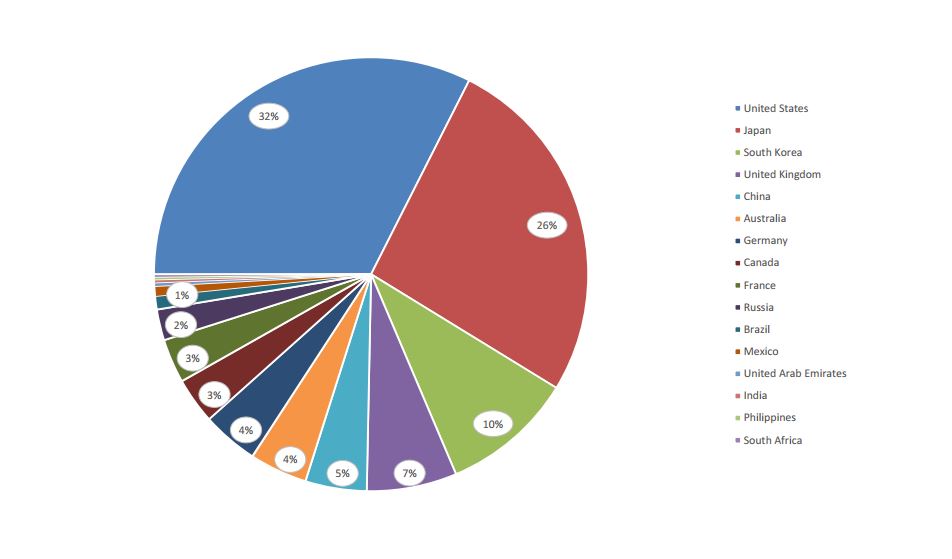

“Both iOS and Google Play are currently strongest in the U.S. as a single country,” App Annie vice president of communication Marcos Sanchez told GamesBeat. “But [the mobile app markets are] stronger in terms of revenue in Asia if you combine all of the territories in that region and compare them against the U.S.”

That’s especially true for Android, and it partially explains why it can have so many users and not make as much money. The average gamer in many Asia-Pacific regions typically has a comparatively limited income and is also less likely to have a credit card. That makes it difficult to convert them into paying customers in premium-priced games or in free-to-play software with in-app purchases. That pattern even extends into North America, where cheap Android phones have found market share with lower-income consumers who might not want — or have — credit for virtual goods. That’s compared to iOS, which is extremely popular with people who bought into the iTunes ecosystem as far back as the early 2000s. Those kinds of consumers already have their credit cards on file with Apple, which greatly reduces the friction that might prevent a consumer from spending. Yesterday, Apple revealed it has 800 million iTunes accounts with 400 million credit cards on file.

Android has started to close the revenue gap, and that’s due to a number of factors. But it still has a lot of ground to make up on iOS.

Now that we’ve laid down some basics, let’s take a look at Android and iOS in the world’s most-important regions.

North America

The battle between iOS and Android in North America reflects the situation in the rest of the world. Hardware running Google’s operating system holds a bigger chunk of the market than Apple’s, but consumers spend a ton more on iOS.

The United States is not only the biggest spender on the continent, it is still the top nation in terms of mobile revenue in the entire world. That’s due to a combination of a high number of people with smartphones and tablets in addition to the amount of money the average player spends.

The current split has Android with more than 50 percent of the U.S. smartphone market, according to industry-research firm Kantar. Apple’s OS has nearly 44 percent. That’s actually a lot closer than in most countries.

Apple’s App Store makes more than Google Play in the U.S. by a 3-to-1 margin. It’s actually worse than that. The iPhone and iPad specific slices of the App Store, which App Annie tracks separately, both generate more spending than Google Play does as a whole.

That’s not because Android owners don’t like apps. Google Play customers download more apps than iOS users.

No, the reason is likely that aforementioned credit card issue. Those longtime iTunes customers, many of whom have spent tons of cash on their music collections, are not likely to hesitate to drop a buck on a game every once in a while. We see that reflected in how the business models break down between the two platforms in the U.S.

Both platforms make most of their gaming revenue from free-to-play games that sell in-app microtransactions. These are your Clash of Clans-style releases that don’t charge anything up front but spend months at the top of the highest-grossing list.

The difference is that iOS still makes 7 percent of its revenue from premium-priced apps (mostly games) and another 7 percent from paid apps that also include microtransactions. On Android, those numbers are only 4 percent and 2 percent, respectively.

That might not like seem like a huge gap, but it reveals that more people on iOS are willing to spend money on games upfront. This likely explains why casual-game developers, like FarmVille maker Zynga, no longer hesitate to release their free-to-play titles on both platforms simultaneously while more traditional, premium priced titles hit iOS long before an Android version does.

In recent weeks, developers have released games like R.B.I. Baseball 14, Hitman Go, and FTL: Faster Than Light on iOS but not Android.

Is Android catching up? Yes. Definitely. App Annie found that spending is growing faster on Google Play than it is on the App Store, but — for now — developers and gamers are all having a better experience with iOS than Android if only do to the spending and release disparity.

Canada and Mexico

While the U.S. is the big market, Canada plays an interesting role in the territory. Publishers often test their games out in Canada as part of a limited soft launch. Most recently, World of Warcraft developer Blizzard launched its new collectible-card game Hearthstone in Canada (and Australia and New Zealand) a few weeks before unleashing it worldwide.

As for Mexico, it is one of the world’s rising stars. While U.S. is No. 1 for spending and Canada is No. 8, the southern-most part of the continent is No. 23. It is often called out as one of a handful of “growth markets” by industry observers.

Asia-Pacific

China

This country is an interesting conundrum. It has a $1.8 billion mobile gaming industry, but Google doesn’t have an official software market presence.

“Google Play doesn’t exist in China,” Chukong Technologies U.S. general manager Lei Zhang told GamesBeat. “That’s the biggest difference between the Android platform in the Chinese market and in the Western world.”

Chukong is responsible for casual games like Fishing Joy, which is one of China’s top-grossing apps.

Google Play’s absence doesn’t mean China is primarily iOS. Android devices have a 73 percent market share compared to Apple’s 23 percent. The difference is that all of those Google-based devices are running more than two dozen different proprietary app markets. This makes it extremely complex for Western developers looking to release their games there.

Even if a developer were to navigate the plethora of Android stores, China has another layer of complexity that is crucially important to success on mobile. Like in the rest of Asia, the Chinese discover most of their new games through messaging apps. Companies like Tencent, with its WeChat text-messaging service, have hundreds of millions of users, and it makes tons of money by taking a slice of the revenue from games.

“We estimate that about 20 percent to 30 percent of the total revenue for the Chinese mobile-gaming space this year will be from WeChat,” said Zhang. “That’s how big this one single platform is in the market.”

As big as WeChat is, Tencent picks and choose the games it releases on the service. You just can’t come along and take advantage of this infrastructure.

That means developers in China who aren’t on Tencent and WeChat need to do the legwork to get into the various Android stores.

“Developers can work with stores directly or through a publisher like us,” said Zhang. “The overall strategy is to have an ultrabroad distribution that covers all of the Android channels.”

The other half of the strategy is carrier billing.

Unlike in the United States, where consumers have more Android devices but spend more on iOS, the Chinese spend between 70 percent and 80 percent of mobile revenue on the Google operating system. That’s because the Chinese have access to and use carrier billing.

“About two years ago, we started carrier billing for smartphone games in China,” said Zhang. “And that saw a huge pickup in spending. Fishing Joy became the highest-grossing mobile game at the time. We enjoyed an extensive revenue pickup on the Android side in China.”

With this business model, consumers don’t need a credit card. It creates a easy payment process that has boosted the number of people who now pay for virtual goods in games.

It isn’t perfect, however, due to a cap that most carriers place on that type of billing. Per transaction, and sometimes per day, mobile companies will cut customers off after $5. That’s OK for social and mobile games, typically, but some releases have microtransactions that are worth $30 to $50. Carrier billing simply won’t work with that.

In games that rely more on bigger purchases, iOS often performs better than Android. Apple has also made a deal with China Mobile to get the App Store running there last year. This means the technology company is actually seeing software generate revenue, unlike Google.

“iOS revenue grew around 70 percent quarter-over-quarter from Q4 2013,” said Sanchez. “There is clearly growing demand for iOS there.”

Japan, Korea, and the rest of Asia

While China is big and convoluted, Japan is actually a more important region right now. Sure, the U.S. is the biggest in terms of revenue, but Japan is No. 2.

That’s because consumers in Japan spend much more than those in any other region. In a study from earlier this year, research firm Distimo found that developers make an average revenue per download (ARPD) of $6.34 in Japan. That’s more than twice the $2.52 APRD in the States. At the same time, Japan also has one of the lowest player acquisition costs. Distimo found the average cost per install is only $1.86 in Japan. That’s extraordinarily low — especially when you compare it to the ARPD.

That’s why Western developers like King and Supercell have zeroed in on that market. King is currently running a second batch of TV commercials for its Candy Crush Saga mobile puzzler featuring Japanese celebrities. The studio even just opened an office in Tokyo that will work specifically on squeezing the most out of Japan’s big spenders.

And between iOS and Android, Google’s OS is the bigger winner, as it makes up more than 50 percent of smartphone spending in Japan.

Korea is even more heavily weighed in Android’s favor. More than 80 percent of the app-market revenue in that country comes from Google Play. That’s primarily because Korea is the home of hugely successful Android vendor Samsung.

South Korea is also the fastest-growing mobile market as its revenue grew by around 900 percent from 2012 to 2013. Japan and China are No. 2 and No. 3 on that list, respectively.

As in China, messaging apps dominate in Japan and Korea. Line has 175 million users around the world, and many of those live in Japan. Meanwhile, Kakao rules Korea, and it has 140 million users around the world.

Europe

The U.K. is one of the countries with the highest revenue potential, according to Distimo. It has a high average revenue per download at $2.33, and its average cost to acquire a new player is only $1.86.

The country is pretty into iOS. Google Play doesn’t even account for a quarter of the revenue. Many gamers in England spend a lot of time and money on soccer-related releases like Football Manager Handheld 2014 on their iPhones and iPads. That Sega-published coaching simulator makes 65 percent of its total cash in the U.K.

Other territories, like France and Germany, are growing as well.

“We’ve definitely seen significant growth for Europe both from an audience-monetization and publisher-success point of view,” said Sanchez. “Germany and the U.K. are both very strong in terms of revenue for iOS and Google Play, and the two top iOS game publishers by revenue — King and Supercell — are both based in Europe.”

The big issue with Europe is that geography and language break it into tiny fragments. That means it requires significantly more work to localize and optimize a game for the several different countries of Europe compared to simply releasing a game in the U.S.

“In Japan, Korea, and China, games are tailored specifically to each market since they are particularly large,” said Sanchez. “Publishers seeking wide international audiences tend to focus on the US and English-speaking markets, as this gives them a much broader reach. As a consequence, there are not many games that are tailored to the non-English speaking European markets.”

The future

Android and iOS look like they will continue to battle it out all around the world, and gaming will likely always play a big role in that. In fact, as more nations start adopting smartphones, the importance of interactive entertainment will only expand.

In 2013, countries like Brazil and Russia emerged as potential mobile-gaming superpowers. On Google Play in 2013, Brazil was No. 2 in terms of total downloads while Russia was No. 3. Despite that, neither charted near the top in terms of spending, but these are the markets of tomorrow, and they seem like they’re on an Android path as each country ranks much lower on iOS’s top-downloads list.

“For Africa, we noted in the Q1 Market Index a rise in iOS revenue in South Africa, where revenue has really taken off in the last few months,” said Sanchez. “In many other African nations, device adoption is likely to lag behind due to economic circumstances, and they are therefore not likely to be major markets at this stage.”

So, who’s really winning?

Brazil, Russia, and China (the BRC in “BRIC nations”) are the next major markets, and Android — with its variety of inexpensive handsets — has an advantage in places like that compared to Apple’s pricier offerings.

Google’s Android might have a bright future, but that doesn’t mean iOS doesn’t. As long as established markets like the U.S. keep making iOS developers more money, you can expect that the content will keep flowing toward Apple first.

So when it comes down to who is winning between Apple and Google when it comes to games. That answer is perhaps a bit too complex and ever-changing. What’s clear is that developers have a pair of legitimate platforms to release content on, and gamers — with a few exceptions — can’t go wrong when choosing between the two.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=cbcb43f4-d91e-4983-9e43-df43f8c282dd)