Telcom AT&T may divest a significantly larger portion of assets to ensure that the company’s merger with T-Mobile is completed, according to a Bloomberg report that cites unnamed people familiar with the matter.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":357742,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,entrepreneur,mobile,","session":"D"}']AT&T and Deutsche Telekom first announced plans for AT&T to acquire T-Mobile USA for $39 billion in March 2011. T-Mobile, which is the fourth largest wireless carrier, has struggled to compete against Verizon, AT&T and Sprint. So, selling to a competitor for a large sum is an attractive option, while AT&T is interested in swallowing up T-Mobile to improve its wireless network infrastructure.

It’s unknown exactly what AT&T is willing to sell off to ensure the merger still happens, but it could be as much as 40 percent of T-Mobile USA’s assets, according to Bloomberg’s report. It’s thought that a divestiture of this size could change the minds of the Department of Justice. Since lack of competition in the wireless carrier market is a main concern of regulators, I’m not really sure how effective AT&T will be.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

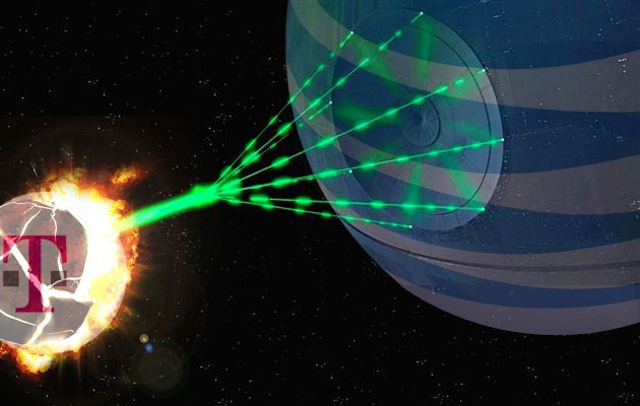

The merger has faced plenty of criticism, which led the companies to withdraw their application for the sale from the Federal Communications Commission on Thursday. In September, Attorney Generals from seven U.S. states joined the DOJ in filing a federal lawsuit against the merger. More recently, the FCC announced that it’s seeking a hearing on the merger before giving it approval. The deal also faces a lawsuit by third-largest wireless carrier Sprint on the grounds that it would eliminate competition.

[Image via Android NewsPad]

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More