U.S. Bank, the country’s fifth largest bank, will be the first major bank to use a new breed of secure and cheap online payment system. If it becomes widely accepted, it could grease the skids of electronic commerce.

U.S. Bank, the country’s fifth largest bank, will be the first major bank to use a new breed of secure and cheap online payment system. If it becomes widely accepted, it could grease the skids of electronic commerce.

Developed by NACHA, a secure online payments association, the Secure Vault Payments system can be used to link consumers to their financial institutions via merchants and billers. The payments startup eWise serves as the exclusive network provider for the system.

Businesses can use the system for real-time authorization of funds transfers with payment guarantees at a lower cost than is available with current payment systems. For consumers, there is no need for credit checks, sign-ups, approval process, and extra fees.

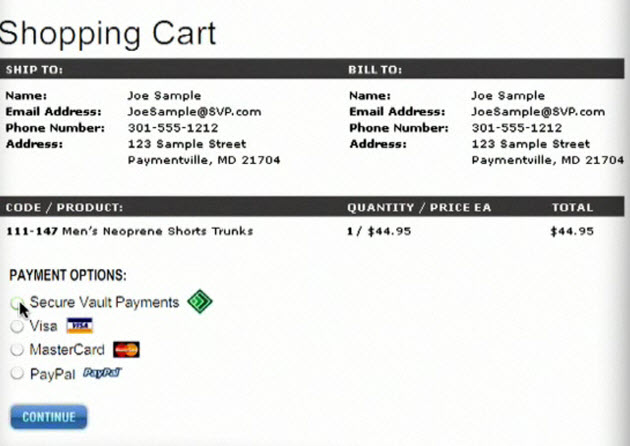

With the new system, consumers initiate payments on a merchant’s or biller’s web site and are automatically redirected to their own bank’s online banking platform. They can choose which bank account they want to use to make the payment. Then they are returned to the merchant or biller’s site, where they get a payment confirmation.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

During the process, the banks can authenticate the consumer and provide the business with a real-time authorization and confirmation of payment. The consumer benefits by not having to share any financial account information with the merchant or biller, adding a new measure of security to online transactions. The merchant and biller do not have to securely store payer account information, said Jeff Jones, executive vice president at U.S. Bank.

A key part of the system is eWise, the exclusive network provider and creator of the online banking electronic payments platform (OBeP). NACHA participated as part of a drive to reduce paper checks and increase the use of the ACH electronic network, which links every financial institution in the nation.

A key part of the system is eWise, the exclusive network provider and creator of the online banking electronic payments platform (OBeP). NACHA participated as part of a drive to reduce paper checks and increase the use of the ACH electronic network, which links every financial institution in the nation.

The deal with U.S. Bank is an important one for NACHA, which is also signing up other partners to provide the Secure Vault Payments, said NACHA president and chief executive Janet Estep. NACHA has more than 11,000 financial institutions as members.

Alex Grinberg, chief executive of eWise, said the company is working closely with U.S. Bank to make sure the system is successful. The system has been in the works for the past 18 months. In a pilot test with the University of Georgia, about 17 percent of students are using Secure Vault Payments to pay their tuition, and 48 percent of users have used it more than five times.

eWise was founded in 1999 and has 50 employees. It has been working with NACHA on Secure Vault Payments for several years. Rivals include PayPal and a number of smaller startups. eWise has raised $12.1 million from Balderton Capital, Total Technology Ventures and Stanley S. Shuman of Allen & Co.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More