No, Barnes & Noble will not be split into one company named Barnes and another called Noble.

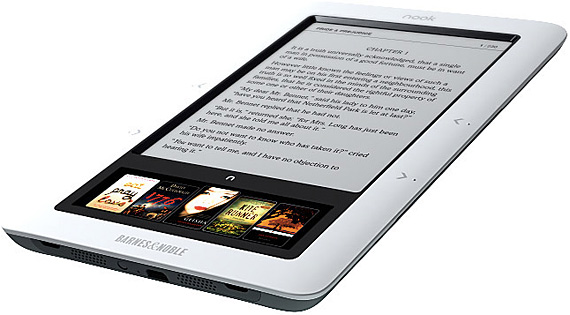

Instead, there will be the B&N retail business and the separate Nook Media business, as VentureBeat reported earlier today. (B&N Retail encompasses the book store and BN.com. Nook Media had been a B&N subsidiary, and it includes the Nook line of devices, the online bookstore, e-content publishing, and college businesses.)

“The businesses have different profiles,” CEO Mike Huseby told VentureBeat today.

“Retail is more predictable and [can be] a cash generating machine,” he said. “College is poised for significant growth and is open to the capital markets, [and] Nook is a business that’s changing, and that we’re trying to turn around.”

The separation announcement was included in the Q4 and year-end report, in which Nook’s revenues dropped 22 percent compared to the same quarter a year ago, and 35 percent over fiscal 2014. In December, the company said it was re-evaluating its tablets.

The separation, Huseby told us, can provide “a more focused management.” While there are “usually separate boards and separate management,” he said the company is still working out the degree of overlap in management or resources, with the goal being “to try to have this completed by the end of first quarter of next year.”

‘A very challenged place’

“I have to imagine that Barnes & Noble has been unable to find a buyer for the Nook division,” Forrester VP and principal analyst James McQuivey told us.

“Certainly a sell-off is a better option for the company than going through the hassle of establishing a publicly traded company that also happens to be in a very challenged place financially,” he said. “But apparently the retail side of the house wants to be free of what it perceives as a problematic corporate sibling,” which could “make the retail Barnes & Noble more attractive for investors interested in the longevity of the brand.”

But, he predicted, “Nook isn’t likely going to be with us for very long, not unless a buyer steps forward and tries to do something interesting with it.”

Ross Rubin, principal analyst with industry research Reticle Research, pointed out to us that “Sony sold off its e-reader business to Kobo,” because it, like B&N, wasn’t seeing “the kind of synergy” it expected.

B&N, he noted, “doesn’t want to be in the hardware business.” Likewise, B&N did exactly that last month with the announcement that Nook software will be pre-installed on Samsung Galaxy Tab 4 tablets. They will be co-branded as Samsung Galaxy Tab 4 Nooks and sold in Barnes & Noble stores.

When Nook e-book reader was introduced in late 2009, it was beset by so many issues it seemed a classic of a troubled launch. The company worked to fix its most glaring problems, but couldn’t quite get it to the point where it could challenge the innovations coming from Apple, Samsung, Amazon, and Microsoft.

“Amazon’s success in the tablet space is driven by its vast ecosystem of digital content that make its Fire tablets a compelling choice,” Parks Associates research analyst Tejas Mehta told VentureBeat. B&N’s content ecoystems, he added, have been “dwarfed by the sheer size of content ecosystems of competitors like Apple and Amazon.”

B&N had “few options left,” Mehta said.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More