Today, large companies are creating innovation outposts in innovation clusters like Silicon Valley in order to tap into the clusters’ innovation ecosystems.

These corporate innovation outposts monitor Silicon Valley for new innovative technologies and/or companies (as emerging threats or potential tools for disruption) and then take advantage of these innovations by creating new products or investing in startups.

Most CEOs assign the responsibility to establish and manage their innovation outposts (and the outpost’s relationships to startups) to their R&D organizations. While that avoids internal management conflict, it’s the wrong way to make an innovation outpost decision.

Instead CEOs and their exec staff should start with a high-level discussion to decide whether their companies should even establish an innovation outpost, whether in Silicon Valley or some other innovation ecosystem. Because this is a critical decision that requires broad management buy-in, the conversation should include senior management, particularly the Chief Digital Officer, the Chief Strategy Officer, the Chief Financial Officer, and the Head of R&D, and maybe even the board of directors.

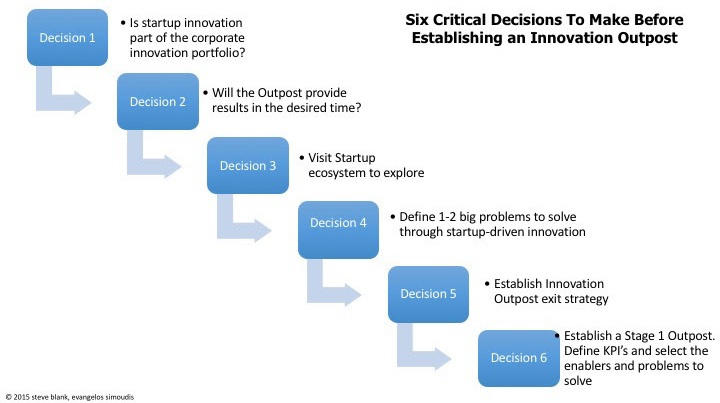

This group needs to carefully consider six key questions to understand if and where an innovation outpost makes sense for their company.

1. Do we believe “startup-driven” innovation (innovation that comes from relationships with external, early-stage companies) should be part of the corporate innovation portfolio?

Including “startup-driven” in the corporate portfolio may make sense if a company:

- Is being disrupted now, as is happening in many IT, print, retail, and telecommunications corporations

- Anticipates being disrupted in the near future, as is the case in the automotive and chemical industries

- Cannot keep up with the pace of innovation in its industry, as is happening in the pharmaceutical, financial services, and consumer packaged goods industries

- Wants to promote intrapreneurship to extend its business model and retain creative employees like Google, Amazon, and Facebook do

2. What is the timeline to ROI and the amount of risk we are willing to assume? Will an innovation outpost provide results at the speed we need?

An innovation outpost focused on the sense and respond model (see post) will best work for a company when:

- A disruption has not already happened or is not imminent. In other words, the disruption is expected to happen within 5+ years.

- A disruption does not present an existential threat to the corporation, and it can be addressed with a relatively modest investment required to establish and expand an outpost rather than the large investments required for corporate moonshots, e.g., IBM’s Watson. (We’ll cover “corporate moonshots” in a subsequent post.)

- Startups are developing IP relevant to the disruption.

Acquiring a growth-stage private startup can provide a faster ROI at lower risk than the acquisition of an early-stage startup. For example, Google’s acquisition of Nest (which had customers, revenue, and a distribution channel) allowed it to enter the connected home market immediately. In contrast, Facebook’s acquisition of virtual reality hardware company Oculus still requires significant product development and identification of a viable business model – and the target market and revenue may never materialize.

If the innovation threats the company faces do not match these, the corporation may need a different approach to addressing the disruption such as making a large scale acquisition, e.g., VMWare’s acquisition of Nicira, merger, or outright selling itself, e.g., EMC’s sale to Dell.

3. What would be the charter for our innovation outpost?

Senior managers should define the 1-2 big strategic problems that can be addressed through a day-to-day presence in the innovation ecosystem. These challenges may be either strategic or tactical. For example, one of Verizon’s strategic innovation goals for its Silicon Valley organization is to create disruptive solutions (technologies and business models) to monetize the digital media its subscribers access on their mobile devices.

In the process of defining the challenges and goals for an innovation outpost, a company must understand why these can be addressed in a particular innovation ecosystem. They may require the utilization of technologies that are prevalent in the ecosystem (big data or 3D printing) or specialized business models (on-demand services) or specific innovation practices (design thinking and lean startup) or the development of a particular type of partner ecosystem (IBM’s Watson partner ecosystem).

Identifying these strategic problems enables the corporation to decide on the location of the innovation outpost, define success, and decide on the innovation KPIs that will be used to measure progress.

4. How quickly can we get out of the building to explore and validate the ecosystem?

Before committing to a particular innovation ecosystem, the CEO and exec staff need to get out of the building and visit the ecosystem to be assured that the reality on the ground matches the corporation’s innovation challenges. These visits should be led by the CEO and maybe even include the corporation’s board of directors, along with execs who are expected to be innovation change agents. This exploration requires a deeper understanding than can be accomplished in a single visit.

While the default for most innovation outposts is Silicon Valley, it may not necessarily be the best fit for a particular company. Visiting the Valley might help an exec staff understand whether this innovation ecosystem would be right for them. For example, CVS opened its Digital Innovation Lab in Boston as did John Hancock, while Thomson Reuters picked both Boston and Waterloo, Canada, and Coca-Cola has its Bridge Innovation Lab in Tel Aviv. Exploration may require several visits to each of the innovation ecosystems of interest to pick the right one.

5. What is our company’s strategy for successfully integrating an innovation outpost?

Innovation outposts most often fail when they come up with innovations no operating division wants and/or the company refuses to fund. (The ghosts of Xerox’s failure to adopt its innovation outpost inventions that became the Apple Macintosh still haunt innovation outposts.) There needs to be prior agreement on what happens if the division develops disruptive products that do not fit the existing company business model. Does it become a new division? Does it get spun out? Sold?

6. How do we establish the innovation outpost and staff the innovation enabling group(s) that will be part of the first phase of the outpost?

Establishing an outpost enables innovation but does not constitute innovation. Once a company has decided to open an innovation outpost, it has to choose:

- How to leverage startup innovation in the cluster – will the outpost invest, partner, acquire, incubate, or invent?

- What is the timeline to a ROI for innovation outpost? Again, the participation of the senior executives in these decisions is critical.

The complete six-step decision process is shown in the figure below.

Stay tuned for a future post outlining how to establish an innovation outpost.

Lessons Learned:

- To avoid “innovation theater,” corporations should use a step-by-step decision process to determine the role the innovation outpost will play

- The decision to establish (and later expand) an innovation outpost must be taken by the CEO working with the senior management team

- It requires hands-on management by the CEO and the senior executive team

- Just saying it has “executive support” means it’s dead-on-arrival

- If the innovation outpost is successful, it will almost certainly conflict with other corporate innovation-related decisions.

- Just establishing an innovation outpost doesn’t mean that the corporation is innovating

- At first it just means there’s a new building

Steve Blank is a retired serial entrepreneur-turned-educator who has changed how startups are built and how entrepreneurship is taught. He created the Customer Development methodology that launched the lean startup movement, and wrote about the process in his first book, The Four Steps to the Epiphany. His second book, The Startup Owner’s Manual, is a step-by-step guide to building a successful company. Blank teaches the Customer Development methodology in his Lean LaunchPad classes at Stanford University, U.C. Berkeley, Columbia University, UCSF, NYU, the National Science Foundation and the I-Corps @NIH. He writes regularly about entrepreneurship at www.steveblank.com.

Evangelos Simoudis is founder and managing director of Corporate Innovation Ventures. Evangelos has worked in Silicon Valley as a technologist, entrepreneur, corporate executive, and VC. Today, he advises global corporations on startup-driven innovation and big data strategies, and invests in early-stage startups working on big data applications. He writes and speaks frequently on corporate innovation, big data, cloud computing, and digital marketing platforms. In 2014, he was named a Power Player in Digital Media, and in 2012 as a top investor in online advertising. He writes regularly on these topics at www.corporateinnovation.co

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More