In recent weeks, we’ve been hearing rumors that companies are canceling their mobile display advertising budgets. But when we looked into it, we found that overall demand for mobile display advertising is actually increasing.

What we’ve started seeing over the last few months is that advertisers increasingly buy ads based on experience they gained testing the medium in recent months. The main driver appears to be successes brand companies have had particularly with iPhone users. This upwards trend has a good shot to continue next year, even though the full effects of the downturn have clearly yet to play out.

Based on feedback from a number of interviews we’ve done, the types of businesses that tend to spend most frequently on mobile display advertising are mobile content companies and what interviewees label “brand advertisers” (non-mobile brand-name advertisers) primarily in four industries: TV and Hollywood, car manufacturers and dealerships, retailers, and financial services companies.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

Mobile content companies have experience with mobile ads, and tend to base their campaigns on that experience.

The spending in the other categories has mostly come from experimental budgets, which can be considered speculative. In recent weeks, however, the results from these tests came back favorable enough that some brands have decided to grow their budgets. We talked to a couple of brand agencies who showed us some case studies, though they requested we not publish any of the studies for confidentiality purposes. You can find some good case studies at the website Mobile Marketer, though.

Here’s a quick overview of the categories, and the sort of campaigns we’re seeing in each:

Mobile content: The bulk of mobile advertising — 40 to 50 percent, according to interviewees — comes from this category. We can break the category into two subgroups. First, there are ringtones/realtones/ringbacks, themes, wallpapers, videos and games companies, including Thumbplay, Zedge and Jamba. Second, there are companies looking for traffic, such as mobile social network eBuddy. In this category, click-to-action/cost-per-click deals are very frequent, while they tend to be less frequent in the other categories.

TV/Hollywood: A typical ad in this category shows the time and venue of a television event or movie, possibly with a link to a downloadable trailer. Brand ads signaling that a particular movie or series “is out now” are frequent, too. Companies like CBS and ESPN show the ads often as part of larger campaigns across different media like online and TV.

Car manufacturers and dealerships: This category includes mobile sites for product launches of a new car — the Ford Flex site, for example. The site features a photo gallery, videos, wallpaper and ringtone downloads, a sign-up portal for SMS alerts and a send-to-a-friend feature. The category also includes dealer locaters used to generate leads.

Retail: Lead-generation approaches are also quite popular in retail. Additionally, these ads address a consumer’s need to comparative shop. For example, take a look at the RadioShack ad below. It makes you aware of what you can do (research, compare, buy) and why you should specifically choose Radio Shack (most trusted).

Financial services: In this category, the most common ads are about raising awareness and usage of a service.

Yankee Group’s Linda Barrabee estimated the size of the overall mobile ad market at $100 million and so did we. One of the biggest players in mobile display advertising is Admob. The company is on target to rake in $42 million in revenue, as we reported five months ago. But some of our readers took issue with that projection. One said it looked more like $7 million annually. The reader assumed that Admob had 5.1 billion impressions served in September 2008, a blended effective cost per mille more in the $.25 range to publishers, and that Admob got a 50 percent revenue share from its advertisers. When we asked Admob’s Jason Spero to respond to this calculation, he said that the estimated $.25 is wrong, and that the company’s actual eCPM is “way higher”.

Future ad spending trends

Let’s take a closer look at the recent trend toward higher mobile ad budgets. In our interviews we found a variety of new drivers among advertisers whose main goal is branding. In addition to witnessing success stories on the iPhone, these advertisers are reacting to the overall rise in the use of the mobile web and to efforts by high-profile ad networks (Nokia, Yahoo, AOL, Google) to snag new business from branding campaigns.

Let’s get back to that iPhone effect for a moment. In the case studies shown to us, mobile display advertising had the most impact on iPhone users. Even if just 5 percent of users exposed to an ad were iPhone users, 45 percent of all responses came from that segment. So advertising will no doubt benefit from the impending rise of next-generation smartphones.

“The iPhone market is exploding,” Spero said. “Inventory is growing and advertisers are hungry for it. It’s mainly apps using CPC ads to drive downloads and brand advertisers eager to reach iPhone users.”

But how broad-reaching is the iPhone effect? In the studies we looked at, advertisers cited a multitude of reasons for not jumping into mobile marketing. Some believe that mobile is an “inappropriate” channel for their product or target audience; some cite a lack of resources to develop mobile advertising strategy; and others talk about their lack of understanding of mobile and the limited reach they can achieve with that advertising.

One indicator of progress is that advertisers we surveyed seem pleased with the quality of the inventory, including the US, since the second quarter of this year. Millenial Media, Quattro Wireless and Admob were often cited as providing “quality inventory.” Previously I’ve repeatedly heard complaints from advertisers that there is not enough quality traffic (for example New York Times) in the regions they prefer to advertise (US, Europe).

The interviews we conducted seem to bear out that effectively executing mobile ads is pretty difficult, and there are only a few agencies out there that can do it properly. “It’s not about selling inventory, it’s about selling programs,” said Adinfuse’s Brian Cowley. “Advertisers are overloaded with digital inventory — it’s too much out there. So the challenge is about providing solutions to advertisers. There’s the gap. Certain companies that figure that out will create value.”

Paul Cheng of mobile marketing firm Velti told us that “for the industry to grow further” one of the top challenges will be “to make the value chain easier for advertisers.”

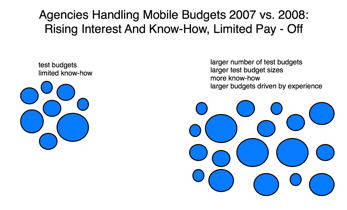

Here’s another key sign of evolution of the industry: In 2007, our interviewees believed that brand agencies had only limited know-how to take advantage of mobile. At that time only five or six brand agencies were equipped to handle the associated challenges. Brands tested mobile display advertising using more expendable experimental budgets.

In 2008 the amount of brands testing mobile advertising increased. There are probably more than 30 brand agencies with the necessary expertise, our interviewees told us. That know-how includes being able to advise a client on what mobile can do for its brand, develop a brand strategy within their overall strategy, and drill down to how a particular campaign should look and be measured. It also means having the relevant experience and the right people to set up and manage mobile campaigns, including relationships with ad networks and other stakeholders. Many ad networks also got that kind of expertise.

Advertisers that connected with competent brand agencies and ad networks were much more likely to garner good enough results to consider upping their mobile budgets.

Two types of advertising tactics yield particularly good results, our interviewees agreed. Direct response campaigns run by mobile content companies bring in strong business. Also, multi-channel mixed campaigns for events and selected products build quality brand awareness. My impression is that it’s particularly the brands that profited from these approaches in recent months that are increasing their budgets today.

As Maria Mandel of marketing firm Ogilvy told us, “Mobile works — the challenge for advertisers is to start spending more in the space and for more consumers to arrive.”

Downturn effect yet to come?

Admittedly, midway through our research, we started to hear news about the downturn putting a damper on mobile advertising — rumored budget cuts, for instance. At the Mobile 2.0 conference at the beginning of November, two of Admob’s publishers told me that the company’s fill rate is supposedly falling, a likely fact despite the mobile advertising panelists’ positive outlook. Moconews reported in October that “evidence is surfacing that big brands are cutting back on their mobile ad buys, which will make AdMob’s job more difficult since it already doesn’t have enough ad inventory to fill every request coming from publishers … a trend that may only increase as we head towards a recession.”

Admob’s Jason Spero and Bango’s Anil Malhotra disagree. Says Spero:

AdMob has secured upfronts in the million dollar range for 2009, which is a first for mobile. We also have advertisers telling us they have budgeted multiple millions of dollars for mobile in 2009 — also a first we believe. These are both strong signs for the industry.

We here at Admob have not witnessed any cancellations of campaigns from brands or agencies firsthand. Zero. In one case a campaign got pushed back from November to December because the iPhone app component (the payoff of the campaign) was late. That wasn’t the economy’s fault. We’ve been working with agencies to plan 2009 budgets for a while now — and we see them on the rise. We hear across the board that advertisers are increasing their spends in measurable media where they can quantify ROI. I spoke to a national agency Thursday that expects to have five of its customers active in mobile in 2009, up from two that were active in 2008. As marketers learn to leverage this new space, they are going to spend more and bring more clients on board.

Our fill rate has ranged from 70 to 98 percent over the last six months. We were at 86.6 percent globally and 93.4 percent in the U.S. for October (see metrics report attached). These are normal levels, and our network is seeing a healthy balance of supply and demand. Note also that we have maintained our fill rate while our network has grown explosively. Growing ad dollars are flowing through the AdMob network. We have seen some of the WAP and xHTML focused advertisers slow down to 75 percent of their normal budgets. They seem to be playing it safe like everyone else. But they have been readily replaced by new iPhone spenders.

Many of our advertisers (both brand and direct response) are basing their entire spend on hard calculations. They are measuring conversions to calls, store locator lookups, video views, email captures and much more. They are also gauging engagement (page views) on landing pages and actively comparing different sources of traffic to see which ads perform best. It all points to the conclusion that mobile advertising works — moving users that much closer to making a purchase (which is pretty much what effective marketing is all about).”

Bango’s Malhotra said fundamentally mobile advertising reflects the growth of mobile commerce which is doing increasingly well: “For mobile advertising to work, mobile commerce needs to work. The bulk messaging market is very well served and growing. Just look at the growing numbers of mblox, openmarket or mx telecom which are an indicator for mobile transactions and therefore content purchase. Also, a webstyle experience of buying which is particularly important in the US market has been growing as our recent releases have shown.”

On the other hand, some interviewees warned that the brunt of the downturn has yet to hit.

One brand agency believes that smartphone uptake is slowing down and will continue to do so as users have less money to updgrade their devices and data plans. That view was shared by another such agency, which advised that, as the economy goes further south, mobile budgets will be the first to be cut — “just as it happened with the Internet in 2001” (an opinion expressed by another agency in a recent Financial Times article).

A product manager from a large publisher spoke to me about this extensively. He believes mobile budgets will be the first to go at companies like his because mobile is still considered a rather lowly form of advertising. Cutting this spending will cause the least organizational pain. Managing mobile ad budgets is usually a part-time role for one employee. In the internal hierarchy these people fall under online marketing and can easily be redistributed. Even if the results from mobile campaigns are positive, they are often still too unimportant in the grand scheme of things. Moconews recently reported that UK Broadcaster Channel 4 abandoned mobile ads as part of the general restructuring of its interactive advertising division. One of the leaders in the mobile content space, Thumbplay, also recently trimmed its headcount to prepare for a prolonged economic downturn.

I guess we’ll just have to wait and see in the months to come if another downturn effect shows. For now the upwards trend in mobile display advertising has a good shot to continue next year behind the industries’ increasingly good fundamentals.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More