Struggling handset manufacturer BlackBerry on Friday released its third-quarter earnings results, which pundits largely chalked up as a big win. Losses, at three cents a share, were milder than the analyst-anticipated 14-cent drop.

It was an eagerly awaited update, revealing sales numbers for BlackBerry’s buzz-generating Priv smartphone — the company’s first to run Google’s Android. But during the call, there was a disconnect between the optimistic note CEO John Chen struck, and the actual data contained in (and conspicuously omitted from) the report.

“My first goal is to get us into a break-even position with the device business, because you really couldn’t do anything strategically with a business that continues to lose money,” said Chen, as reported by Re/code. “We’re in that ballpark now.”

Sounds like, in its first month of sales (only 22 days, from November 6 – 28), Blackberry’s Priv was a runaway hit — something we’d heard soon after launch through scattered reports of quick sellouts and limited availability.

Conflicting information

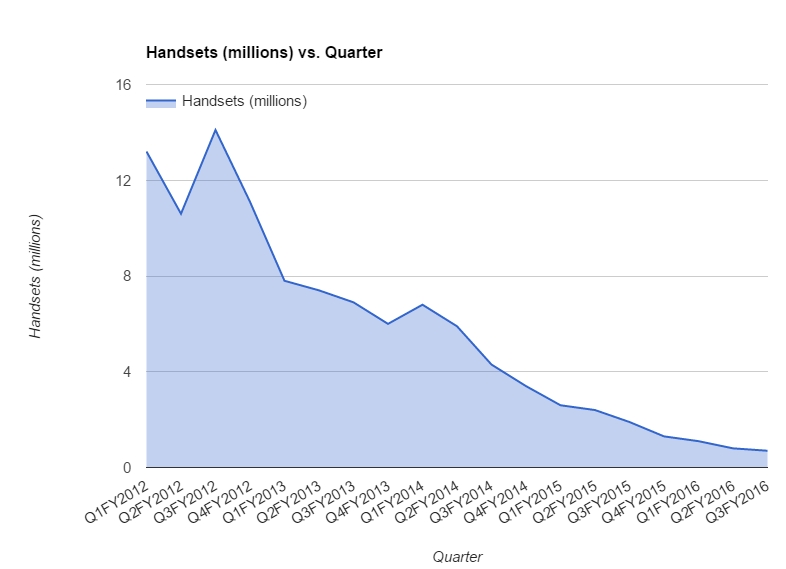

But if Blackberry’s hardware division is really riding Priv’s coattails so successfully, why was this the first time in at least 19 quarters — dating back to 2012 — that BlackBerry didn’t break out device sales figures to lead its press release?

Possibly that’s because the company sold fewer total handsets last quarter than it ever has before: just 700,000. (Some sources are citing that figure as the number of Privs sold, but we verified the number with BlackBerry.)

That means Blackberry sold just a hair over 2.5 million handsets during the first three fiscal quarters of 2016. Despite Chen’s assertion yesterday that the hardware division would attain profitability in the next quarter or two, he told The Verge back in October that the break even number was around five million devices annually.

To hit that figure by the end of its fiscal year, BlackBerry has to sell more phones in Q4 than it’s been able to do since Q1/Q2 of last fiscal year — and it needs to break a streak of 10 consecutive declining quarters (which stretches to 16 if you ignore a slight uptick in sales between late 2013 and early 2014).

The caveat

To be fair to BlackBerry, let’s make two things clear: First, Priv hasn’t had much time at all to impact sales figures. Despite the tendency to assume that a new product’s sales will be front-loaded as pent-up demand is uncorked, another factor to consider is the lack of a full rollout; the Priv just hit Germany this week and has yet to be stocked by leading U.S. carrier Verizon Wireless.

Second, it’s important to realize that BlackBerry is far more than a hardware OEM — and the fact that handset sales have been slipping for years now has only accelerated its push into other categories (a la HTC). Blackberry’s recent acquisition of email client Good Technology is said to be the driving force behind its better-than-expected results this past quarter.

Still, 700,000 is just not a lot of units to move in a quarter, any way you slice it. Apple regularly sells more handsets in a single day, following a new iPhone release, than BlackBerry moved all quarter. Even new kid on the block Xiaomi famously racked up 800,000 purchases in a single day during one of its popular flash sales.

The unfortunate truth to these numbers is that if the trend they form continues for much longer, BlackBerry may not have the luxury of choosing whether to remain in the market: Its exit will have been dictated not by John Chen, but by the even more powerful hand of the free market.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More