You can read the announcement at the new BlackBerry Partners Fund China website. The big message is that China’s mobile market is already the world’s largest, it’s still growing quickly, and the BlackBerry fund wants in on the action. For local expertise, it’s partnering with China Broadband Capital Partners, a firm that was founded in 2006 and focuses on media and communications investments. The new venture will have offices in Beijing, Shanghai, and Hong Kong.

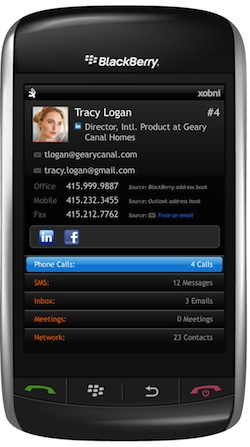

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":186906,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,entrepreneur,mobile,","session":"A"}']The BlackBerry fund was first announced in May 2008, shortly after the unveiling of the iFund from Kleiner Perkins Caufield & Byers, which focuses on iPhone investments. At the time, JLA partner Rick Segal told us that while the fund would invest in companies that build applications and services for BlackBerry devices, they wouldn’t have to be BlackBerry-only. The fund’s portfolio companies include location-based service Buzzd, traveling aid WorldMate, and social email startup Xobni (the Xobni app is pictured).

Kleiner also increased its investment in the iFund recently, doubling it from $100 million to $200 million.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More