Mobile payments company Boku is lifting the lid on a new cross-platform payment mechanism today, one designed to make carrier billing a breeze for online transactions.

E-commerce giants such as Amazon, Google, and Apple make the process of paying online easier by storing your bank card details on file, meaning you don’t have to fill in your 16-digit card number for every product you purchase. Now, Boku is launching a new technology designed to replicate this — except your mobile phone number is kept on file instead.

Founded out of San Francisco in 2009, Boku’s platform allows users to pay online using their mobile number, and enables this through deals signed with the major mobile carriers. So, if a user wants to pay for content such as movies or games through their smart TV, for example, they enter their phone number and the charge appears on their phone bill. On the other side, Boku also provides software for merchants to process these payments, taking a cut of the transaction for its efforts.

Boku has raised north of $70 million in funding since its inception, and now claims to operate in 70 countries, working with more than 250 carriers across 40 different currencies.

Phone-on-file

With the so-called “phone-on-file” technology (as opposed to “card-on-file”), Boku is not only looking to remove the friction from online transactions, but boost its clients profits in the process. Fewer steps to digital payments means more money, in essence.

It’s worth noting here that Boku already offered one-click checkout services, whereby a user can simply click a button and the goods are purchased, with the payment added to a user’s phone bill. However, this was only for payments made on mobile, for example with Boku on the mobile Web or for an in-app purchase.

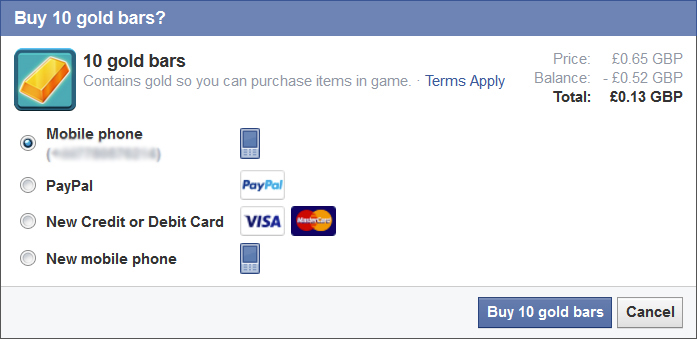

Now, Boku is going cross-platform, meaning once the initial set-up is completed by the consumer, they can transact on any device. It’s worth adding that Boku has already implemented the technology with a number of big-brand platforms, including Spotify and Facebook. But these were for testing purposes — today marks the first time this is available for any merchant to integrate.

Moving forward, you’ll likely start to see more of this type of option when signing up to subscription services or when making one-time payments.

So this is really designed to copy the existing way of paying for things, where a shopper is asked to select how they prefer to pay for something, be it credit card, debit card, PayPal, or whatever other method is supported. In terms of security, users confirm a purchase via a SMS authentication once, and can then use it anywhere without the need for further authorization.

This is a notable advance for ecommerce, as it opens things up to those without a credit or debit card. They simply pay for all their purchases at the same time as they pay their mobile phone bill. It also helps alleviate so-called “subscription fatigue,” whereby a consumer can become overwhelmed by the sheer number of transactions that come out of their account each month. This way, a user can elect to pay for all their digital services in one fell swoop, though of course this will depend on all the major companies (Netflix, Dropbox, etc.) signing up.

“A key element to the strength of companies like Amazon and Apple has been their ability to create frictionless checkout experiences using stored credit card information,” explained Jon Prideaux, Boku CEO. “This is that same experience that Boku is bringing to the mobile phone number with phone-on-file. Our goal is to do make a stored phone-on-file every bit as powerful as a card-on-file for the benefit of our merchant partners.”

For launch, the phone-on-file functionality will be available in the U.S., Germany, U.K., and Italy, though we’re told that more markets will be added in the coming months.