San Francisco-based Boku raised $10 million in a recent round of funding to buy startups Mobillcash and Paymo in a transaction that was announced in June. The combined companies now handle mobile payments for online transactions with 1,000 merchants and online publishers in 56 countries. That’s some serious momentum that could generate lots of fees for Boku.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":123918,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,enterprise,social,","session":"C"}']The mobile payments serve as an alternative payment to credit card payments. In these transactions, Boku handles payments to merchants and then bills you via your monthly mobile phone statement.

The company — a finalist at our recent MobileBeat conference — has lined up a “who’s who” list in social web sites because it has come up with clever yet simple way to let you pay for things you purchase online, said Ron Hirson, co-founder and senior vice president of marketing at Boku.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

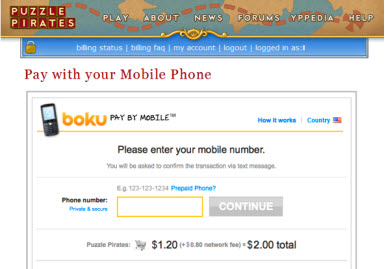

Here’s how it works. In an online store or online game, you can buy a virtual good, such as a more powerful weapon in a game. Upon purchase, you enter your cell phone number. Boku sends you a text message to verify that you want to purchase the item. You type the letter “y” in a response message to verify the purchase.

You can use the system to buy just about any item online. The bill goes directly to the mobile phone user’s monthly bill. It’s great for those who have no credit cards or no other way to pay for goods. It’s also fraud resistant, as long as you don’t lose your mobile phone: Users have to know a mobile phone number and then have to be in possession of the corresponding mobile phone in order to make a purchase.

Hirson said customers include makers of Facebook and MySpace games as well as web sites that offer “freemium” games, or those where you can play for free but pay for extra goods, such as personalized decorations for your game character. Game-related customers include Aeria Games, Badoo, fatfoogoo, Gambit, Games-Master, Hitgrab, Hive7, Icebreaker, IGG, Jambool, K2 Networks/GamersFirst, Meez, Offerpal, PageFad, Playfish, Slide, Sometrics, SuperRewards, TheBroth, Three Rings, Trial Pay and Wee World.

Boku said today it is also expanding to four new countries: Finland, Indonesia, Slovenia and Taiwan. Boku makes money by taking a fee on the net of the carrier fees of about 5 percent to 10 percent. The average transaction is $11 and Boku makes tens of cents per transaction, Hirson said.

To date, Boku has raised $13 million from Benchmark Capital, Khosla Ventures and Index Ventures. It has about 50 employees. Virtual goods is expected to be a $2.5 billion market by 2010, according to Piper Jaffray.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More