There are a few companies that stand in the way of Intel as it tries to make an empire in consumer electronics chips. One of them is Broadcom, the Irvine, Calif.-based chip design firm that sells billions of dollars worth of chips in the home, mobile, and communications infrastructure markets.

There are a few companies that stand in the way of Intel as it tries to make an empire in consumer electronics chips. One of them is Broadcom, the Irvine, Calif.-based chip design firm that sells billions of dollars worth of chips in the home, mobile, and communications infrastructure markets.

Scott McGregor, chief executive of Broadcom, plans to dominate the markets for chips used in set-top boxes, digital TVs, modems, cell phones, and wireless networking chips. During the downturn in the past year, the company strengthened its market position on a variety of fronts, even as it buried legal problems associated with its past leaders.

We caught up with McGregor at the recent Consumer Electronics Show.

VentureBeat: You folks are pretty far into this business, with billions of dollars in sales. What are the battles that you have won, and what are ones that are still to come?

Scott McGregor: To use a baseball analogy, some technologies are in the early innings and some are late in the game. Broadcom has done an excellent job in the set-top box area. We have done well in all of the “last mile” technologies to the home such as cable, DSL, and satellite TV. We have done very well in the networking space. A whole different branch of our business is in the infrastructure that is the backbone of the Internet. We have done a great job on wireless connectivity, such as Wi-Fi chips, but that is still in the early earnings. Wi-Fi has penetrated PCs very well. But it is only just beginning to penetrate cell phones and TV sets and other devices in the living room. Wi-Fi is both mature and it has great growth ahead of it as it moves into new devices. The same goes for Bluetooth.

VB: Players like Intel are moving into your markets in the living room. What’s the impact of that?

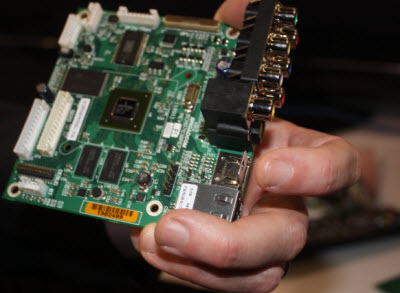

SM: Intel has come into the consumer electronics space multiple times in the last decade. If you Google “Intel” and “LCOS” (liquid crystal on silicon), you’ll find stories about their last entry into the consumer electronics space that was canceled a year after they announced it. They are a formidable competitor with good technology and smart people. But what’s good for the PC isn’t necessarily what’s good for consumer electronics. People who have consumer electronics devices don’t want to see their products crash. They don’t want to add fans to the product to cool it off. Being the fastest processor is not as important as being the most cost-effective processor that can be integrated easily into other things. In a single chip, we include all of the processing, Internet access, analog and digital processing. There isn’t a separate socket for a processor.

VB: They make the argument that one size fits all. TVs and phones are moving toward the PC as they become connected and do more computing. That’s why they are trying again.

VB: They make the argument that one size fits all. TVs and phones are moving toward the PC as they become connected and do more computing. That’s why they are trying again.

SM: That is fallacious logic. The premise doesn’t justify the conclusion. We all agree we are doing more computing in consumer electronics devices. But we solve that problem with embedded processor cores as part of the system on a chip in a device. We are shipping in Internet-connected TVs that run apps such as Netflix, Yahoo Widgets, and all of these other things. It seems to work just fine with embedded processor cores. It’s the most cost-effective way to deliver a consumer electronics solution. You don’t need a stand-alone Intel chip in the box.

VB: And that’s the case even as more Internet-enabled operating systems arrive?

SM: We run Android, various flavors of Linux, and Windows CE. We run all sorts of software. We don’t run Microsoft Office on Windows on your TV set. In that case, Intel would have an advantage. Failing that, probably not. If you make computer chips, you approach the market as devices in need of computing. We see consumer electronics devices that happen to need more computing power and so we give it to them. You still have to do things like digital rights management, analog conversion, and video processing.

VB: There is still a lot of contention among the companies that want to transfer high-definition video around the home. What will win there?

SM: We support a number of the different technologies here. We do think people will want to transfer HD video around the home. Today you can do that in compressed formats over Wi-Fi. Some people want to do that in an uncompressed format, where the quality is better. For that, you probably need to move to 60-gigahertz technologies to get the bandwidth to do that. Broadcom hasn’t announced products in that space, but it is obviously a space that we are interested in.

VB: What else fits that picture of technologies that are just getting off the ground?

SM: I would say 3-D TV is in that category. There is no good industry agreement for how you encode 3-D content. There are a number of different choices. It’s a classic case where it is more important to choose a standard, than which standard you settle upon. That would enable more devices to support 3-D. We would also like to see broader adoption of Digital Living Network Alliance, which is a group making devices that can talk to each other in the living room and the rest of your house. Many companies support it. But it’s like the early days of Bluetooth, when it was difficult to pair devices and the profiles for usage weren’t all done. It’s quite iffy. DLNA is in that state today and will go through the same evolution as Bluetooth. At some point, it just works. You can expect devices to talk to each other and you will control those devices in the living room.

VB: Your company is a big advocate of combination chips. Please explain.

SM: We have done a great job of taking different wireless technologies and building them into the same chip. You get multiple radios in one device, without interference. It’s pre-integrated into the device. It saves a lot on costs. We can prioritize the delivery of data so that video packets will not be interrupted by some other kind of data being delivered.

VB: Is that differentiating your company?

VB: Is that differentiating your company?

SM: We are the largest player in combo chips today. Competitors haven’t been successful yet in fielding rival solutions. We don’t announce chips until they are shipping. Our competitors announce them before they are ready to ship. Many of the ones they announced have not gone into production. Sometimes they have good Bluetooth radios but the wireless networking is weak.

VB: Is there a Holy Grail radio chip that can be made, where a single flexible chip can handle any radio protocol?

SM: It’s called software-defined radio. There is some merit to those ideas and challenges. You may, for instance, want to do Bluetooth, Wi-Fi, and FM radio all at the same time in one device. In that case, you need three software defined radio chips in one device. Then you don’t wind up saving very much money. To the extent you only want to do one thing at a time, having a chip that can do many things is useful. But we find that consumers want to do a lot of things at once. It has yet to pan out.

VB: Do you see Marvell and Texas Instruments as competitors?

SM: In the TV market, we see more of the TV makers doing their own chips.

VB: It seems like we are in another age of gadget proliferation. There is talk about the battle for devices with screens that are five inches to 15 inches. There are eBook readers, smartbooks, and other things. How will it unfold?

VB: It seems like we are in another age of gadget proliferation. There is talk about the battle for devices with screens that are five inches to 15 inches. There are eBook readers, smartbooks, and other things. How will it unfold?

SM: The process of evolution has two steps. The first is mutations. The second step is natural selection. At this show [CES], we see a lot of mutations. There are a lot of different ways to deploy technology. What we will see over the next year or two is a natural selection process where a lot of these things will not survive. It’s hard to predict which ones will survive. But that’s OK because we tend to be in most of the devices. It doesn’t matter as much to us which ones win and which ones lose.

VB: What are the big trends here?

SM: 3-D TV is one. Internet-connected TV is another. And so are tablet computers. Those are the big three. Those will likely go mainstream over the next few years.

VB: Is everything else going well?

SM: Yes. We invested during the downturn. We powered through it. We have 7,400 employees now.

VB: The legal weirdness is behind you?

SM: Mostly. There is still some cleanup to do.

VB: How do you look back on that?

SM: Nobody likes headlines like we got. But it didn’t distract our core product teams from what they were doing. It wasn’t a big distraction for our customers and our investors. It’s good to have it mostly behind us.