Every morning, somewhere between 4 and 6 a.m., my inbox is assaulted by daily deal emails. This morning I fought back, feeling a sense of accomplishment as I deleted my last offer: 50 percent off a Brazilian Wax. Sound familiar? Groupon, the inventor of daily deals, has become one of the fastest growing companies in the history of the world. Much to its chagrin, Groupon seems to have created one of the fastest growing, most competitive industries in the world: 581 daily deal copycats now compete for your inbox.

Every morning, somewhere between 4 and 6 a.m., my inbox is assaulted by daily deal emails. This morning I fought back, feeling a sense of accomplishment as I deleted my last offer: 50 percent off a Brazilian Wax. Sound familiar? Groupon, the inventor of daily deals, has become one of the fastest growing companies in the history of the world. Much to its chagrin, Groupon seems to have created one of the fastest growing, most competitive industries in the world: 581 daily deal copycats now compete for your inbox.

Competitive pressure appears to be wearing on Groupon, who announced declining profitability in mature markets last week. Savvy local businesses now compare multiple services and demand lower commissions. Consumers, overwhelmed with daily deal newsletters, buy less often from a single provider.

So what does the future look like for Groupon, a company on the verge of a $20 billion IPO? With the exception of LivingSocial, none of the daily deal copycats are large enough to pose a real threat. Larger competitors like Google seem no more likely to unseat Groupon than they were Twitter or Facebook.

The real challenge for Groupon, like most market innovators before it, may be the evolution and fragmentation of the industry it created.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

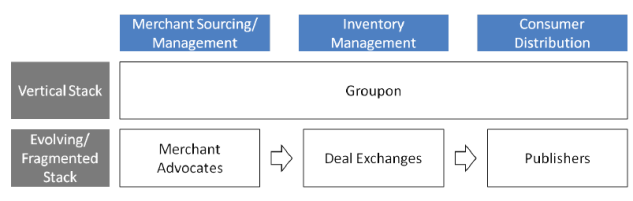

Groupon is a vertically integrated business, performing three major functions in-house: deal sourcing, inventory management and consumer sales. Every day Groupon’s telemarketers make half a million calls to small businesses around the world. Negotiated offers are handed to copywriters and account managers who push them to Groupon’s 116 million consumer newsletter. As the pioneer of daily deals, Groupon had to perform all of these functions internally – none of them existed three years ago.

Groupon’s newest crop of competitors is beginning to work together, allowing each to specialize in one of these three major areas:

Merchant Sourcing. Merchant advocates (like Signpost) believe they can more efficiently reach merchants and manage their offers. Because they’re not limited to a single distribution channel, these companies are able to serve a wide variety of merchants and offer flexible terms.

Inventory Management. An emerging group of companies now operate a ‘deal exchange’. Approved merchant advocates push their deals into an exchange where each deal is matched with the right set of publishers.

Consumer Distribution. Thousands of new and existing publishers now look to local deals to better monetize their consumer audience. Exchanges may allow them to select the most relevant deal(s) for their audience and avoid the cost of a local sales force.

The real threat for Groupon is that one or more players in each of these segments (which I’ve simplified) beat the corresponding function at Groupon. The resulting fragmented ‘stack’ has the potential to provide merchants and consumers with a better, lower cost, more relevant product. Traditional online experienced a similar evolution over the last 15 years. None of the market innovators survived as an independent business.

So will Groupon continue to thrive as its market evolves? The company has executed well despite rapid growth, decimated all but one of its direct competitors, and continues to rapidly release new products including Groupon Stores, Groupon Now!, Groupon Getaways and Groupon Home & Garden.

Groupon’s SEC filing indicates the company is no longer innovating fast enough. Groupon’s main growth engine, consumer email marketing, now appears to be ROI negative. Revenue per merchant in established markets like Boston is less than half what it was a year ago. Now, with ten thousand employees and a $4 billion flagship business, Groupon may once again be called on to return to its nimble roots.

Further Reading:

–The Innovators Dilemma (Clayton Christensen)

–The Daily Deal Ad Stack (yipit.com)

![]()

Stuart Wall is co-founder and CEO of Signpost, which aims to connect locals with deals that matter to them. He has previous written guest columns for Business Insider.

–

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More